As a small business owner or operator, having a high-functioning team that supports you is important to your company’s success. Your next hire needs to be a great fit for your team and a productive contributor as soon as possible. You can assess your candidate’s aptitude in many ways, including using information contained on an applicant’s credit report. In particular, if the position you’re hiring for requires handling money, accessing sensitive financial data or developing budgets, then reviewing a credit history can be important to appraising if the candidate will be careful and reliable.

It’s important you learn how to read a credit report because it’s one of the best ways to get an idea of how an applicant handles their financial responsibilities.

A credit report contains detailed information about past and present credit accounts. It identifies accounts in good standing and accounts that are late. It will show account balances due and payment history. The report also calls out negative accounts with late payments, or debts significantly in arrears that have been sent to a collection agency.

A credit report from ShareAble for Hires gives you important financial information that may include:

- Tax liens

- Collections

- Negative accounts paid or charged off

TransUnion, a trusted consumer reporting agency with four decades of experience, draws information from its database that maintains credit histories on 230 million consumers domestically. Our information is updated and monitored regularly, so you have confidence that our reports will help you make more informed hiring decisions.

Taxonomy of a credit report

We’ll walk you through the kinds of information contained in a credit report.

The main parts include:

- Basic identifying information

- Profile summary

- Tradelines

- Collections

- Inquiries

Below we provide parts of a sample credit report so you can follow along easily.

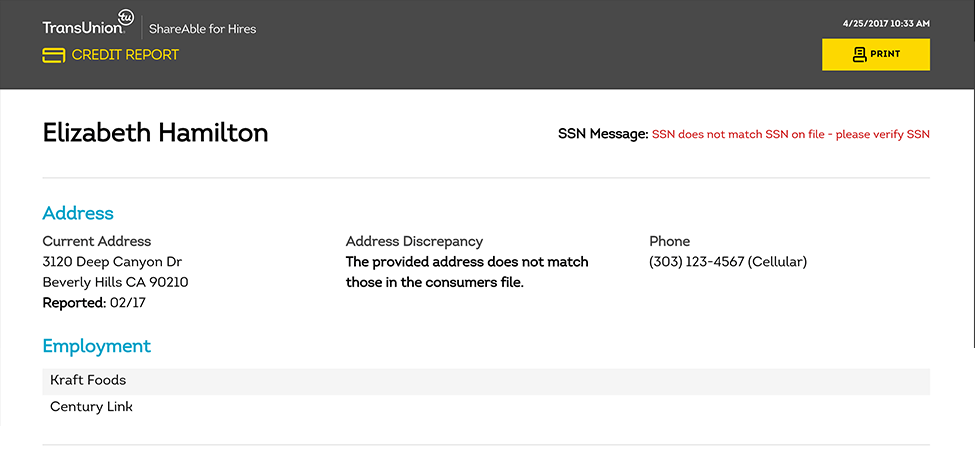

Basic Identifying Information

In this section, you can determine at a glance whether the applicant’s information (name, current address, recent employment history) on the credit report is the same as that included on their application form. This section provides peace of mind your applicant’s information matched what’s on the credit file, so you can be even more confident you know who you’re hiring.

