As a small business owner, there may be times in which you question the dependability of your new employee. This line of questioning isn’t wrong, but these questions can’t be answered with a resume alone. As much as employers would like to trust their employees to manage financial resources, protect sensitive information, and deliver premium customer service, the underlying uncertainty prevails.

There are plenty of recruitment risks you may encounter while hiring a new employee, including false credentials, negligent hiring, and employee turnover. To help minimize these hiring risks, many small business owners opt to use a pre-employment screening service. According to a TransUnion survey, 97% of small business owners say they do some sort of screening, and 45% use a paid pre-employment screening service.

Disclosure: This content, except as otherwise indicated or stated on this site, is the property of TransUnion Rental Screening Solutions, Inc. This content is for educational purposes and for convenience only. Trademarks used are the property of their respective owners, and no endorsement or affiliation is implied. The information presented in this content is “as is” without warranties of any kind, and specifically is not represented to be complete and does not constitute legal advice, and is subject to change without notice. You are encouraged to check these terms from time to time for changes, and by accessing this site you agree to these terms and all terms listed. Laws and regulations may vary by state and locality. Consult your own counsel if you have legal questions related to your rental property practices and processes.

Disclaimer: Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

In this article, we highlight some of the common hiring risks small business owners face in the recruitment process and explain how pre-employment screening can help better protect against these risks. Click on a particular risk to read more or read the post in full to learn how employee screening could protect you and your business.

Risk #1: Making Negligent Hires

Negligent hiring practices are one of the top recruitment risks facing small business owners and hiring managers. Negligent hiring claims can be made against employers who are accused of knowing—or employers that should have known—information about an employee’s background that may have indicated dangerous or untrustworthy prior acts. Negligent hiring claims can be expensive, and the odds are often stacked against the accused employer:

- The average lawsuit of a negligent hire isnearly $1 million

- Employers have lost more than 79% of negligent hiring cases

How Pre-Employment Screening Can Help

Consumer reporting agencies that offer employment screening services must follow the regulations imposed by the Fair Credit Reporting Act (FRCA) which promote accuracy, fairness and transparency in the data held by the consumer reporting agencies. Screening with a reputable and regulated consumer reporting agency can help an employer uncover past conduct as part of the hiring process.

Risk #2: Falling for False Credentials

Your organization’s open job position may require that the candidate has earned a certain degree of education (associates, bachelors, Ph.D., etc.) in order to qualify. There are also careers that may require more specialized credentials, such as CPR certification.

Employers may assume that the information on a candidate’s resume is accurate, but that’s unfortunately not always the case. A recently conducted survey found:

- 49% of hiring managers have caught a job applicant fabricating some part of their resume

- 53% of all job applications contained inaccurate information

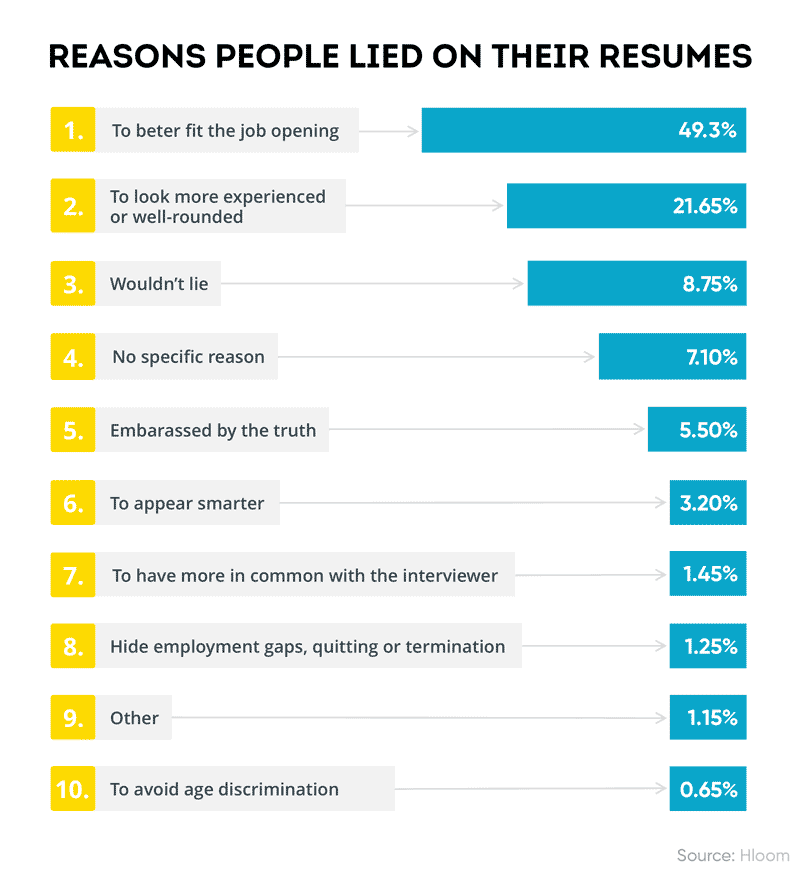

A study from Hloom surveyed job candidates about why they might report false information on a resume. Almost half of those surveyed said that they may lie on a resume in order to better fit the job opening, while 22 percent of those surveyed would lie in order to look more experienced or well-rounded.

