When it comes to employee background checks for small businesses, not all screening providers are created equally. When vetting potential background check servicers, it’s important to consider the kind and trustworthiness of the reports provided, report cost, industry-specific features, speed, and level of customer service. Instead of risking potential lawsuits going the DIY route, use an accredited, FCRA-compliant background check provider with a good reputation.

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

You probably wouldn’t take your Lamborghini to Shifty Al’s Tire ‘n Lube for repairs. Similarly, you shouldn’t trust your new employee’s background check to just anyone. Just like different mechanics work on different types of vehicles, screening services vary––and they’re not all created equally.

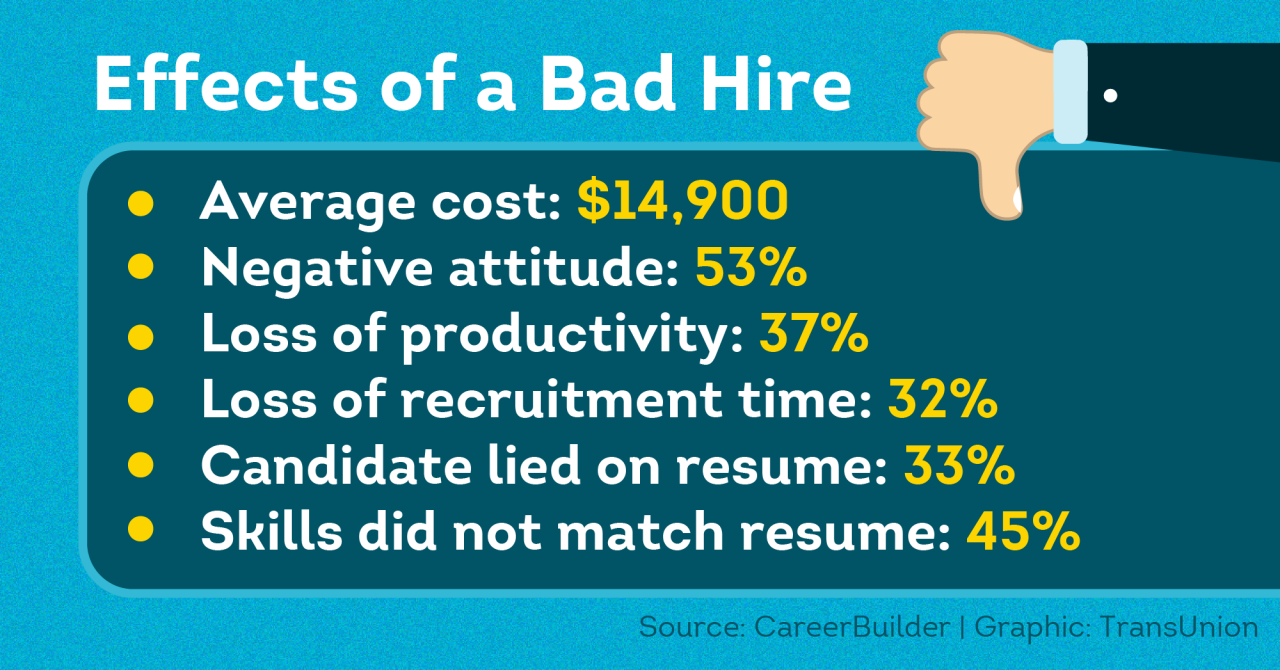

When it comes to adding new people to your team, the stakes couldn’t be higher. A bad hire can cost your company 30% of the departing employee’s salary. That doesn’t even count the potential property and reputation damage a negligent employee might bring.

What’s worse, if you miss something in your screening process and your employee makes a harmful mistake, you could be liable for the damage in a negligent hiring lawsuit. That’s why it’s absolutely essential to use a reputable pre-employment screening provider like ShareAble for Hires. provider like ShareAble for Hires.

This guide covers what to look for in a background check provider and how to get the best results for your business. Keep reading for an in-depth look at employee background check companies, or use the links below to navigate the post.

Why Finding the Right Background Check Company is Crucial

With so many background check companies to choose from, how do you find the right one for your business? While it may be overwhelming, finding a suitable background check provider ,is essential. Pre-employment screening helps protect you from bad hires and saves you from headaches down the line. In fact, according to a CareerBuilder Survey, a bad hire can result in:

- Loss of productivity

- Increase in negative employee morale

- Decreased quality of work and output

- Negative impact on client relations

- Fewer sales

In addition to the consequences above, bad hires can create unsafe work environments for surrounding employees. That’s why it’s so important to find a screening service that isn’t just trustworthy and professional, but also delivers accurate reports in a matter of minutes. That way, you don’t waste time during the hiring process

What do background checks include?

