Salary transparency laws require small business owners to disclose anticipated compensation or pay ranges on job postings. Even when not legally required, sharing expected salary can attract better candidates, increase trust, and promote fair pay practices. It can also help small business owners avoid legal implications, reputational damage, and employee dissatisfaction. By complying with salary transparency laws, small businesses can better build credibility, attract top talent, and create a more positive work environment.

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

Some hiring trends are like wading in the ocean. If you’re not paying attention, you risk getting knocked over by a coming wave. Among the top hiring trends of 2023, one issue has continued to cause ripples across the country: salary transparency laws.

Rising in popularity, salary transparency laws require employers to provide things like compensation ranges and income expectations directly on job applications, so that applicants know what they’re getting into before diving in.

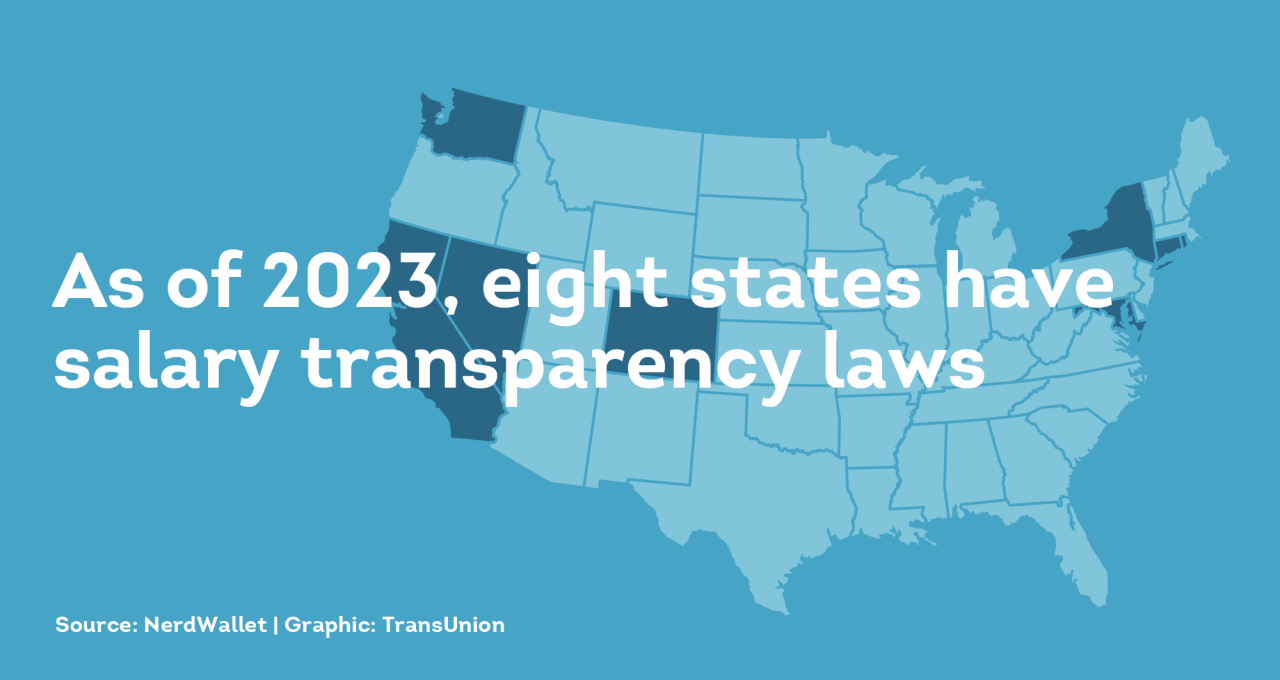

According to money site NerdWallet, at least 8 states already have salary transparency laws, and others have these laws at the city level. Even if it’s not yet formally a law in your area, you may still want to consider adding anticipated salary to open positions as a best practice.

In this way, salary transparency laws are like background checks. Though only sometimes required by law, conducting pre-employment screening of all job applicants through a reputable service like ShareAble for Hires® can help you find the best candidates, protect your businesses, and encourage growth.

