Resume and application fraud is something that a small business owner needs to have on their radar. Fake references, false certifications or credentials, and misrepresentations about employment history are some examples. Fortunately, there are ways to increase your chances to spot resume fraud, like asking the right questions, requiring candidates to perform a pre-hire project, and conducting employment background checks. Read further to gain more understanding about how to spot resume fraud to protect your business.

For small business owners, detecting fraud on a resume can feel like trying to solve a diamond heist caper.

One hundred years ago, the best a detective could do was follow a hunch, wear the heck out of a trench coat, and do their best to piece together the clues to solve the case. But instead of relying on your hunch, there are now things that business owners can do to be vigilant when screening new candidates for job openings.

Resumes serve as your initial contact with a prospective hire and are an integral piece of the initial candidate screening process. But, who really has time to read them all… in detail? Between managing daily operations, overseeing current staff, increasing your bottom line, and strategizing for the future, how many minutes do you realistically have left in the day to scrutinize every line on every resume?

According to GlassDoor, the average job opening attracts an average of 250 applications, leaving small business owners inundated with a small mountain of applicants to sift through.

Hiring managers spend, according to TheLadders, an average of 6 seconds reviewing a resume, which doesn’t leave much time to scan anything outside of the basic qualifications. Unfortunately, a hasty review can leave you more vulnerable to resume fraud.

If you’re not thinking about how to spot resume fraud, you’re putting your business at risk. Mispresenting skills—and even outright lying—on application materials are more common than you may think. According to a recent CareerBuilder survey 3 out of 4 hiring managers say they have spotted fibs on a resume.

Like a modern-day detective, it’s crucial that you’re aware of the proper strategies for spotting resume fraud and utilize all appropriate tools to verify applicant information; this includes comprehensive identity verification and background screening with a reputable service like ShareAble® for Hires.

In this article, we investigate examples of resume fraud and dive into strategies for spotting inaccuracies within a prospective hire’s application or resume.

Click on a link below to jump to a particular section or read the piece in full to learn more about resume fraud.

What is Resume Fraud?

Resume fraud occurs when job applicants intentionally falsify their information on a resume. In most cases, this falsification is committed with the hopes of increasing the applicant’s chances of being considered for a position. Resume fraud can be committed in a variety of ways, including:

- Offering fake references: In order to appear more qualified, some job applicants provide fake references. While a prospective hire may provide a list of previous employers or colleagues, the contact information may be that of a friend or family member.

- Falsely claiming to hold a certification or degree: If your open position requires a certain level of education or training, unqualified applicants may fabricate a degree or certification in order to be considered for the role. In some cases, they may outright lie that they attended a school they never actually did; in others, they may have started a program but never finished, or even used a diploma from a fake university.

- Inflating former responsibilities or capabilities: Some job applicants misrepresent the level of responsibility held at a previous position to convince hiring managers that they have the requisite experience.

Applicants may commit this type of resume fraud in a variety of ways, such as:

- Listing the last position held, but implying that they held it their entire tenure

- Completely falsifying job titles or responsibilities

- Claiming to have supervisory or management duties when they did not

- Lying about employment duration at an organization: Job applicants could cover up employment gaps by lying about the number of years they worked at a previous company or strategically omitting dates.

What Are the Consequences of Resume Fraud?

Resume fraud can have devastating consequences for a small business. If an employer makes the wrong hire based on falsified resume information, this may create problems for the employer and if the new hire can’t perform their duties or isn’t qualified to do so. It can also create more work for your other employees, who then must take time to train, supervise, and perform duties that should be managed by the new hire.

A single bad hire can cost a company nearly 30% of that employee’s annual salary. Additionally, it may be difficult to quickly fire someone who is performing poorly. Depending on your company’s policy and relevant employment laws, it could take months of performance plans and attempts at training before you are allowed to let an underqualified hire go.

