First and foremost, we are not desiring to nor do we want you to consider the information in this blog to be legal advice. Instead, this is intended only to be helpful (but general) information. You are encouraged to check with your legal counsel as to any laws mentioned in this blog and any obligations you or your business may have.

You’ve seen first-hand how hiring the right employees can make or break workplace productivity. A great employee team is as efficient, energetic, and dynamic as a well-oiled machine. However, accidentally hiring a sub-par employee can throw a major wrench in the gears—and bring your whole system to a grinding halt.

For small business owners, such breakdowns in communication and efficiency translate into losing money. That’s why it’s crucial to thoroughly vet your candidates with a well-organized hiring process, including a comprehensive background check. While background checks are critical for employers, they also require attention to detail and from a legal perspective. Employee background checks are generally considered “consumer reports” under the Federal Fair Credit Reporting Act (FCRA), which means they are subject to parameters around access and use. Remaining compliant with FCRA regulations throughout the background screening process is crucial. If you ignore consumer laws—even accidentally—you can expose yourself to expensive and time-consuming lawsuits that can run you out of business.

It is essential to use a FCRA-compliant employee screening service like ShareAble® for Hires when bringing new people on board. Knowing that your employee background check follows consumer reporting regulations means one less thing you have to worry about when selecting the best candidate for employment.

In this article, we’ll discuss – from a general level (this is not legal advice; check with your legal counsel for that) - how FCRA regulations affect the background screening process and go over some important steps.

What is the Fair Credit Reporting Act (FCRA)?

The FCRA is a federal law that was enacted in 1970. Originally designed to help consumers dispute and resolve inaccuracies in their credit reports, this act has since been expanded to cover numerous other consumer reports.

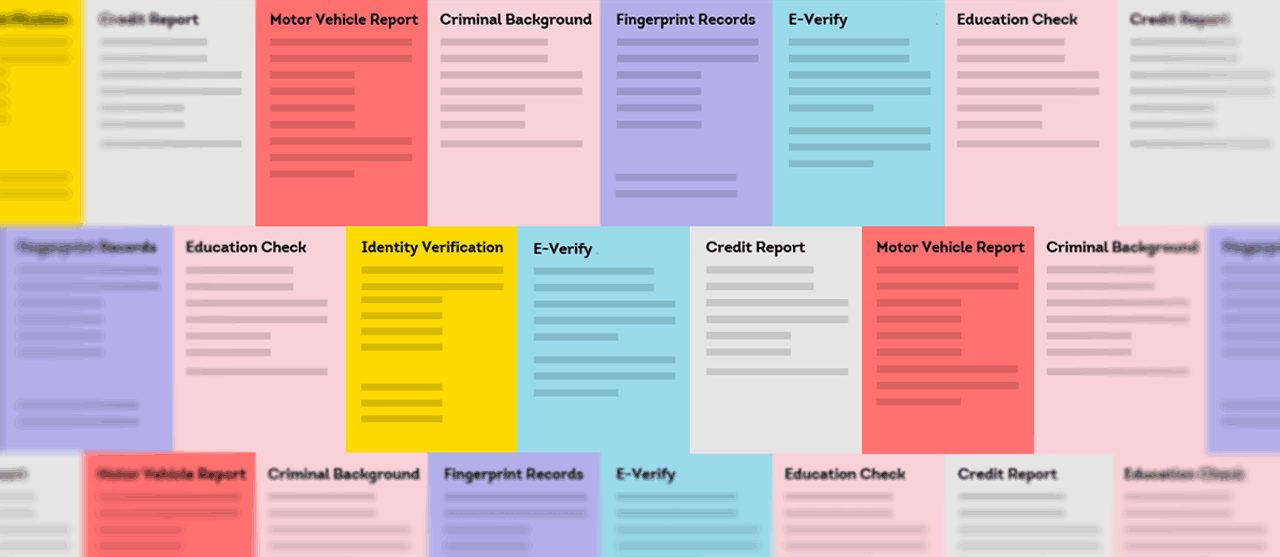

A consumer report contains information provided by a consumer reporting agency. This information may detail a consumer’s:

- Credit health

- Character

- General reputation

- Personal characteristics

- Mode of living

The information above is typically used to determine eligibility for a variety of purposes, including employment, credit, or insurance.

Today, FCRA compliance standards generally regulate employers that use background reports, along with the Consumer Reporting Agencies (CRAs) that provide them with these reports. FCRA rules generally apply any time an employer obtains a background check on a potential job candidate from a third-party source.

Among other provisions, and according to the FTC, the FCRA safeguards job applicants by ensuring:

- They have the right to be informed of a background check

- They have the right to provide consent for an employment background check

- They have the right to review information pertaining to their personal and financial information

- They have the right to correct any inaccuracies their background report may contain

- They have the right to appeal decisions if the applicant feels the decision was made unfairly

What is FCRA Compliance and What Does This Mean for Employers?

“FCRA compliance” typically means adhering to the requirements set forth by the Fair Credit Reporting Act. These requirements generally require employers to conduct background checks that are accurate, transparent, and fair to consumers.

To help ensure your small business is protected from an FCRA lawsuit, it’s important to familiarize yourself with the process of requesting an FCRA-compliant background check.

The Federal Trade Commission (FTC) lays out employer responsibilities in three different categories::

- Before requesting a background check

- Before taking adverse action

- After taking adverse action

Each specific stage of a background check has its own requirements in the screening process.