Similarly, though not required, including salary on job applicants could be the thing that helps you weather the changing tide of the labor market.

This article provides information about salary transparency laws, their benefits, their challenges, and how to figure out what you need to do to comply with relevant laws.

Here’s what to expect:

- What Are Salary Transparency Laws and Why Do They Exist?

- Should You Post the Salary If It’s Not Required?

- Benefits of Salary Transparency Laws (And How to Maximize Them)

- Challenges of Salary Transparency Laws (And How to Solve Them)

- How to Learn About Salary Transparency Laws in Your Area

- Consequences of Violating Salary Transparency Laws

- Boost Best-Practices with Pre-Employment Screening through ShareAble for Hires

What Are Salary Transparency Laws and Why Do They Exist?

According to Honigman law firm, salary transparency laws require employers to disclose anticipated compensation or pay ranges on job postings for a position. These laws aim to promote transparency, fairness, and equal pay in the workplace.

The specifics of salary transparency laws vary by jurisdiction. Some locales may require employers to provide salary ranges directly on ads for open positions, disclose pay scales post-application, or just make salary information available upon request.

It’s important to familiarize yourself with the specific laws applicable in your location to make sure you’re following the rules. Like with any laws, non-compliance with salary transparency regulations can result in penalties, fines, legal consequences, and a hit to your reputation.

Pro Tip: Your risk of legal action doesn’t end when you get someone in the door. Check out these tips for how to help avoid negligent hiring lawsuits and protect your business.

Should You Post the Salary If It’s Not Required?

When it comes to work, salary is obviously important. A recent study from McKinsey & Company showed that “inadequate compensation” is the number one reason that all workers leave their jobs, regardless of age or generation. And, when people do leave their jobs, they want to know exactly what’s waiting for them somewhere new.

While posting the salary might not be required in your area, you may want to consider it anyway, especially if you’re trying to recruit Millennial and Gen-Z talent. According to a Future Workplace Study from Abode, 85% of Gen-Z workers said they’re less likely to even apply for a job if the salary isn’t listed on the job description.

That means you may be completely missing out on even the chance of great talent, due to lack of transparency. Additionally, according to CNN Business, posting salaries is good for employers because it:

- Creates trust between employers, current employees, and applicants

- Helps normalize salaries at a particular employer

- Saves everyone time

Plus, even if you’re not sharing salary information on your job applications, your employees probably already are. According to a survey from The Empower Institute, 53% of Gen Z and 58% of Millennials would openly share their salary information on their LinkedIn. That’s not even counting the number of employees who share their salary information anonymously on sites like GlassDoor.

Given the benefits and potential pitfalls, posting salary ranges may still be worth it––even when it’s not required.

Pro Tip: Along with posting salary, another trending best practice is to conduct ongoing employee background checks at several key points in an employee’s job cycle. Knowing when to re-screen current employees can help you protect your business.

Benefits of Salary Transparency (And How to Maximize Them)

