To help protect your current staff, customers, and property, it’s essential to vet all potential employees before letting them into your livelihood. Background checks include checking some or all of the following for a job applicant: verifying identity, criminal background check, credit report, educational, certification, and credential verification, motor vehicle records, E-Verify confirmation, and fingerprint checks with the FBI.

Disclosure: This content, except as otherwise indicated or stated on this site, is the property of TransUnion Rental Screening Solutions, Inc. This content is for educational purposes and for convenience only. Trademarks used are the property of their respective owners, and no endorsement or affiliation is implied. The information presented in this content is “as is” without warranties of any kind, and specifically is not represented to be complete and does not constitute legal advice, and is subject to change without notice. You are encouraged to check these terms from time to time for changes, and by accessing this site you agree to these terms and all terms listed. Laws and regulations may vary by state and locality. Consult your own counsel if you have legal questions related to your rental property practices and processes.

Disclaimer: Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

Your favorite candidate just left the interview. You can’t wait to offer them a job before they get snatched up by a competitor. Now, do you trust a quick Google search to confirm your gut instinct, or do you run an online pre-employment screening and get actual data to help verify your hunches?

Even if a candidate looks perfect on paper, it’s crucial to do your due diligence to help ensure that you’re hiring a good employee that will add value to your company. If not, you could risk an ill-fitting hiring potentially destroying your business through recklessness, carelessness, or even fraud. Then, if that happens, you could be on the hook for a potential negligent hiring lawsuit, which may be expensive.

Unfortunately, gut instinct and DIY background checks may not be enough.

To help reduce the risk of making a bad hire, small business owners and hiring managers should vet prospective employees. Background checks like ShareAble®for Hires may help show you potential concerns about a candidate’s credit report and relevant criminal history.

There are different types of background screenings available, and the right one for your business depends on your industry and your organization’s needs.

Keep reading for an overview of the benefits of employment screening, the differences between types of employment background checks, and how ShareAble for Hire can help with some of your background checks.

Article Summary:

Benefits of Pre-Employment Background Checks

It costs U.S. companies substantial funds and time to hire one new employee. According to the Society for Human Resources Management, the average cost for a single hire is $4,700 and can easily reach three to four times the salary of the open position.

Thankfully, investing as little as $40 to screen applicants ahead of time could help protect your company from wasting time and money.

There are several benefits to running a pre-employment screening. By requiring job applicants to undergo an online background check, employers and hiring managers can:

- Make an informed hiring decision: Armed with background check information, you can have peace of mind that you’re making the right hire.

- Aid in verify candidate claims: Resume fraud and other forms of misleading or inaccurate application information is shockingly common. Background screening can be used to help verify claimed identity, certifications, education, and experience.

- Help mitigate the risk of negligent hiring claims or lawsuits: Negligent hiring claims are one of the top recruitment risks you may encounter. They generally occur when an employer knew (or should have known) that an employee was a hiring risk. Negligent hiring claims frequently occur in certain industries and businesses: utility companies, delivery companies, hospitality businesses, nursing homes, healthcare, and real estate. Regardless of your industry, it’s in your best interest to avoid a potential negligent hiring claim and screen candidates.

Pro Tip: Not every hit on a potential employee’s record means potential disaster. Learn what to do if a job applicant fails a background check.