Regardless of reason, it’s clear that many candidates feel compelled to report false or incorrect information on their resumes – and this trend of misinformation is something every small business owner or hiring manager should be aware of.

Whether it’s a bachelor’s degree or a CPR certification, the credentials listed on a resume should be properly researched and verified before an offer of employment is extended. Small businesses in particular should be wary of hiring an incompetent candidate, as the time and money lost on onboarding and training can be devastating.

How Pre-Employment Screening Can Help

Verifying a candidate’s education with pre-employment screening can help you when determining whether or not a candidate truly holds the degree(s) and credentials they indicate on their resume. As mentioned before, the level of education your employee holds should be reflected in their past role and job title. In that case, employment verification can also be used to confirm whether or not the candidate held the indicated position at the listed workplace.

Risk #3: Overlooking Employee Fraud

It’s essential that you have confidence in all of your employees, especially those that have access to important company assets and information, such as an accountant or financial manager. Employee fraud can occur when an employee commits a criminal act against their company for the purpose of personal or financial gain.

The Association of Certified Fraud Examiners (ACFE) reports:

- The average company loses 5% of revenue each year due to fraud

- $145,000 is the median loss due to fraud

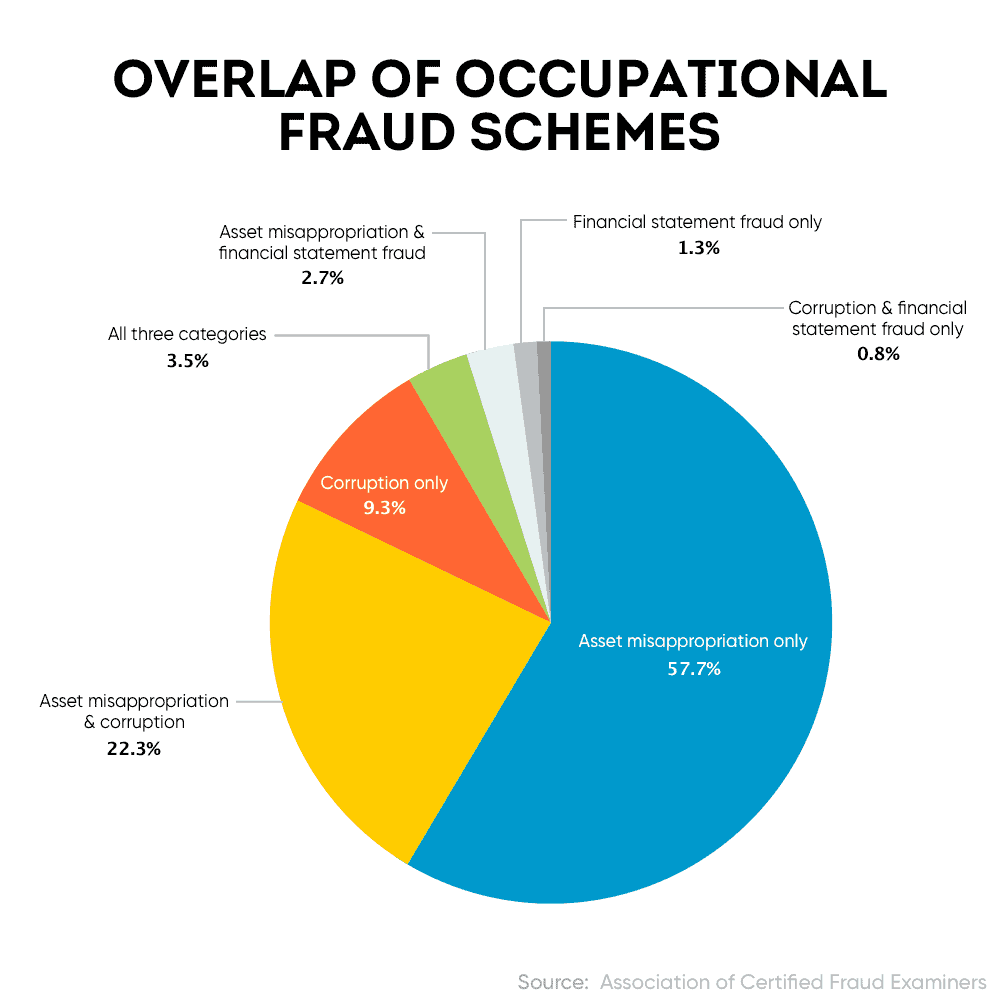

What exactly does occupational fraud look like? Employees may commit fraud in a variety of ways. According to ACFE, occupational fraud can be classified into three different categories:

- Asset misappropriation: Examples of fraudulent activity in this category include false expense reimbursements, check tampering, and cash larceny.

