One way to stand out in today’s competitive job market is to offer strategic employee compensation and benefits packages. For small business owners, this means really understanding your open position’s duties, researching the compensation of similar jobs, setting expectations with transparency in your job description, and highlighting both monetary and non-monetary perks in your hiring process.

Disclosure: This content, except as otherwise indicated or stated on this site, is the property of TransUnion Rental Screening Solutions, Inc. This content is for educational purposes and for convenience only. Trademarks used are the property of their respective owners, and no endorsement or affiliation is implied. The information presented in this content is “as is” without warranties of any kind, and specifically is not represented to be complete and does not constitute legal advice, and is subject to change without notice. You are encouraged to check these terms from time to time for changes, and by accessing this site you agree to these terms and all terms listed. Laws and regulations may vary by state and locality. Consult your own counsel if you have legal questions related to your rental property practices and processes.

Disclaimer: Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

To catch a prize tuna, you need the right bait. Similarly, if you’re not offering strategic compensation and benefits packages for your employees, you might end up with an empty hook––and lost productivity.

Many small business owners work hard to write job descriptions, spot potential red flags in resumes, conduct high quality interviews, and run pre-employment screening through a reputable service like ShareAble for Hires®.

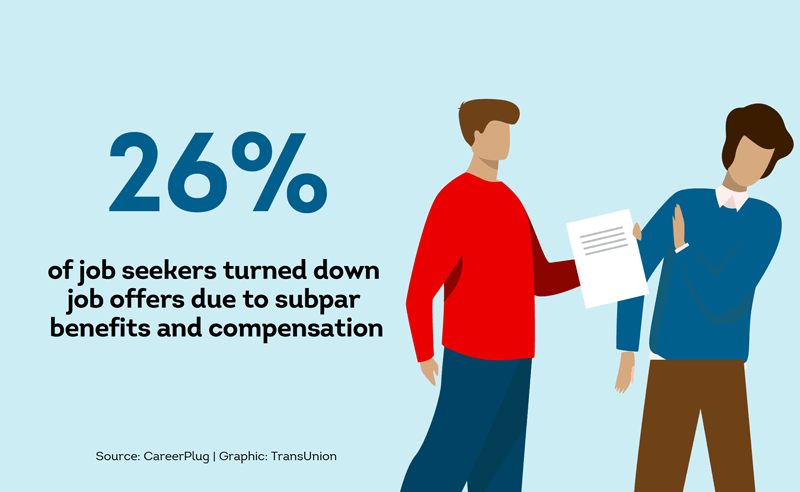

However, not all businesses put as much thought into the total compensation and benefits packages they offer––and that could be a huge mistake. According to data from recruiting site CareerPlug, 26% of job seekers turned down job offers due to subpar benefits and compensation.

If over one-fourth of your top candidates turned down your job offer, where would that leave your business. Can you afford to lose even more time and effort on a hiring process?

Well thought-out employee benefits and compensation packages can help entice great candidates to join your company––and help you reach your business goals. Even if you’re not able to provide the giant, dazzling benefits packages of giant corporations, there are still several perks you can offer job applicants to be a more attractive employer.

This article covers compensation and benefits tips for small business owners, so you may help boost your recruiting efforts.

Here’s what to expect:

What’s Included in Compensation and Benefits Packages

According to job site Indeed, employee compensation and benefits packages are the total combination of an employee’s base salary and the cluster of perks and benefits (both financial and non-financial) a company provides.

Outside of a base salary, standard employee benefits packages often include things like:

- Health benefits, including health, vision, and dental insurance, flex spending accounts, Health Savings Accounts, and more.

- Paid time off, including paid vacation days, personal time, sick days, observed holidays, and more.

- Additional insurance for things like disability and life insurance

- Mandated benefits*, that are often required for many jobs, such as workers compensation, FMLA, overtime pay, COBRA benefits, and unemployment

* Please consult your legal counsel for guidance on your specific business operations and responsibilities under federal, state and/or local laws, and to assist with any questions on your responsibilities for mandated benefits applicable to your small business.