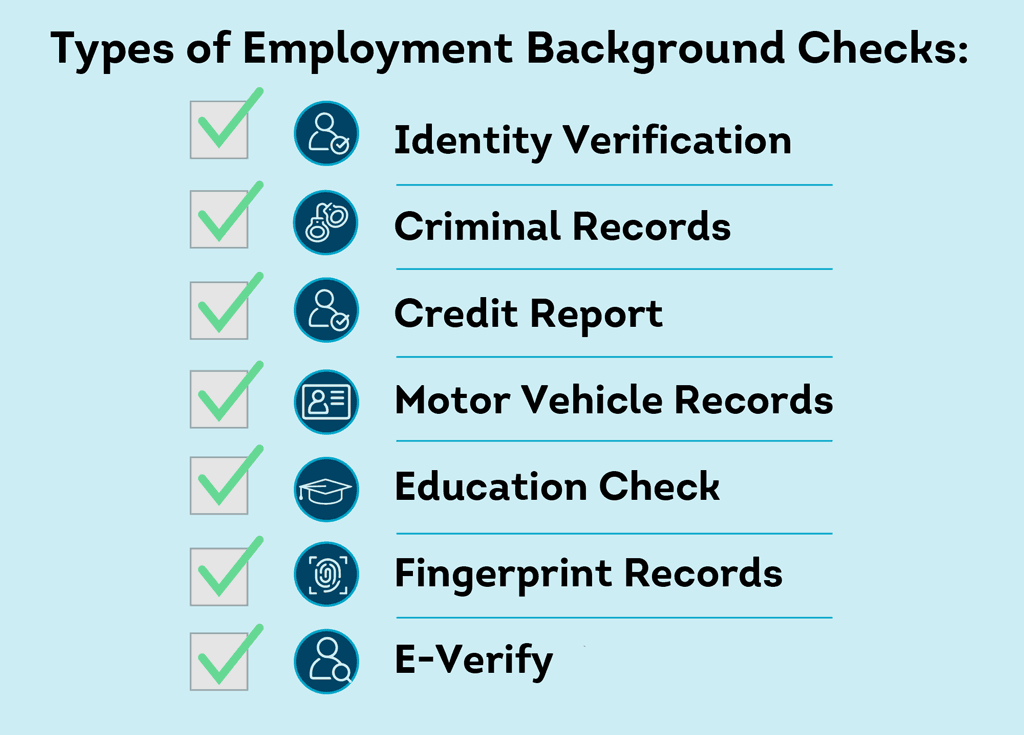

7 Types of Employment Background Checks

Below are seven different types of employment background check options you could leverage to find the perfect fit for your business.

- Identity Verification

- Criminal Background Checks

- Credit Background Checks

- MVR Reports

- Professional License & Education Background Checks

- Fingerprint Background Checks

- E-Verify Checks

1. Identity Verification

Identities are stolen. Frequently. According to the Bureau of Justice Statistics, 9% of American adults were victims of identity theft and losses due to this fraud totaled over $16.4 billion in 2021. With all that fraud happening, it’s imperative that employers and hiring managers help verify that candidates are not using stolen identities when applying for jobs.

Identity verification background checks help employers confirm that prospective hires are really who they say they are.

ShareAble for Hires uses sophisticated record matching logic to match identity checks to your job applicant, resulting in fewer false-positive matches. These identity checks include verifying:

- Name check

- Address check

- SSN check

- Date of Birth check

- Fraud alerts

- Deceased person alert

Pro Tip: Some job applicants may falsify their own identity, others may fib about their past work experience or even provide fake references for you to call. Knowing what employee reference questions to ask during a check can help you prevent falling victim to this kind of fraud.

2. Criminal Background Checks

Employers should conduct a criminal background check, but it’s especially important for employers looking to fill roles that involve access to sensitive financial information, security responsibilities, and proximity to vulnerable populations, such as children or the elderly.

Performing a criminal background check online is helpful to avoiding unnecessary risks with a new hire. These employee criminal background checks typically include things like:

- County, state, and federal criminal records

- FBI’s Most Wanted

- National Sex Offender Public Registry

Knowing more about your candidate’s past with the information above can help you make more confident hiring decisions. A ShareAble for Hires criminal records check scours millions of criminal records searching for a potential match for your job applicant.

Note: Always consult legal counsel to help comply with your local laws and regulations for employment criminal records check.

3. Credit Background Checks

Pre-employment credit checks may help reduce the risk of fraud and other crimes for candidates being considered for financial positions or roles that handle confidential information. Credit checks typically include:

- SSN verification

- Recent applications for credit

- Credit history

- Accounts in poor standing

- Bankruptcies

- Level of debt

- Previous employment history (where available)

Jobs requiring a security clearance, access to finances, and handling sensitive data frequently may require credit background checks.

With ShareAble for Hires, you get employee credit reports that are backed by TransUnion, a major credit agency with nearly 40 years of data expertise. That means more results with easy-to-read reports that are delivered after your candidate consents.

Do note that, while you may use a credit check to evaluate candidates, you should give your employees a chance to explain negative credit report information.

By getting the full picture of a candidate who will potentially handle company finances, you may be more likely to find and hire a reliable, responsible employee.

Pro Tip: Not all background check companies are created equally. Before you start screening it’s essential to know what to look for in a background check company to help you get better results.

4. MVR Reports

Any employer who requires employees to drive company cars or transport clients or customers should check motor vehicle records (MVR) to help ensure they hire the a responsible drivers. In addition, employers subject to the U.S. Department of Transportation or Federal Motor Carrier Safety Administration’s regulatory requirements should also screen MVR.

What does an MVR check show? According to insurance provider Progressive, the exact information contained in a Motor Vehicle Record varies by state. However, they typically include biographical information and some information about a driver’s record and past infractions.