- Financial statement fraud: This category might include fraudulent activities such as asset or revenue overstatements/understatements.

- Corruption: Examples of occupational fraud in this category might include bribery, illegal gratuities, or economic extortion.

In many cases, these three different fraud categories occur concurrently. The below chart shows the overlap of these occupational fraud schemes.

How Pre-Employment Screening Can Help

Background checks can help shed light on a candidate’s criminal history, which may help you to weed out those who might prove to be a security risk.

Additionally, performing a credit check can be valuable if you’re hiring for a position within the financial sector. Information about your candidate’s past and current personal financial history could help you to answer questions like the following:

- Does this candidate make payments on time?

- Are they responsibly managing their money?

Learning more about your candidate’s spending habits can help when determining whether or not you are putting your small business at fraudulent risk.

Risk #4: Maximizing Customer and Employer Saftey

Part of an employer’s responsibility is to provide a safe and secure environment for both staff and customers. In the event of making the wrong hire, you could potentially introduce a threat to your current team and clients. Employers should be extra mindful of who their employees and customers will interact with on a day-to-day basis. Not only could the wrong hire pose risk to your employees and customers, but to the overall brand of your small business.

How Pre-Employment Screening Can Help

Background checks can help employers to spot a criminal history or dangerous track record, which allows you to make a more informed hiring decision.

Risk #5: Facing Sudden Employee Turnover

Sometimes an employee may leave a company on good terms and for honest reasons such as relocation, fresh company culture, or for a more attractive offer elsewhere. Other times, however, employers may face more abrupt employee turnover because they simply hired the wrong person from the start. For example, they may have had to dismiss the employee due to a lack of performance, or in the worst-case scenario, due to an unlawful act of employee fraud. Abruptly losing an employee can put a significant strain on a small business, leaving other employees to pick up the slack and substantially affecting workflow, productivity, and profitability.

Whether you have to let go of an underqualified employee due to false credentials or because they presented inappropriate behavior on the job, each time you have to hire a new employee your company picks up the bill.

As a small business owner, you and your hardworking employees may already be wearing many hats in order to keep things running efficiently. Having to recruit and train new employees time and time again might impair daily operations, which could jeopardize the success of your small business.

According to the Society for Human Resource Management, the average cost of hiring a new employee is $4,129. If your company has been facing high turnover rates, you could be cutting into your profit margins more than you’d think.

How Pre-Employment Screening Can Help

The more you know about your applicant’s work ethic and qualities, the better equipped you’ll be to make a well-informed hiring decision. Part of the pre-employment screening process includes contacting the candidate’s professional references to gain insight into:

- Past employment behavior

- Job responsibilities

- Accomplishments in the workplace

Because this information isn’t included in pre-employment screening reports, it’s extra crucial to get an understanding from an outside source.

Once you’ve done the diligence of making reference calls, pre-employment screening can help you gain insights into your candidate’s education and criminal background. Covering all of these bases can help you avoid employee turnover and its costs in the long run.

ShareAble for Hires Pre-Employment Screening

As a small business owner, it’s your duty to protect your business, your employees, and yourself. That’s why it’s crucial to implement a pre-employment screening practice into your hiring process. As we’ve discussed, the proper pre-employment screening method can help to reduce hiring risks during employee recruitment.

By using a pre-employment screening service like ShareAble for Hires, small business owners have convenient, online access to FRCA-compliant reports specifically made for small business owners. Shareable for Hires delivers background checks, credit reports, and identity verification checks in minutes so you can make a quick and easy hiring decision as soon as possible.

By adding online screening reports to your hiring process, you can gain the confidence you need to put forth your next job offer. With pre-employment screening services, you can rest assured that you’re doing your due diligence to bring on high-quality employees, positioning your company for success in the long run.

Unlike traditional screening companies which take weeks to complete employment screening, ShareAble for Hires provides employers with crucial hiring information within minutes. That means you can higher sooner and mitigate the extensive costs of employee turnover.

With ShareAble for Hires, an applicant can push their information to an employer. That gives both employer and applicant peace of mind when sharing personal information necessary for a hire, including date of birth, driver’s license numbers, and more. The applicant can send this information safely and securely to us, and we send only the necessary information on to you.

Getting started with ShareAble for Hires is easy. There are no membership requirements, no sign-up fees, and no hidden costs. Take advantage of pay as you go pricing and affordable pre-employment screening solutions and invest in the future of your business, paying only for what you need.

With ShareAble for Hires, you can screen now, receive reports now, and hire now.