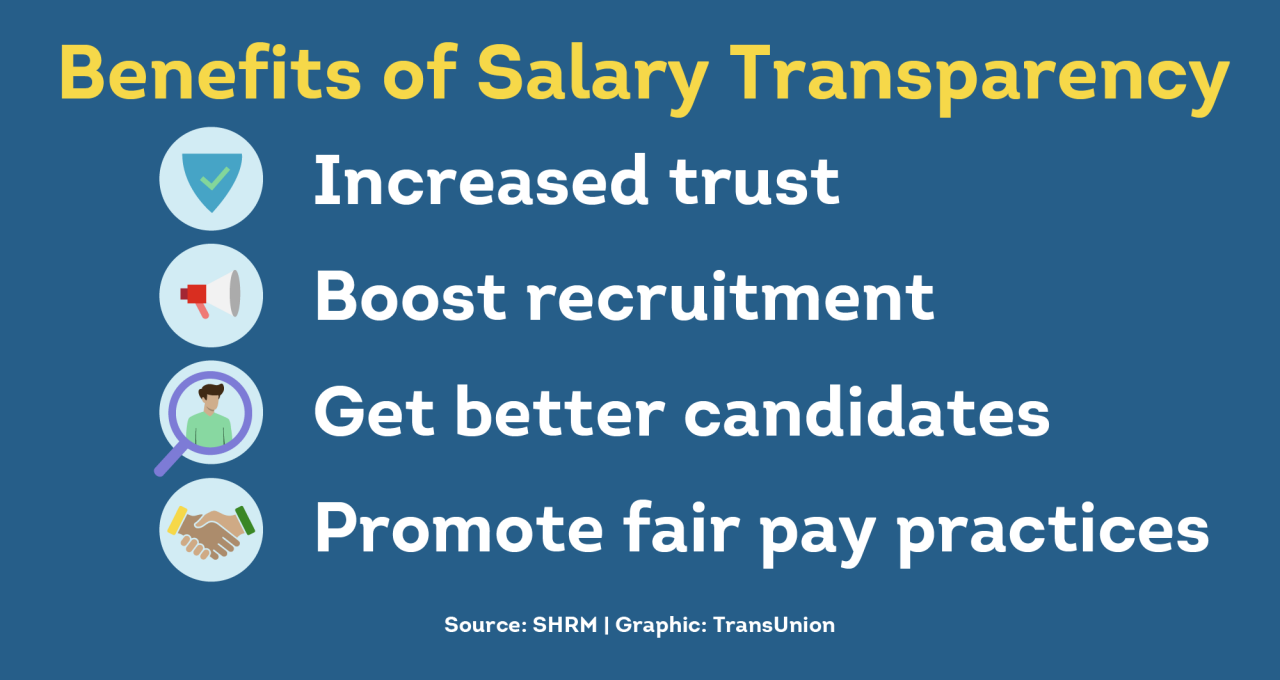

Even when it’s not required, including the expected compensation on job postings has several benefits. According to a salary transparency survey from the Society for Human Resource Management (SHRM), including payment information can:

- Increase trust: 73% of job applicants stated they were more trusting of companies who listed the salary upfront.

- Boost recruitment: 70% of businesses say including salary boosted the number of job applicants for a position.

- Get better candidates: Knowing how to find high quality job applicants is always a challenge in small businesses. The survey showed 66% of companies discovered posting the salary upfront attracted higher quality candidates.

- Promote fair pay practices. The same SHRM survey also noted that posting that salary is one step to helping decrease the gender pay gap and reach parity.

On top of all of the benefits mentioned by SHRM, posting the salary also helps both you and the applicant save time. Candidates that are a bad match can weed themselves out right from the start, so neither of you waste precious hours on a doomed process.

Additionally, according to HR guidance site 3R, posting salaries upfront can help reduce stress among job applicants and workers because they don’t have to play the negotiation game.

Pro Tip: Posting the salary is one of several strategies for streamlining small business hiring. Check out the article to discover them all.

Challenges of Salary Transparency (And How to Solve Them)

There are always small business hiring challenges to navigate when bringing in someone new. While posting compensation can be very beneficial, it can also bring out new obstacles––especially when you’re just transitioning into the practice.

Some of these challenges include:

Potential for internal conflict

Current employees may compare their salaries with newly hired or existing employees. They may feel discontent if they perceive inequities, leading to tension within the workforce.

How to handle it: Even without salary transparency laws, internal conflict about compensation is a risk you need to know how to manage.

According to the National Labor Relations Act (NRLA), employees are allowed to discuss pay with anyone they want. Trying to prevent or discourage these conversations could run you afoul of the law. Plus, the Department of Labor protects workers against retaliation from exercising rights like discussing pay, filing complaints, and more.

Have a plan for how to manage these conversations productively, because they are likely to happen and there’s little you can do it about. Your plan might include raising wages or understanding if existing staff go elsewhere to look for jobs.

Be prepared to communicate openly and honestly about why there is a pay difference and what the expectations are going forward.

Competitive disadvantages

Publicly disclosing salary ranges may give competitors insights into a company's compensation strategies, impacting its ability to negotiate salaries.

