Criminal Background checks uncover a variety of important information that can prove useful to employers looking for quality employees. Through a background check, you can receive information on an applicant’s criminal history, such as felonies and misdemeanors, along with an Identity Check to ensure they are who they say they are. Another component of pre-employment screening is credit checks, which can help you better gauge a candidate’s financial responsibility, such as spending habits and level of debt.

Read through to learn more about what background checks show and how to use this information to make a confident hiring decision.

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

Every new hire offers a new opportunity for increased productivity or revenue, but every person added to your team also presents a new business risk. Performing background checks during your pre-employment screening process can help confirm your hiring decision and can help keep your business profitable and productive.

What does an employment background check show?

People often wonder what actually shows up on a background check. The answer is that it depends on which type of search you order, since there are several different sets of records and data to pull from. Generally speaking, a background check for employment may show identity verification, employment verification, credit history, driver’s history, criminal records, education confirmation, and more.

Employers gather a wealth of information in order to evaluate a candidate’s character and help protect against the wrong hire. Read on to learn the various types of background checks for employment, what they may show, and why they matter.

What does a employment background check consist of?

Although there are many different types of background checks, employers are usually concerned with the top three searches. The most common pre-employment searches include:

1. Identity and Social Security Verification

By searching extensive databases such as the Department of Homeland Security and Social Security Administration records, a background check for employment can show whether or not a Social Security number is valid, who it belongs to, and if it’s been used in the past.

Online identity checks may also be used to verify an address, which can be cross-referenced to the information provided by a job applicant to detect inaccuracies.

2. Credit Report

Credit reports are prepared by credit bureaus who collect information from a variety of sources. For example, credit card companies and financial institutions furnish data to credit bureaus, who in turn maintain records on consumers.

Although credit reporting agencies do not necessarily have identical information, the general categories of information that show on a background check include:

- Identifying Information Credit bureaus can provide identifying information such as name, date of birth, and address.

- Credit Inquiries

Employment credit reports contain a list of past credit inquiries, identifying retailers, financial institutions, and other lenders that have requested a consumer’s credit report.

- Tradelines show accounts established with lenders. It could include the date the account was opened, the type of account opened (mortgage, auto loan, credit card, etc.), the loan amount or credit limit, the account’s current balance, and the borrower’s payment history.

- Public Records Credit reports may show previous bankruptcies.

Credit reports can reveal many potential warning signs in an applicant, especially if your new hire will regularly be handling money. High levels of debt or excessive spending on assets could indicate financial irresponsibility.

3. Criminal Records

If an employer knows—or should have known—about an employee’s relevant criminal background, they may face negligent hiring claims if the employee is accused of further wrongdoing. The information that shows up on a criminal background check may help safeguard business owners by revealing histories of criminal convictions.

Criminal background checks for employment may show criminal offenses at the county, state, and federal levels.

Various offenses which may be reported include:

- Current pending charges

- Misdemeanor convictions

- Felony convictions

- Acquitted charges

- Dismissed charges

Employers should take caution when evaluating what shows up on this form of background check for employment.

Depending on the type of job employers are hiring for, they might require additional information from their candidates and ask for more information on their background check for employment. Further searches include options such as motor vehicle and driving records, employment history, education verification, reference checks, and drug screening.

Why does it matter what a background check shows

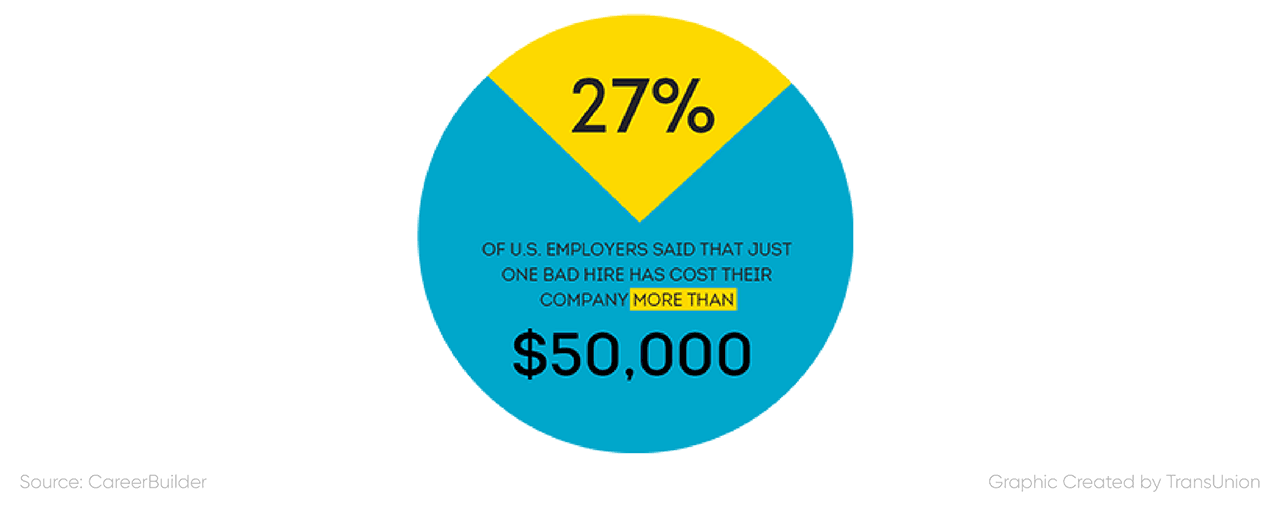

The consequences of making the wrong hire are staggering. According to a recent CareerBuilder survey, almost 27 percent of U.S. employers said that just one bad hire has cost their company more than $50,000.