Examples of what might be found on an MVR include:

- Driving history

- License, license class, and license status

- Endorsements

- Past license statuses: suspensions, revocations, cancellations

- Vehicular crimes

- Accident report

- DUI convictions

- Traffic citations

- Unpaid summons and insurance lapses

According to Arash Law, there are several scenarios where an employer may be held liable for employee car accidents—and potentially bear a hefty financial burden. It’s up to you to help make sure you can trust your employees with company resources, including vehicles.

To check a candidate’s driving history, you’ll need to go through a third-party vendor. Or, you can ask the candidate to submit a copy of his or her driving record from the DMV. Keep in mind, if you’re employing people that will drive for your business, hire people with good driving records—motor vehicle crashes are the leading cause of work-related deaths in the U.S. according to the Center for Disease Control.

5. Professional License & Education Background Checks

Any employer hiring for roles that require specific levels of education or licensure should run a license and education check on job applicants. Occupations that may need license or education verification include:

- Plumbers

- Professors

- Barbers and salon workers

- Contractors

- Teachers

- Fitness instructors

- Senior roles requiring advanced degrees

- Positions where education is critical to legal processes or public safety

This education verification process involves an employer checking for a high school diploma, undergraduate, or graduate degree to cross-reference the resume information provided. Candidates may exaggerate their education, breadth of experience, job responsibilities, or even a job title within their resume and cover letter. It’s a good idea to verify the education or license information and look for any potential red flags.

You can help mitigate the risk of hiring the wrong employee by using an education background check to vet any new hires. Verification helps spot diplomas from diploma or degree mills.

Why should employers verify education and professional licenses? Hiring someone without the requisite skills and education may make you vulnerable to potential lawsuits and other problems. You can help avoid this by using an education check which investigates a candidate’s:

- Degrees

- Academic institution

- Years attended

- Specific certifications

- Specialized training

Drawbacks: Third-party educational verification can be a slow process that may take weeks.

6. Fingerprint Background Checks

Fingerprint data is collected and kept by the FBI in the Integrated Automated Fingerprint Identification System, which has about 70 million criminal profiles.

Any employers who have employees dealing with security clearances or handling sensitive customer or company information should require new hires to undergo a fingerprint background check. Results are delivered in just a few days or up to a few weeks, depending on the submission and delivery methods you choose.

According to the FBI, a fingerprint background check can generally include the following information:

- Criminal arrest dates, charges, case results

- Basic information like birthdate, name, and address

- Police reports that are linked to fingerprints

7. E-Verify Checks

E-Verify is an electronic system that scans information regarding an employee’s Form I-9, Employment Eligibility Verification, to verify they are authorized to work in the United States.

If you participate in E-Verify, you’re likely required to post the Notice of E-Verify Participation poster available from the Department of Homeland Security (DHS) and the Right to Work poster issued by the Department of Justice.

According to the E-Verify program website, this type of check generally results in one of the following outcomes:

- Employment Authorized: This means that the information entered matches records in the DHS and/or Social Security Administration (SSA) The employee is authorized to work in the U.S.

- DHS or SSA Tentative Non-confirmation (TNC): This means the information did not match. An employee can generally contest this result. As an employer, you might be able to terminate employment if the employee doesn’t contest the result or if the employee receives a Final Non-confirmation result indicating the employee’s work authorization can’t be confirmed.

- You may also get the result that additional time is needed to review the case, the case must be resubmitted, the case cannot be resolved, or a similar administrative message.

However, a TNC result doesn’t always mean an employee isn’t authorized to work in the U.S.; it simply means the records don’t match and the employee can escalate the issue by contacting and visiting an SSA field office or contacting DHS.

Conduct Employee Background Checks with ShareAble for Hires

Are you hiring some much-needed support or a hidden wrecking ball? Don’t leave your livelihood open to chance. Back up your gut instinct with fast, online pre-employment screening through ShareAble for Hires.

Help reduce your hiring risk. A criminal records check zips through millions of criminal records to searching for a potential match for your candidate. Meanwhile, identity verification can help confirm your shining star applicant is who they say they are.

Corporate fraud, embezzlement, espionage, theft, and worse isn’t just found in fiction. Learn more about your job applicant’s financial track record with an employee credit check, which is especially important if the job involves handling cash, sensitive customer data, or business secrets.

Designed specifically for small business owners with only occasional screening needs. There are no monthly minimums, subscriptions, registration charges, or any hidden fees. Simply create a free account and start screening immediately. Pay only for what you need and only when you need it.

When you’re deciding what to order for lunch, trust your gut. When it comes to sizing up potential employees, rely on the data. Help make more confident hiring decisions with identity, credit, and criminal checks through ShareAble for Hires.

ShareAble for Hires

Sign-up Now. Reports Now. Hire Now.