How to handle it:

Competitors are also facing the same pressures to share salaries. If they don’t, they also risk missing out on potential candidates. As more and more states enforce salary transparency laws, the playing field will be leveled. That also means you will have access to the same information from competitors.

Privacy concerns

Some employees may prefer to keep their salary information confidential, and forced transparency could infringe on their privacy rights.

How to handle it:

Consider posting a general range rather than an exact number, if the laws allow.

By anticipating what may get bumpy ahead of time, you can hopefully help prevent many common problems that arise when sharing employee salaries.

How to Learn About Salary Transparency Laws in Your Area

As an increasingly popular issue, the state of salary transparency laws is in constant flux. Many of these laws are relatively new. Others are still working through state and municipal ratification processes.

It’s incredibly important to stay informed of changing labor laws in your area, so that you don’t accidentally make mistakes or open yourself up to lawsuits. You can consult federal, state, and local labor departments or seek legal advice to identify specific salary transparency laws that apply to your location.

One great place to start looking is with the Labor Office for your state.

While it’s convenient to search relevant blogs and sites for basic information, it’s important to always verify the information is correct before taking advice. This may include consulting legal counsel when needed.

Checking Compliance and Best Practices

Like with any labor law, it’s essential to weave compliance into existing practices and have a plan for evaluation. Here are two things you can do to help comply with salary transparency laws:

- Conduct internal audits. Review current salary structures to make sure they comply with transparency laws. This also helps you identify any potential disparities.

- Regularly review and update practices. Stay informed about changes in salary transparency laws and adjust policies and procedures accordingly.

Consequences of Violating Salary Transparency Laws

Salary transparency laws are like any other laws. If you violate them, there could be consequences, including:

- Legal implications. Legal consequences could include fines, penalties, and potential lawsuits. According to law firm Foley, Foley, & Lardner, violating salary transparency laws can result in fines ranging from $300 to $250,000! The higher end of this scale could definitely destroy a small business.

- Reputational damage. In many businesses, the biggest asset you have with customers and employees is trust. Involvement in lawsuits––especially when it comes to sensitive topics like hiring and compensation––can destroy your credibility among employees, customers, and the public. This reputation hit could also mean difficulty in attracting and retaining talent.

- Employee dissatisfaction and turnover. If you’re not willing to comply with a law that helps employees, you may see decreased employee morale, productivity, and loyalty––not to mention an increase in employee grievances and potential legal action. Afterall, according to SHRM, one of the most common reasons employees sue employers is “my boss is a jerk.”

Boost Best-Practices with Pre-Employment Screening through ShareAble for Hires

Just as the sea's tides shape the shore, structuring a strong and trustworthy team is vital for your small business's success. While salary transparency laws may help you bring new staff aboard, it’s essential to make sure they’ll help keep your operation shipshape with pre-employment screening through ShareAble for Hires.

Don’t get capsized by unexpected hits. Criminal background checks swiftly scan vast federal and state-level criminal records––nearly 400 million of them––to help discover any matches with your potential hire. Meanwhile, identity verification helps confirm your applicant is actually who they say they are. Knowing what your applicant’s past contains can help you make safer, stronger hiring decisions.

Just because someone is good with negotiating salary doesn’t mean they're good with money––especially when it comes to your organization’s finances. FCRA-compliant credit checks provide crucial information about an applicant's financial background. By examining their credit track record, you can gain insights into their payment history, outstanding debts, and financial responsibility. This can help you see if they’ll be good for business––or be a potential anchor dragging you down.

Avoid getting washed out by delays and complexities. With ultra-convenient, on-demand reports and small business-friendly pricing, you can ride the wave of seamless screening. There are no hidden fees, no subscriptions, no application processes, site checks, or any other screening barrier. Simply sign up for a free account and start screening immediately.

Don’t let ill-fitting employees leave you high and dry. Help sail on to brighter futures with fast, affordable employee screening through ShareAble for Hires.

ShareAble for Hires

Sign-up Now. Reports Now. Hire Now.