When calculating the cost of a bad hire, you must consider variables such as:

- Advertising fees to fill the role

- Time and money spent on a new search

- The overall impact on work and output

- Dissatisfied customers

- Brand and reputation damage

- Legal costs, if the new hire pulls you into an employment lawsuit

Plus, the consequences of making the wrong hire extend beyond monetary concerns. Bad hires may:

- Decrease productivity across your team

- Negatively impact company morale

- Make mistakes that cause clients or vendors to leave

- Affect relationships with existing customers

- Tie current employees up with administrative work

In addition, an individual that is willing to lie to secure a job may be untrustworthy in other ways. If the job opening in question deals with sensitive or financial information, hiring someone you can trust is paramount.

How to Spot Resume Fraud

By itself, the high costs of making the wrong hire are usually incentive enough to check for fake resume information. According to a 2014 CareerBuilder survey, 51% of employers would automatically disqualify an applicant if they discovered a lie on his or her resume.

However, not all hiring managers know how to spot fraud or even what they’re looking for. Although resume fraud isn’t always easy to identify, there are four main ways to check for resume red flags:

- Ask Specific Questions

- Check References

- Ask Your Applicant to Complete a Pre-Hire Project

- Conduct Background Checks

1. Ask Specific Questions

The more specific you can be with an applicant with your question set, the more likely you are to spot resume padding, fudging, or outright lies.

Once you’ve collected a few promising resumes, consider moving to complete a phone interview with each candidate. This step in the due diligence process is important. It offers employers the opportunity to test a resume that looks a little too good.

Once you have the applicant on the phone, ask specific questions about the information listed on their resume and application materials. Candidates who have misrepresented themselves may find it difficult to provide much detail or keep track of any intentional resume padding or “white lies.”

Asking your prospective hire the right questions may help you discern between misrepresentations and reality.

Here are a few questions that may help you find resume fabrications:

- How did you achieve the results stated on your resume?

- How long have you been at your current company? What was your start date?

- What title do you currently hold? What are the responsibilities of this position? How quickly did you move into this position?

- How do you use this [skill listed on resume] in your current role? Please provide examples.

- You mention that you’re familiar with [subject]. Can you provide details about your experience with [said subject] and an example of where you used it for a project?

Throughout the call, refer to their application and resume, then ask questions about the information you see there. Request that candidates provide more detail around certain bullet points, particularly those regarding skill level, experience, and any degrees or certifications listed.

As a reminder, this material is not legal advice nor is it a complete review of employment laws. Check the laws applicable to your business and consider consulting a legal advisor before you embark on hiring someone.

2. Check References

Verifying past employment is an essential component of the employment screening process, and particularly helpful for uncovering resume fraud.

Candidates will often supply hiring managers with two or three references, and it’s important to follow through with reference checks. Of course, employers have long understood that job applicants may list false references that they did not actually work with or under. In order to verify the information reported is true, employers should conduct “blind” reference checks.

Call the company listed on their resume directly to speak to people who work there. Or check out the organization’s roster on LinkedIn to find other points of contact. Ask these individuals to verify the information reported on your prospective hire’s application or resume, and ask important employee reference check questions, such as:

- How long did the applicant work for your company?

- What position did they hold?

- What were their responsibilities?

- Did they complete projects as listed on their resume?

- Would the applicant be considered for rehire?

Do note that reference check calls are subject to both federal and state-level employment and hiring laws. Before creating your reference check questions, make sure they abide by all local, state, and federal regulations. If you’re unsure about which questions are permissible, seek help from experienced legal counsel.

3. Ask Your Applicant to Complete a Pre-Hire Project

If your applicant moved past the phone interview stage, it’s time to ensure your candidate is capable of the role’s responsibilities by asking them to complete a pre-hire project. Pre-hire projects can help employers verify that a candidate can actually do the job.

Depending on the industry and available position, this project or assessment may take on many forms. In some cases, you might want to opt for a larger, paid project, such as editing a set of sample articles. In others, an on-demand demonstration of skills during an in-person interview might suffice. Ultimately, the assignment should test the candidate’s abilities and knowledge as it relates to the job for which they’ve applied.

