If you don’t thoroughly vet job applicants, you could be at risk for being liable for any harm or injuries your employee causes while on the job. This could include things like physical and psychological harm, property damage, and more. Employers lose negligent hiring suits the majority of the time and settlements can cost business owners millions of dollars. Be sure to reduce your risk by standardizing hiring practices, verifying resume information, checking references, conducting background checks, and onboarding successfully.

Table of Contents:

- What is a Negligent Hiring Claim?

- Ways To Protect Yourself Against Negligent Hiring Claims

- Standardize Your Hiring Process

- Verify Resume Information

- Ask Smart Interview Questions

- Verify Their Abilities with a Skills Assessment

- Check References and Recognize Red Flags

- Conduct Thorough Background Checks Every Time

- Provide New Employees with Clear Expectations

- Consider a Probationary Period

- Keep Excellent Records—You May Need Them in Court

- Help Avoid Negligent Hiring Claims with ShareAble for Hires

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

If you place a rusty nail on your welcome mat, you can’t be surprised if someone steps on it. Similarly, if you place a potentially dangerous employee in your small business, you can’t be surprised if they hurt other people. In fact, you could even end up on the hook for any injuries they cause.

Negligent Hiring lawsuits arise when your employee harms or injures others while at work. By conducting an effective screening, you could potentially reduce the risk of having negligent hiring suits.

As a small business owner, you might not think negligent hiring lawsuits pose much of a threat. However, if you end up with one of these claims, the odds of not being held liable are not in your favor. According to a white paper from insurance group Zurich, employers lose negligent hiring cases about 75% of the time, with an average settlement of 1 million.

A lawsuit like that could easily bottom out insurance limits and potentially bankrupt many small businesses. That’s why it’s absolutely essential to conduct thorough pre-employment screening with a reputable company like ShareAble for Hires® to reduce the risks of negligent hiring lawsuits.

The following article covers the details of negligent hiring, provides examples of when employers might be found liable, and highlights practical, easy-to-implement steps that can help you reduce your risk of getting slapped with a negligent hiring lawsuit.

What is a Negligent Hiring Claim?

Negligent hiring is a legal claim made against an employer that often arise when an employee harms colleagues, customers, other people, or property while on the job. These lawsuits often argue that the employer knew or should have known the employee’s history before hiring. This is usually because they lack the training or qualifications, or have a background that should’ve excluded them from the job, such as a relevant criminal past or negative track record in similar roles.

According to law firm Barada and Associates, a negligent hiring claim arises “due to a company’s failure to properly screen employees to perform job duties.” Essentially, if an employer doesn’t do a thorough enough job vetting an applicant, they could be at risk for any harm done.

It’s true that you can’t always know exactly how a job applicant will act on the job. Even so, it is your responsibility to protect your staff, customers, business, and yourself by conducting a thorough employment background check and qualification review.

Bottom Line: If you don’t thoroughly screen your new hires and they cause harm to current staff, customers, or others while at work, you could be liable for the injury and responsible for the damages

Examples of Potential Cases for Negligent Hiring Claims

Below are some examples of potential scenarios that might result in a negligent hiring lawsuit. It’s important to note that laws vary by location. This section provides general examples only. Make sure to look up relevant information for your specific locale and consult your legal counsel if you have any questions.

- Employee lies about their skills, certifications, or qualifications. Example: You hire someone who claimed they were certified for operating a forklift, but didn’t bother to verify their credentials. You discover they’ve never operated one before when they injure several coworkers due to negligence.

- Employee has a relevant history of violent assault or abuse. Example: You hired a new cashier but didn’t get a criminal background check. Soon, a disagreement with a customer leads to a violent assault. You could be found liable for the attack because you failed to discover that the employee had a long history of similar assaults.

- Employee Commits Fraud. Example: You hire someone for a financial position without proper vetting or checking identity, only to discover they are an expert embezzler and fraudster who neatly made away with your client’s money––all under an assumed name.

Ways To Protect Yourself Against Negligent Hiring Claims

The best method to reduce the risk of negligent hiring claims is thorough, consistent screening of anyone who comes into your business to work. No matter if you’re bringing in full-time employees, part-time employees, seasonal workers, interns, or even volunteers, it’s essential to protect yourself with high-quality background checks.