Pre-employment background checks are a vital hiring tool that provide insight into an applicant’s past. While these screenings can reveal an extensive amount of information, what shows up on a background check ultimately depends on the type of employee background check your business gets. In most cases, employee screening divulges the following information:

- Full name and aliases

- Previous employment

- Financial history

- Prior convictions or arrests

- Military records

- Past and current professional licenses or certifications

- Vehicle records

- And more

Below is a breakdown of the top three types of background checks that can uncover the most critical information for small businesses. This includes identity and social security verifications, credit report screenings, and criminal record checks.

Identity and Social Security Verification

Is your new hire really who they say they are? Whether trying to hide a troubling past, conduct a scam, or even engage in corporate espionage, there are many reasons why someone may apply for jobs with fake credentials.

Conducting Identity Verification can help lower your risk of falling victim to fake credentials. These checks often compare your job applicant’s self-supplied data to official Department of Homeland Security and the Social Security Administration records. Identity reports also show if the candidate is using a real, fake, or stolen Social Security number, helps ensure you hire someone that’s honest about who they say they are.

Credit History

Checking an applicant’s credit history can prove valuable, especially if they'll be responsible for your company’s finances, have access to sensitive customer data, or handle money. Credit checks for employment pull information from credit bureaus and disclose past credit inquiries, open lines of credit, bankruptcy, and more.

However, you must be careful when getting credit reports. Consumer data is federally protected. Anytime you’re requesting a credit report, ensure you’re using an FCRA-compliant provider like ShareAble

Criminal Records

It’s your responsibility to keep your workforce and business safe. This means that it’s critical to learn as much as you can about any potential employee with a criminal check for employment. Screening for criminal activities may show pending charges, arrests, and convictions.

A criminal screening through ShareAble for Hires scours 370+ million records across dozens of federal and state-level databases. Near-instant reports include matches from agencies like the FBI’s Most Wanted List and the National Sex Offender Registry, Drug Enforcement Administration, Department of Homeland Security, and more.

How much do background checks cost?

The cost of a background check can range anywhere between “free” to hundreds of dollars, depending on the required information and access fees, the company, and the number of background checks you need. However, there’s no standardized price, so you may have to compare prices and the offerings from different companies.

Some small business owners might be tempted by the seemingly low cost of a DIY background check. However, this trap is one of the most common pitfalls of small business screening. While there are ways to perform a do-it-yourself background check with information found online, publicly available information is often unreliable, incomplete, and may not actually match the identity of the person you’re searching for. It’s well worth the small fee to get a trustworthy background check through a reliable provider. With ShareAble for Hires, all reports are backed by TransUnion, a major credit agency with decades of consumer data experience You get fast, affordable screening packages with reports you can trust.

According to the society for Human Resources Management, hiring the wrong individual can cost up to $240,000. The small price of professional screening pales in comparison.

What to Look For In A Background Check Service

With several options for background check services available, narrowing down the ideal company to work with can be challenging. Here are some of the most important factors when selecting a background check provider. As you go through the list, keep in mind that these services should improve the hiring process at your business instead of slowing it down.