For example, if your candidate claims to be an expert at spreadsheet management or data analysis, you could give them a set of sample data and thirty minutes to analyze and review the spreadsheet to glean as many insights as possible. You can also ask how the data collection or spreadsheet layout could be improved. A true expert with spreadsheets and analysis would have no problems finishing this simple task in the allotted time and explaining how it was done.

Testing your candidate with a project can help you determine whether or not the skills reported on their resume are accurate. You can create your own pre-hire project, or ask candidates to complete relevant aptitude tests.

4. Conduct Background Checks

Every hire should be thoroughly vetted by way of pre-employment screening, not just passing the “gut” instinct test. Comprehensive employment background checks through a reputable company can provide small business owners and hiring managers with the information you need to verify an applicant’s resume.

Recent research shows that up to 46% of resumes include at least one discrepancy between the information provided and the results of a background check. That’s almost half. Are you willing to take those odds when your own business is on the line?

ShareAble for Hires background checks are designed to help small businesses get the information that they need to make an informed hiring decision. Signup to transaction can take as little as minutes. And, with easy-to-read background check reports, you can analyze the information you need and make a hire on-the-spot.

In addition to regular identity, background, and employment credit checks, you should also consider performing background checks that are particularly relevant to the job or your industry. For example, if the position requires your new hire to drive, whether transporting clients or goods, it’s a good idea to run MVR checks to ensure they have the necessary driving credentials. If the role involves interaction with a vulnerable group, such as children or the elderly, you’ll also want the peace of mind of running a background check against the National Sex Offender Registry.

Education Verification Background Checks

Your candidate lists a prestigious school on their resume, but you notice there’s no mention of a degree. This could be a purposeful omission and might be a red flag indicating resume fraud. Resume fraud can involve any credential—including education falsification. Candidates may claim a degree, certificate, or diploma that they didn’t earn.

The Society of Human Resources Management (SHRM) splits educational resume fraud into three different areas:

- Outright lies: This type of resume fraud may include complete fabrication, such as making up a degree from a school the applicant never attended or even naming a school that doesn’t exist

- Degree falsification: Claiming to hold a degree from a college they attended, but the candidate never actually graduated

- Fake diploma: Listing degrees of no value from nonaccredited online schools, also called “diploma mills”

In order to avoid situations stated above, whether at the C-level or entry-level, employers must take care to verify that an applicant’s educational credentials are valid. Employers can use education verification to confirm:

- Institution and years attended

- Degrees awarded

- Certifications or licenses achieved

- Specialized training

If you’re not sure how to manage the credential evaluation, you can learn how to verify your job applicant’s education and ensure the degrees, certifications, and specialty training reported on their resume is accurate.

Help Combat Resume Fraud with ShareAble for Hires

Just as a modern detective’s toolkit includes more than cigarettes and a magnifying glass, your small business needs to evolve in order to spot intentional resume inaccuracies—fraud that can devastate your business.

While some lies on resumes are obvious, but others are not. That means you must be especially vigilant. In addition to following the above tips, one of the best ways you can stop resume fraud in its tracks is with comprehensive employee background screening.

ShareAble for Hires provides quick and thorough employee screening that helps you piece together a better picture of your candidate to make more confident hiring decisions.