The following tips could help you avoid the costly, destructive headache of negligent hiring lawsuits:

1. Standardize Your Hiring Process

One of the best way to know for sure that you did all necessary steps for each new hire is to standardize the process for everyone. Make sure everything from a unified application process and a standardized interview scorecard to reference checks are the same for each candidate.

Your process should be organized and trackable. That way, it is easy for the entire hiring team to see where a candidate is in the screening process and difficult to overlook even the smallest details.

2. Verify Resume Information

Resume fraud is extremely common and lots of people over inflate their skills for a leg up in the application process. According to CNBC, at least 78% of job applicants lied during some part of a job application process, with many of those lies occurring on the resume itself.

If someone puts such bold lies in print, imagine what they might do if set loose in your company. To help protect your current staff, customers, and business from negligent hiring claims, it’s up to you to verify that the person has the skills to due to job. it is essential to learn how to verify resume information, including educational verification for potential hires.

3. Ask Smart Interview Questions

Your responsibility as an employer is to do everything you can to help verify a new hire isn’t going to be a threat to you, current staff, customers, or your livelihood. Interviews are a great place to suss out an applicant's real experience, career development, and potential for harming your business.

Make the most of your interviews. Whether conducting in-person or phone interviews, know the right questions to ask:

- Go beyond the basic yes or no questions. Get a feel for your candidate’s values with questions about their experience and point of view.

- Ask specific questions about skills or listed on the resume, such as languages, achievements, or special certifications

4. Verify Their Abilities with a Skills Assessment

One of the best ways to verify an employee can do the job is to put them to the test. Skills assessments are often used in jobs that require specialized skills or knowledge, such as design, computer programming, analysts, editing, or jobs that require high attention to detail, like scheduling, or filing.

5. Check References and Recognize Red Flags

It’s no secret that many job seekers frequently lie job applications, and frequently try to fudge reference checks by padding their reference list with friends and family members. To help sniff out fraud, know what questions to ask in reference checks. This can help you get to the bottom of your employee’s character before letting them in your small business

6. Conduct Thorough Background Checks Every Time

Your gut feeling about a candidate may not always be accurate––and certainly won’t hold up in court if you get sued for negligent hiring. Help protect yourself with thorough pre-employment screening through a service like ShareAble for Hires.

While conducting employment screening, make sure to get:

- Criminal background check. ShareAble for Hires checks nearly 400 million federal and state-level criminal records searching for matches to your candidate

- Credit report. Be sure to check into their financial history: ShareAble’s FCRA-compliant credit checks can give you more insight into a job applicant’s financial track record, which can be an indicator of responsibility.

- Identity verification: Learn if your job applicant is really who they say they are to help reduce the risk of negligent hiring through identity theft or other fraud.