1. Accreditation and Accuracy

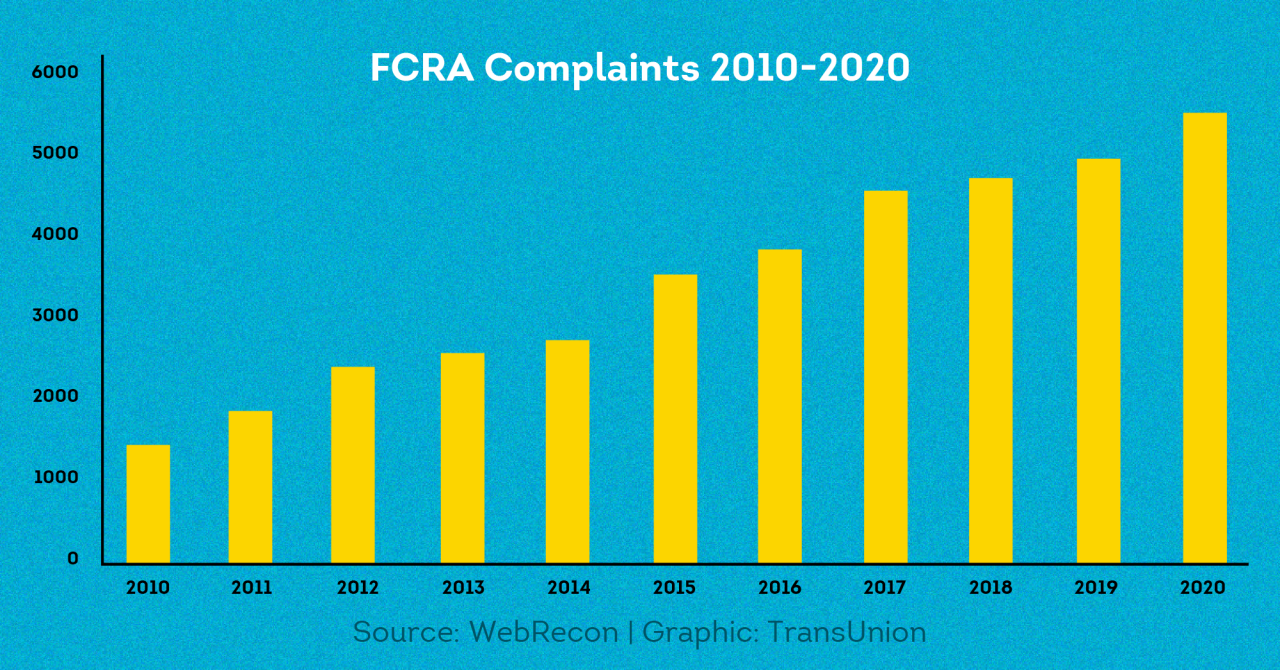

The verified background check agency you work with should comply with the Fair Credit Reporting Act (FCRA). This act protects workers from unfair hiring practices and ensures consent is given before a background check is conducted. If your background check company cannot provide proof of proper accreditation, walk away. Not doing so could result in working with a fraudulent company that may cost you more trouble than they’re worth. This is especially true since FCRA complaints have continued to rise since 2010, according to WebRecon.

Besides FCRA, it’s also recommended that your screening agency is accredited by the National Association of Professional Background Screeners (NAPBS). This is because companies accredited by the NAPBS must adhere to strict regulations, ensuring an applicant’s information will be accurate and gathered legally. You don’t want to receive the wrong background check report and base your hiring decision on incorrect information.

After all, you’re paying to receive an employment screening to make a knowledgeable hiring selection, so making sure the information received is up to date and correct is important.

2. Types of Screenings

Your background check service should provide the type of screenings you need. For example, businesses that offer relocation services may need to dive deep into an applicant’s driving and criminal history to determine if they’re fit for the role since they’ll be required to drive long distances or transport expensive items.

There are several different types of employment background checks available for small businesses, including:

- Identity verification screenings

- Criminal background checks

- Credit history checks

- Education background checks

- Motor vehicle reports

- Fingerprint records

Whether you need one specific screening or multiple, the type of background check you need is a vital factor to consider as you search for an employment background check solution.

3. Industries Served

Not all employment background check companies cater to every industry. In fact, some tailor background check reports to particular sectors , such as manufacturing or transportation. This is due to some industries having complex and strict regulations that employers must follow.

There are also background check companies that offer different packages, depending on the type of business you run. Others will ensure accurate and thorough reports regardless of the industry. While it’s not necessary, industry-specific employment screenings can provide an added step to the applicant evaluation process that allows for a better hiring decision. Additionally, some background check providers specialize in serving companies based on the size.

Designed specifically for small businesses, ShareAble for Hires providers on-demand screening at affordable rates. There’s no application or sign-up process, no subscriptions, monthly minimums, or hidden fees. Simply pay only for what you need and only when you need it.

4. Turnaround Time

If a background check takes too long, your top candidate could accept a job elsewhere before you even get the results. This makes knowing the turnaround time of a background check essential. In general, background checks can take a few minutes to a few weeks to complete. However, the longer it takes to conduct a pre-employment screening, the more time and resources are spent and the greater risk your candidate will get hired by a competitor.

ShareAble for Hires provides lightning-fast background checks, so you can identify top talent and confidently hire applicants right on the spot.

5. Customer Service

If you or the applicant ever has trouble with their background check, you want to be able to count on the provider for support. Whether this is done via email, live chat, or the phone, access to a customer service representative when you need it is essential to receiving the report back as quickly as possible. Slow downs due to inadequate customer service can significantly delay the background check process and hinder your hiring altogether.

Help Get the Facts with ShareAble for Hires Background Checks

When it comes to driving success in your small business, hiring an ill-fitting employee is a major roadblock. Help clear the way ahead with fast, dependable screening through ShareAble for Hires.

Does your top candidate have a winning history or are they hiding a reckless past that could put your business at risk? A criminal record check zooms through millions of records looking for a match to your job applicant. Meanwhile, identity verification helps confirm your potential hire is exactly who they say they are. Backed by decades of TransUnion data expertise, you can feel more confident in the accuracy of your reports and in your hiring decisions.

Finding a mechanic to fix a luxury car is hard. Finding an excellent background check provider doesn’t have to be. Speed through your hiring process more safely with ShareAble for Hires.