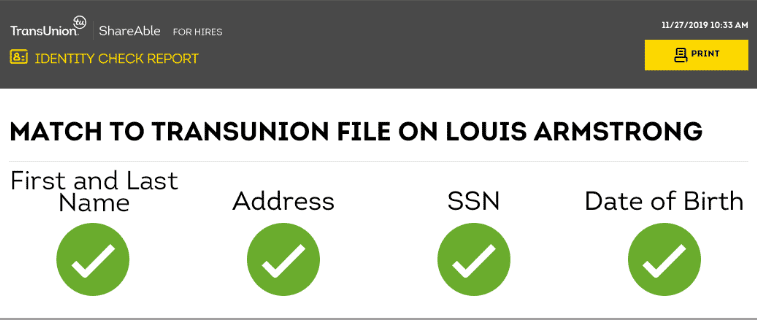

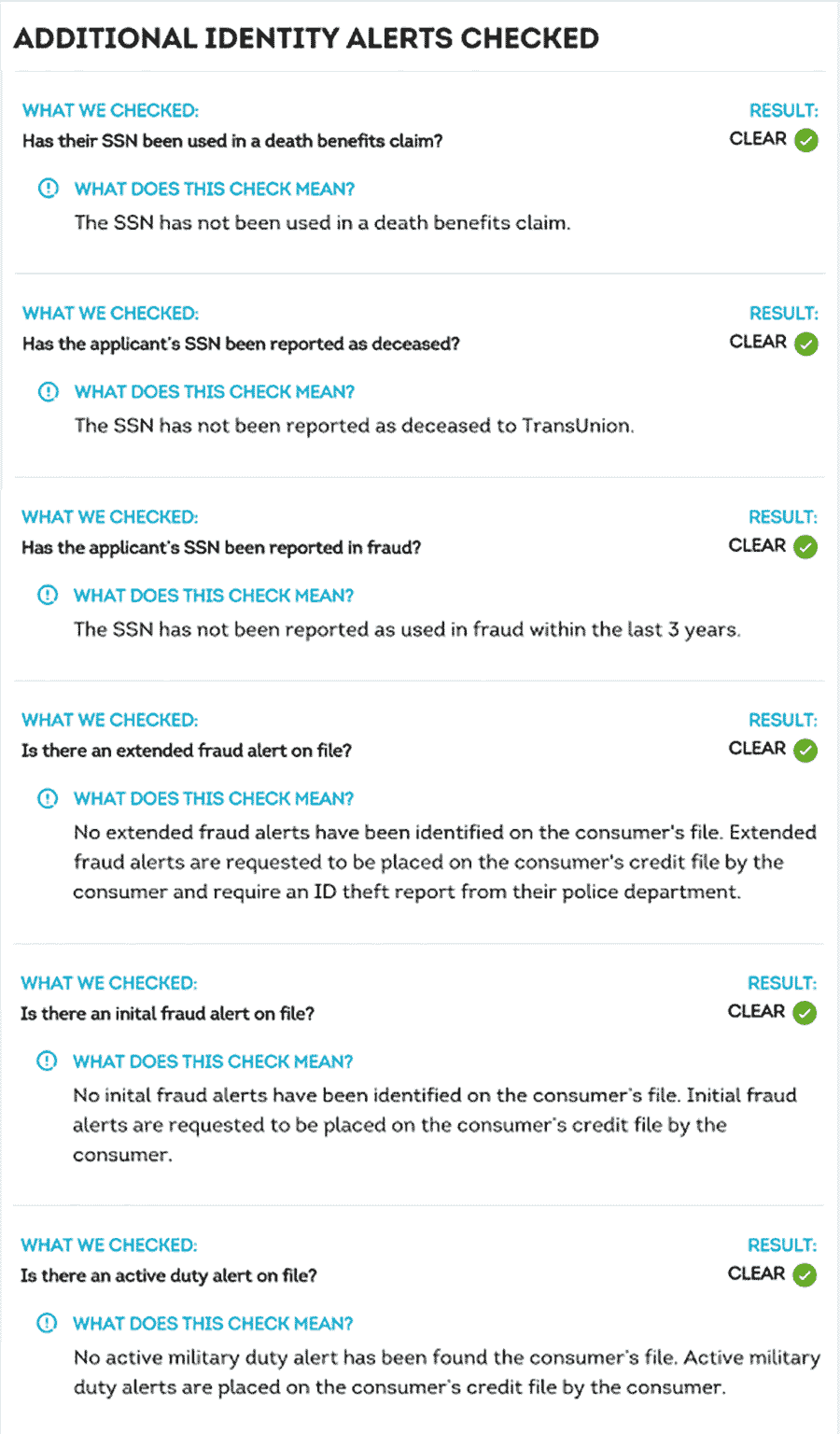

ID Report (sample)

The Identity report is the first step in the screening process and can help ensure accurate results for any additional reports you run. Due to the abundance of illegal websites that sell fake identities, identity theft has become a significant problem in the United States. Ultimately, if a job applicant supplies false information, then you’ll be making a hiring decision based on lies, which could quickly hurt your business. A detailed Identity Report can help confirm your applicant is who they say they are and help you save time and effort manually verifying your job applicant’s identity.