7. Provide New Employees with Clear Expectations

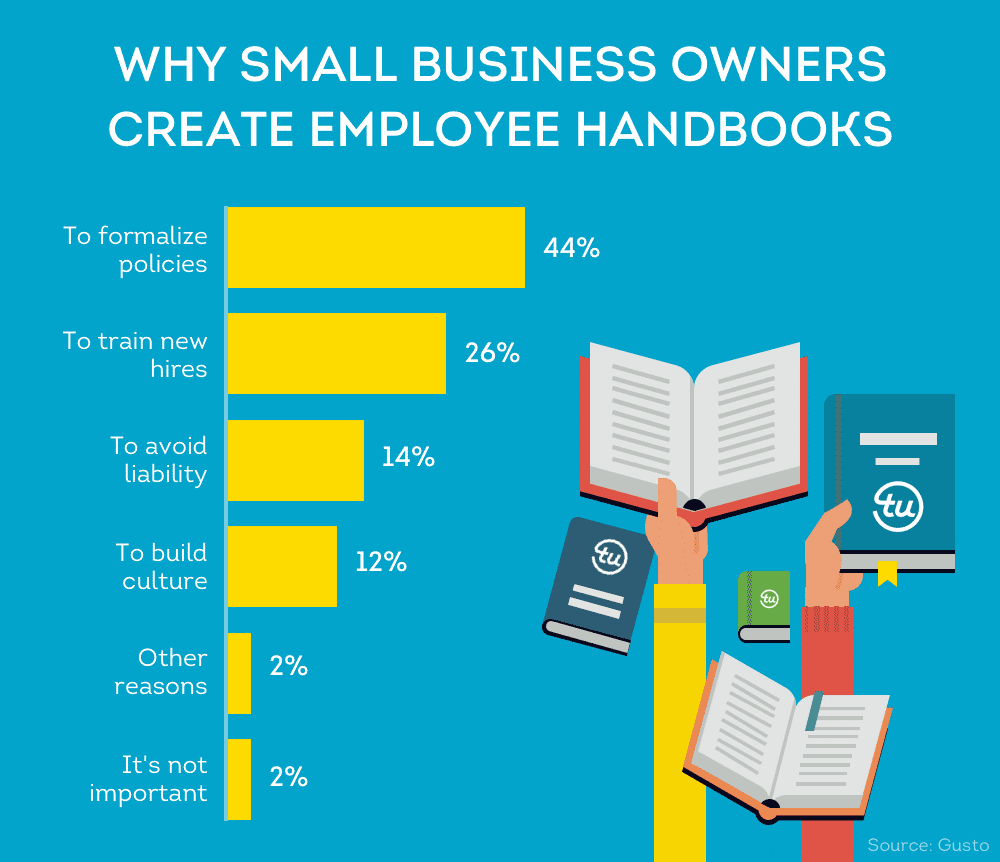

Be prepared when new employees start. One good practice to put into play is writing up an employee handbook.

It is essential that new employees know and understand your policies to help solidify the success of your small business. Without the formal guidance contained in your handbook, your team could unknowingly be breaking rules or causing confusion in the office, which could lead to employee turnover

At a high level your employee handbook will:

- Detail important office protocols

- Establish a positive work environment

- Define your unique company culture

Excellent employee onboarding not only makes employees feel more welcome and comfortable, it can also help protect you from negligent hiring claims by making it easier to catch warning signs early on.

Pro Tip: Provide employees with clear expectations and KPIs from the beginning. That way, you can measure progress with data you can later use in conversations about performance. Having an organized onboarding schedule also lets you know exactly what information and training has been provided, which can help prevent excuses from dangerous hires.

8. Consider a Probationary Period

If you notice someone is a ticking time bomb in the early days of employment, don’t wait for them to go off. Probationary periods allow many employers a set period of time during which they can terminate a new hires employment for any reason.

After probationary periods are complete, employers can usually only fire employees for very specific reasons and are often required to first put a performance improvement plan in place. The laws for probationary periods may vary by state, job type, and location, so make sure to learn what’s applicable in your area and consult legal counsel, as needed.

9. Keep Excellent Records–You May Need Them in Court

Even if you did everything right, it’s possible to be sued for negligent hiring. If you do get sued, you may need to provide proof that you did your due diligence and conducted adequate screening.

Keep all documentation about the hiring process, including the application materials the candidate submitted, screening reports, notes from interviews and reference checks, proof of educational verification, and any other documents related screening and hiring.

Help Avoid Negligent Hiring Claims with ShareAble for Hires

Most small business owners wouldn’t put their staff and customers in the path of a speeding train. However, if you don’t conduct sufficient employee screening, you might as well tie your livelihood to the tracks yourself. Help keep your business out of harm’s way with lightning-fast screening reports through ShareAble for Hires.

Does your top job candidate have a history of relevant crimes or behaviors that could put your small business at risk of a lawsuit? Our criminal reports scour felony and misdemeanor records from dozens of federal and state-level agencies looking for a match. Knowing about your job applicant’s past can help you make better decisions about who to hire and who might not be a good fit.

Negligent hiring claims aren’t just limited to undiscovered criminal history. Help verify that the sparkling resume information you’re seeing actually belongs to the job applicant in front of you. Identity checks can help reveal that your candidate is really who they say they are. Meanwhile, employee credit checks can give you insight into your candidate’s financial track record. This is especially important if you’re assessing qualifications for positions that manage cash or sensitive information.

All ShareAble for Hires reports are FCRA-complaint. ShareAble is a product from Transunion, a major credit agency with over 4 decades of industry experience. This means you get solid reports with better quality data, which are conveniently and secured stored on your account, making them easy to retrieve, if needed.

Don’t leave your business open to the risk of negligent hiring claims. Screen all candidates with ShareAble for Hires.