On top of that, some employers offer employee benefits packages that include additional perks like the following:

- Educational benefits, like tuition payment, a budget for continuing education, or student loan reimbursement

- Stock options and profit-sharing for companies that are publicly traded

- Retirement benefits, like 401k, pension plan, and others

- Benefits for workers with children, such as a free daycare, childcare reimbursement, flexible time off for parents, or extra parental leave

- Housing benefits, such as providing employee housing, reimbursing relocation expenses, or equipment budgets

- Remote work and options for telecommuting or hybrid working

- Wellness benefits, such as an on-site fitness center, reimbursed or discounted gym memberships

- Transportation benefits, such as a company car, gas reimbursement, car service, or public transportation benefits

- In-office perks, such as a dog-friendly office, free food and beverages, a social area with games, or other activities

Depending on the company, employers may offer just a few or many of these benefits. Smaller companies are sometimes limited in the amount of salary they can provide employees. However, offering some lower cost perks, such as in-office comforts, could be a creative way to provide a more attractive workspace for employees.

Pro Tip: Offering the right benefits package is just one of the ways to boost your recruitment process and help to hire better employees. Read the article to learn more.

Why The Right Compensation and Benefits Package is Important

Now more than ever, employees move between jobs when they’re unhappy. In fact, increased job hopping was one of the trends in recent years. And when people do look for new positions, compensation and benefits are top of mind.

According to human resource management company ADP, one in three job seekers look for better benefits and compensation compared to their current roles. This means, if you don’t have a good compensation and benefits package, you might get ignored by 30% of job seekers––and may drive your current employees to look elsewhere.

In a competitive job market, you should do everything you can to stand out. If you’re not able to provide a great candidate experience, conduct pre-employment screening quickly, and offer an attractive compensation and benefits package, then you could risk losing your top candidates to competitors.

How to Calculate an Employee Compensation Package

When trying to decide what compensation and benefits package to offer a job candidate, it’s helpful to look at your own company’s budget and at similar roles at other companies. Below, you’ll find details on both:

Determine Your Company’s Budget

One of the biggest limiting factors while setting the salary for a position is how much your company can realistically afford. When looking at the budget, don’t forget to calculate total compensation and not just hourly or salary pay.

According to job site Indeed, total compensation includes things like:

- Full cost of salary

- Overtime pay

- Bonuses (e.g. performance, holiday, and sign-on bonuses)

- Health, workers comp, disability, life, and other insurance

- Childcare or educational benefits

- Moving, relocation, or equipment reimbursement expenses

Having an accurate calculation of your maximum budget can help manage the expectations of both you and your potential applicants.

Compare Similar Roles to Your Job Description

While surveying other postings, it’s important to look beyond job titles. To make a fair comparison, you should also look at:

- Job duties and hours

- Expected amount of previous experience

- Required educational level

- Where the position is located (in a higher or lower cost of living area)

- Monetary benefits (such as health insurance)

- Perks and extras (such as remote work, free food, or social activities)

If your job has more duties, requires more experience, and is in a higher cost of living area, then you’ll likely need to turn up the salary and benefits to remain competitive. However, if your job requires less experience, has great perks, and is completely online, you may be able to get away with the lower end of the scale.

Making Benefits and Compensation More Attractive to Job Applicants

Even as a small business owner, there are several things you can do to help make your business shine when it comes to employee compensation and benefits packages.

Here are some tips to help stand out:

Stay on Top of the Compensation Trends

Knowing what job seekers want can help you better prepare your company for current market needs. According to the Society for Human Resources Management, top benefit and compensation trends include:

- Pay increases to match or exceed inflation

- More healthcare coverage, focusing specifically on mental health

- Finding creative ways to manage increases in healthcare costs

- The potential return of pension plans

Knowing what job seekers expect can help you better position yourself. For example, if all of your competitors are raising their wages to match inflation, then it might be time for you to offer a larger salary, too. If not, you may not be as attractive to potential job applicants.

Be Transparent From the Start

Having a mismatch between what your small business can offer and what your candidate expects can lead to frustration, a bad experience, and potentially wasted time on both sides. That’s why more and more businesses are being clear about their compensation and benefits from the get go.