As a part of the ShareAble for Hires process, the applicant provides ShareAble with their name, address, SSN, and date of birth. The ID Report compares applicant information to information in our databases and reports back on whether the elements match.

ShareAble for Hires Identity Report goes beyond basics. Additionally, it will look for any fraud or deceased person alerts that may be associated with the applicant’s information, which can keep you from hiring someone who has committed the crime of identity theft. Again, if any of the information should return as nonmatching, then you may/should consider requesting additional proof of identity.

Important Note: An Identity Report cannot be the basis for denying an applicant and is not adverse actionable. ShareAble for Hires Identity reports via ShareAble for Hires can generally only be used to help you determine if additional proof of identity is necessary. It’s always encouraged to review the terms and conditions for Identity reports and to speak with your legal team on these matters. Terms and conditions for ShareAble and Identity Report apply.

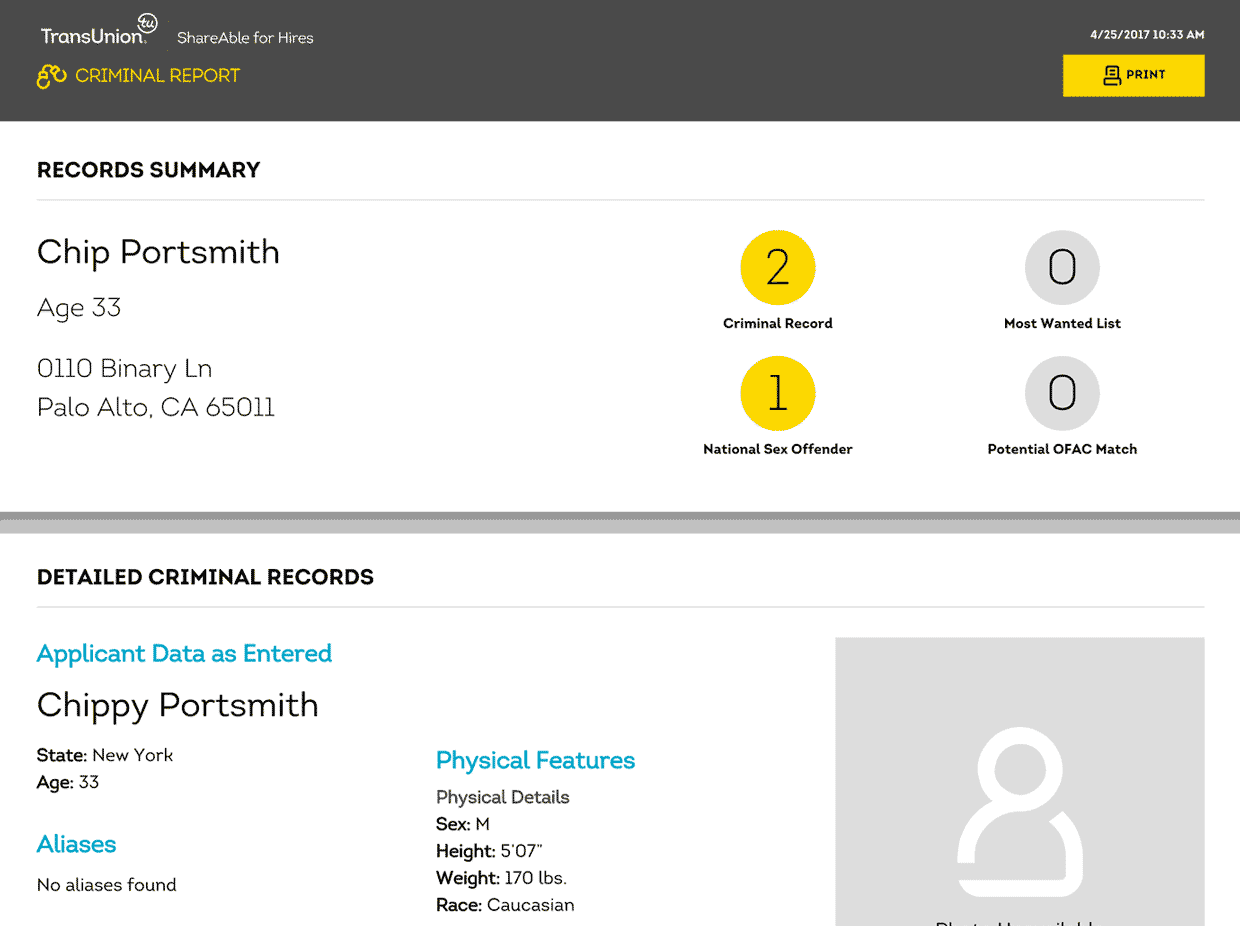

Criminal Background Report (sample)

Next, a criminal background check pulls crucial details from numerous sources, including local and state jurisdictions, the FBI’s Most Wanted list, and U.S. Customs and Border Protection (CBP), to help find out if your top candidate is a bona fide Regular Joe or an unsavory character who is loose with the truth.

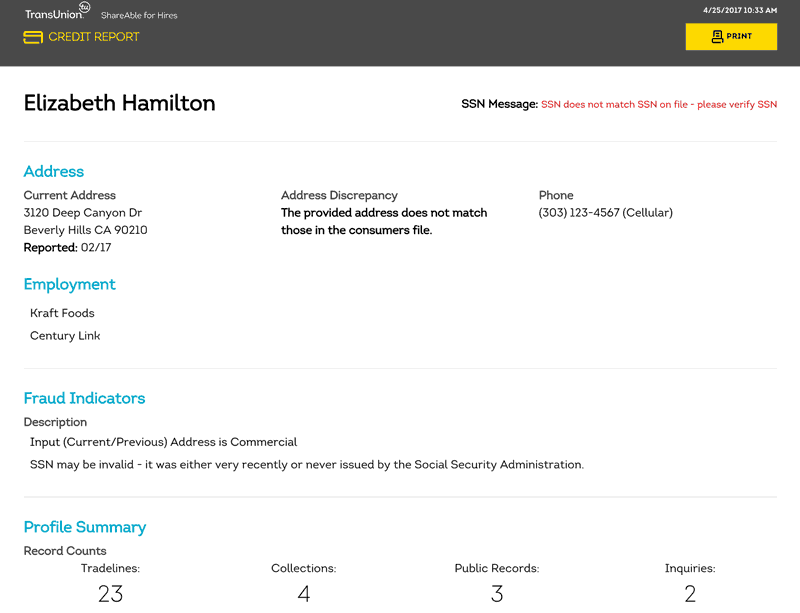

Credit Report (sample)

The credit report can be a very helpful tool beyond learning more about the candidate’s financial track record. The consumer demographic information section can be of particular use. You can determine at a glance whether the applicant’s information (name, current address, recent employment history) on the credit report is the same as that included on their application form. It some instances you’ll be able to see employment history too. This section provides peace of mind your applicant’s information matched what’s on the credit file, so you can be even more confident you know who you’re hiring.

Tip: If you need help in terms of how to read a credit report for employment purposes, then check out our blog article to learn more.

Also, if you are hiring for roles that have access to company financial information, you can get a glimpse at the money handling skills listed on your applicant’s resume with a ShareAble for Hires credit report. You can uncover if there are any accounts in poor standing, high level of total debt, recent applications for credit, and more.

Final Notes

When it comes to screening employees, it’s crucial to scrutinize the information contained on resumes and conduct thorough employment background checks. While you likely will not utilize the skill of a top-notch detective, you can take steps to spot resume red flags. Become your own PI by asking good questions and follow-up questions, check blind references, ask the candidate to complete a pre-hire project, and conduct background checks. With ShareAble for Hires, you’ll get a comprehensive, online employee screening service that includes everything except the trench coat.

Create your account and start screening today.