The U.S. Department of Labor supports this claim; according to their reports, the cost of the wrong hire can add up to at least 30 percent of the individual’s first-year earnings. Depending on the position’s salary rate, this can easily exceed tens of thousands of dollars. Why are these costs so extensive Termination expenses. You may be required to pay additional healthcare expenses and, in some cases, face litigation expenses should your ex-employee choose to take legal action. Having to replace a bad hire can also be expensive; you’ll likely need to provide training courses, employment testing, orientation services, and more.

So how do modern business owners get a more complete picture of their job applicants to avoid a bad hire

There are several different pre-employment screening services that employers may use when trying to make a hiring decision, and what shows up on a background check will vary depending on which service is chosen:

- A traditional background check company may provide a wealth of information including military records and license verification. Although they may be thorough, these packaged services are usually costly and time-consuming, forcing small business owners to pay for exhaustive background checks that may not be necessary.

- Online people searches are a do-it-yourself form of background checks that show public information obtained online. Employers may type a job candidate’s name into a search engine and check for results on business pages or social media sites. While these searches are usually free, such types of background checks consist of information that may be unreliable, out of date, or out of context.

ShareAble for Hires offers reliable, trustworthy, and comprehensive pre-employment screening that can help you have a more complete picture of your job applicant. Through our low cost employment background checks, you will receive access to criminal reports, credit history, and identity verification, you can confirm your hiring decision and verify if your applicant meets your criteria.

Know Your Applicant’s Background with a Criminal History Check

Keeping your business safe should be a priority, and running criminal background checks on job applicants can protect your company, employees, and customers.

TransUnion data shows that nearly 1 in 4 employment background reports contain a criminal record. If you’re hiring for a position that requires direct contact with the public or handling cash, sensitive financial data, or sensitive personal information, it can be especially important to check your applicant’s criminal report.

ShareAble for Hires scours 300 million national and state criminal records. Our criminal reports glean information from Most Wanted databases, the Sex Offender Public Registry, and criminal databases from 43 states.

Because there are many legal regulations regarding the use of criminal reports while hiring, it’s important you conduct a background screening process that follows federal and state laws. ShareAble for Hires criminal reports offer FCRA-regulated data, providing you with the relevant criminal history information needed to effectively screen potential employees.

When you use ShareAble for Hires for background checks, you’ll receive a criminal history report that includes search results from:

- 300 million criminal records

- Felony and misdemeanor criminal records from state and local jurisdictions in 43 states

- Most Wanted databases

- National Sex Offender Public Registry

- Records from federal agencies, including:

- The Drug Enforcement Administration

- The FBI

- Homeland Security

- The Bureau of Alcohol, Tobacco, Firearms and Explosives,

- Marshals, the U.S. Secret Service, and the U.S. Treasury Office of Foreign Assets Control

Get a Picture of Your Applicant’s Financial Situation with a Credit Report

Why should you consider a job candidate’s credit report Bad credit isn’t enough reason to dismiss a candidate, but the financial patterns and habits shown in their credit history might better indicate a candidate’s fitness. Getting a more complete picture of your applicant’s financial background can help you better determine the risk. You may decide to have stronger financial criteria for applicants who will be regularly handling money, and a credit report can be useful in determining the financial trustworthiness of your applicant.

Employers often use credit history to gauge a job applicant’s level of responsibility, but good money habits can also be important to specific categories of companies and positions. Does the position in question involve the handling of money Will your hire have access to the company’s sensitive financial information Knowing whether a candidate manages their finances responsibly can help you determine if they’ll handle your company’s finances responsibly as well.

ShareAble for Hires draws its credit reports from TransUnion, a trusted, reliable credit reporting agency with over 40 years of experience.

When you use ShareAble for Hires for pre-employment background checks, you receive a credit report that includes:

- Recent employment history*

- Verification of name, address, and social security number

- A summary of active accounts and credit lines

- Any debts incurred, including credit card debt, mortgage and car payments, and student loans

- Payment history

*Not all employment history may be available or contained within a credit report.

Identity Verification Confirms Your Applicant is Who They Say They Are

Identity theft reached an all-time high in 2016. New data from Javelin Strategy & Research shows an estimated 15.4 million consumers were impacted by some type of identity theft. That means almost 1 in 16 U.S adults were victims of identity theft in the past year alone.

What does this mean for your business As an employer, you should be confident that you know exactly who you’re hiring. To ensure job applicants are straightforward and forthcoming with their histories, it’s essential to verify their identity.

ShareAble for Hires offers built-in identity verification with each screening package so you know your applicant is who they say they are. Applicants enter their information into the system and answer a series of personal questions to confirm their identity and grant consent to screening.

The process is done entirely online so you can screen whenever it’s most convenient for you. All applications and reports are kept on your employer dashboard so you can manage and refer to applications in one place.

Conclusion

Finding an honest, responsible and trustworthy employee is no simple task, but ShareAble for Hires makes it easier. Make faster, better-informed hiring decisions with ShareAble for Hires pre-employment screening services. With criminal reports, credit histories, and identity verification delivered to you in minutes, you’ll have the information you need to support your hiring decision.