Employer Responsibilities Before Requesting a Background Check

Employers should consider doing the following before requesting a background check:

- Provide a written notice to the applicant, explaining that information obtained in their consumer report may be used for employment-related decisions. The notice must stand alone and cannot be included in the employment application.

- Get the applicant’s written permission to obtain the consumer report.

Employer Responsibilities Before Taking Adverse Action

If you decide the results of a background report disqualify a job candidate from a position, there are steps you must take before you can reject their application, deny a promotion, or take any other adverse employment action. Generally, you must provide the applicant or employee with:

- A notice with a copy of the consumer report you used to make your hiring decision

- A copy of A Summary of Your Rights Under the Fair Credit Reporting Act

- A reasonable amount of time to review the report and either confirm or dispute its findings

Employer Responsibilities After Taking Adverse Action

If you decide to move forward with adverse action, you generally must provide notice of your intention verbally, electronically, or by writing to the applicant.

An Adverse Action Notice explains an individual’s rights to review information reported on a background check. This provides them with the opportunity to correct inaccurate information. The notice should generally include:

- Information on the Consumer Reporting Agency that provided the report

- A statement that the background screening service didn’t decide to take the adverse action and cannot give specific reasons for it

- Indicate a person's right to dispute the accuracy or completeness of any information

- Inform the individual that they can receive an additional free report from the company if they request it within 60 days

According to the Equal Employment Opportunity Commission (EEOC), you must preserve this documentation for one year after pulling the report, or after action was taken, whichever happens later. Once that period is over, you must dispose of the consumer report correctly. Again, check with your legal counsel if you have questions.

Complying with EEOC Discrimination Regulations

In addition to FCRA compliance, businesses typically must also abide by the standards set forth by the Equal Employment Opportunity Commission. These standards may include the following:

- You cannot check the background of applicants and employees when that decision is based on age, race, national origin, color, sex, religion, disability, or genetic information. For example, only asking applicants of a certain age or older about their financial history can be classified as discrimination.

- You must apply the same standards to everyone.

- You must not base employment decisions on background problems that may be more common among certain groups.

- You may need to make exceptions for problems revealed during a background check that were caused by a disability.

While the majority of business owners wouldn’t intentionally ignore FCRA regulations, even unintentional non-compliance can result in severe consequences that can devastate your business.

It’s crucial to confirm the Consumer Reporting Agency that provides you with a report is credible and reliable; a mistake by the agency you hire to run a background check could also hurt your business. Which is why it’s crucial to select a reputable employer background screening service that complies with all consumer reporting regulations from the start.

What are the consequences of FCRA non-compliance?

Your business can face severe financial penalties for running afoul of FCRA compliance regulations—even if the violation is accidental. Settling an FCRA background check lawsuit can be incredibly costly.

According to Webrecon LLC, in February 2018 alone, 422 FCRA lawsuits were filed. The numbers have steadily increased each year, indicating that potential employees are savvy about their rights and are prepared to take action against non-compliant employers.

Such costly litigation could ruin your small business; employer lawsuits incredibly expensive and can take months—or even years—to resolve. Employer generally should make every effort to remain FCRA-compliant.

How do I comply with the FCRA during the hiring process?

You should discuss this question with your legal counsel. One way to ensure that your background screening process is FCRA-compliant is to use a reputable screening service. An FCRA-compliant background check provider covers the collection and storage of an individual’s report.

Note: there are some state-specific laws that can limit your ability to obtain certain personal information during a background check. For example (this is not necessarily an exhaustive list), California and Massachusetts have regulations in place that, in part, specify that employers cannot consider or seek information about arrests that did not result in a conviction. In addition to abiding by the FCRA compliance playbook, it’s necessary to stay up-to-date on any state laws where your business operates.

Run FCRA-Compliant Background Checks with ShareAble for Hires

Bringing new employees into your business is a delicate task; you have to comply with applicable consumer reporting laws, while still trying to determine if they would be an asset or liability to your company. Bolster your compliant process with comprehensive employee background screening through ShareAble for Hires.

Created specifically to help small businesses, ShareAble® for Hires provides comprehensive, FCRA-compliant reports in a matter of minutes. Confirm an applicant’s personal information and help prevent fraud with pre-employment credit screening and an identity check. With these in-depth reports, you can discover identity-related red flags and learn more about a candidate’s financial history, including outstanding debts. Knowing your potential employee is responsible with money can give you peace of mind—especially if the role involves financial oversight. Backed by TransUnion, a major credit reporting agency, you can feel confident that your results are accurate and reliable.

Help protect your business, employees, and customers from a potential wrench in the gears with industry-leading criminal background checks. Each criminal report adheres to applicable FCRA regulations while scouring national and state-level criminal databases, including the FBI’s Most Wanted and the National Sex Offender Public Registry. With in-depth review of arrest records, warrants, and court proceedings, you can rest easier knowing that you used compliant background checks toward to help drive a reduction of the risk of dangerous hires.

ShareAble for Hires provides simple, straightforward pricing, with no subscription requirements or sign-up fees. This is ideal for hiring managers who don’t need to screen hundreds of applicants every year. You pay only for the background checks you need, when you need them.

While you can’t protect your business from every potential threat, you can help reduce the risk of consumer reporting lawsuits with FCRA-compliant background screening. Protect your business and keep your well-oiled machine running smoothly with ShareAble for Hires. Learn more and start screening today.