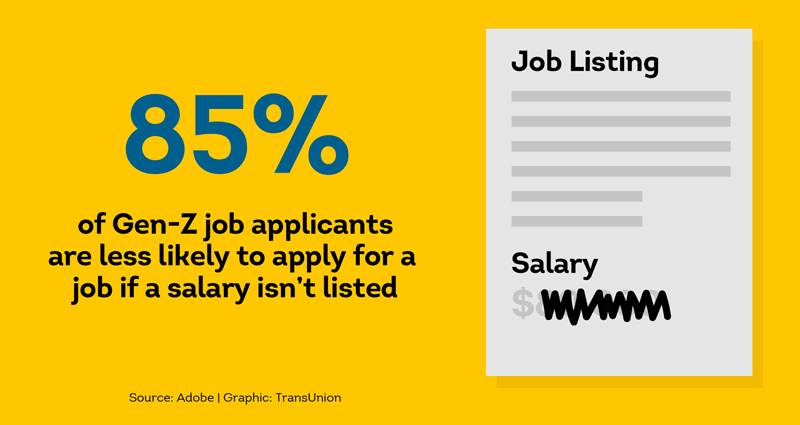

In fact, according to research from Adobe, 85% of Gen-Z job applicants are less likely to apply for a job if that salary isn’t listed.

For a better candidate experience and potentially hire application yield, consider posting the expected compensation on the position.

Pro Tip: Transparency shouldn’t end when your new staff member walks in the door. Help them start off on confident footing with a quality employee onboarding program.

Get Creative. Offer Non-Monetary Perks

Small business owners often lack the hiring budgets, specialized recruitment professionals, and administrative time of large corporations. For example, a small start-up is unlikely to offer the same salary to a Software Developer as Google.

Still, it’s important to maximize resources to make the most out of what you can control. When it comes to hiring, having great perks and benefits can make your company stand out. If you can’t offer the same benefits as large companies, even the following gestures could go a long way in building loyalty, increasing retention, and attracting talent:

- Remote or hybrid work

- Flexible schedule set by the employee

- Dog friendly office

- Food, snacks, coffee service

- Games, rest, or decompression areas

- In-office fitness center or reduced cost gym membership

- Public transportation benefits

- Company sponsored meals or happy hours

Pro Tip: Many perks, such as an office coffee service, are also often tax deductible. Maximizing these strategic small business tax tips at filing time could help reduce your tax burden.

Provide an Excellent Candidate Experience

The hiring process is your job applicant’s first impression of you as a potential employer. While you’re trying to judge if someone will be a good employee, they’re also deciding if you would be a good employer.

Providing a fantastic candidate experience helps you look organized and professional. Plus, it’s a great way to highlight your compensation package exactly the way you want. Here’s how:

Framing Your Salary and Benefits

A great candidate experience means you control the narrative. Even if you can’t offer the same compensation as larger companies, you can spin this as a positive.

For example, consider these two statements:

- “We pay $57,000 annually and have some great benefits”

- “We pay $57,000 annually. People love working for us because we offer fully remote work, autonomy over your schedule, and a clear path for advancement.”

Sometimes people may be willing to take a lower salary if the benefits are excellent or if it’s the exact type of job they’re looking for. Make sure to highlight what makes your small business desirable in your job description and during interviews.

Pro Tip: Highlighting work culture, work-life balance, and paths for promotion are also some of the top ways to attract millennial employees.

Use ShareAble for Hires for Pre-Employment Screening

Even the best benefits package won’t matter much if your new employee turns out to be an ill-fitting hire who may drain your patience and resources. Help prevent reeling in a disaster with flexible pre-employment screening through ShareAble for Hires.

Criminal records reports scour hundreds of millions of crime records while searching for a potential match to your candidate.

Your candidate puts on their best face during your hiring process––but is it actually theirs Identity verification helps confirm your applicant is actually who they say they are. This can help you prevent hiring potential scammers or fraudsters.

If your open position is responsible for managing cash, sensitive data, or company secrets, consider running an employee credit report. This helps you learn more about their financial track record.

Pay only for what you need, and only exactly when you need it. There are no hidden fees or barriers to entry. You can get screening reports in minutes . All reports are backed by TransUnion, a major credit agency with nearly 40 years of data expertise.

When you’ve got a great candidate on the hook, don’t let them swim away with a slow, sloppy hiring process. Keep your lines tight with fast, affordable pre-employment screening through ShareAble for Hires.

ShareAble for Hires

Sign-up Now. Reports Now. Hire Now.