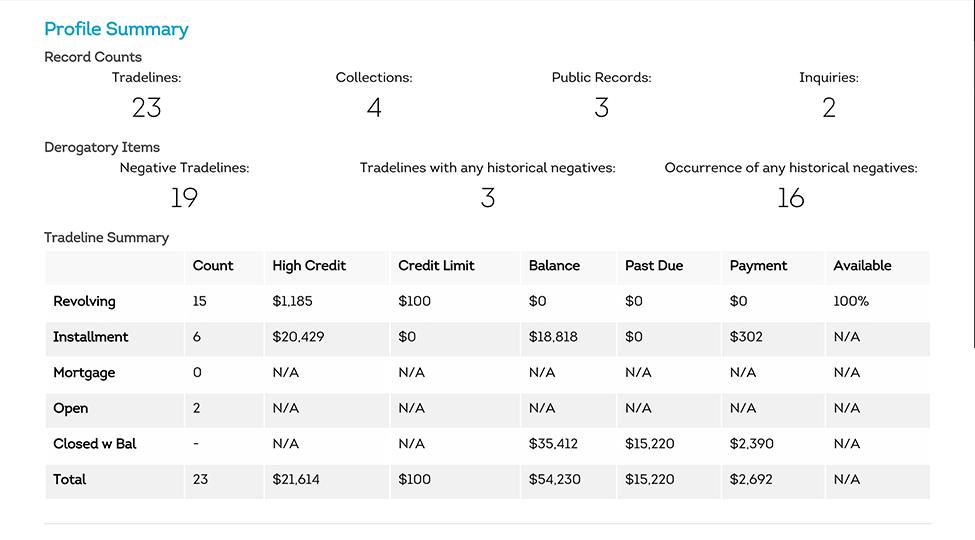

Consumer credit profile summary

This area of the applicant’s credit report is important because it provides an overall summary of the activity on file. It delivers pertinent information relating to your applicant’s consumer credit profile. It’s broken into digestible parts to appraise overall financial health and evaluate factors such as: payment history, debt-level and monthly financial obligations.

In top section, you get a snapshot of:

- Total number of tradelines, which is the sum of revolving, installment, mortgage and open accounts

- Total number of public records

- Total number of accounts sent to collections

- Total number of inquiries

In the section below, you get a snapshot of delinquency:

- Total number of derogatory credit accounts

- Total number credit accounts that have historical derogatory information

- Total number of derogatory occurrences

In the chart, you’ll get more detailed credit history information broken out by account type:

- Total number of accounts

- Highest amount owed on the account

- Maximum amount of credit approved by the lender

- Amount owed as of the date of the credit report

- Amount past due as of the date of the credit report

- Amount due monthly based on payment terms

- How much credit is available for revolving accounts

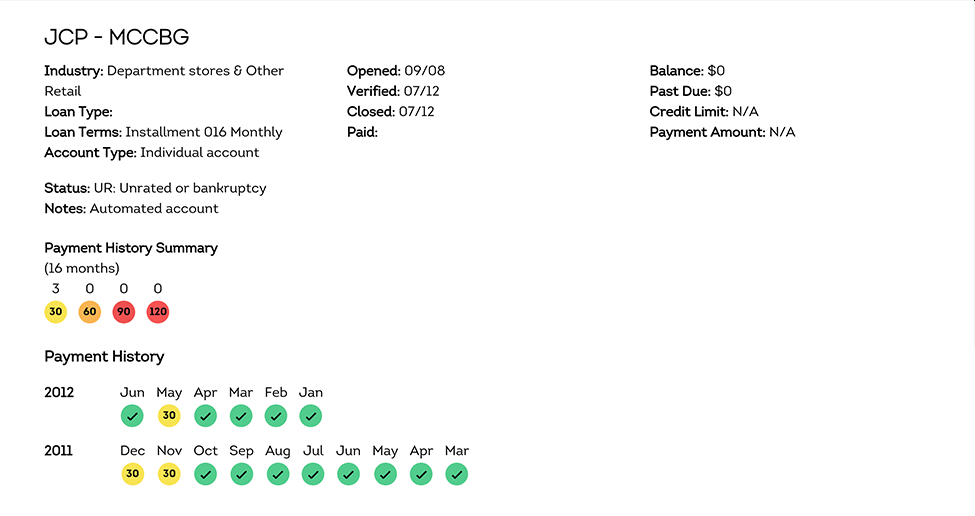

Tradelines (credit account history)

Tradelines, an industry term to describe consumer accounts, including credit accounts or lines of credit, is information that’s reported to consumer reporting agencies and will appear every time you read a TransUnion credit report. The tradeline summary is another important area because it provides an overview of various kinds of credit accounts: revolving, mortgage, installment, open and closed. These accounts include auto loans, home loans, credit cards and other kinds of credit lines, in addition to other debt obligations of the consumer.

You’ll be able to review information, such as:

- Account name

- Account type

- Credit balance

- Credit limit

- Who is responsible for paying

- Payment status

- Date of delinquency

- Date account was opened

- Date account was closed

These tradelines help you develop an overall picture of financial responsibility. You can review whether the applicant carries a high debt load and how leveraged an applicant is.

Tradelines also show current and past payment history, along with whether payments are being made on time. If payments have been received late, it’s described in more detail in buckets of 30, 60, 90, 120, or 180 days.

If a creditor determines they’re unlikely to be paid, other kinds of payment statuses will be noted. Tradeline payment history calls out derogatory accounts, which can be defined as accounts significantly late for payment and the creditor determined that the consumer is in default. Derogatory accounts stay on a credit report for seven years or longer from the latest activity date and may include foreclosure, charge-offs, and accounts reported or sent to debt collectors.

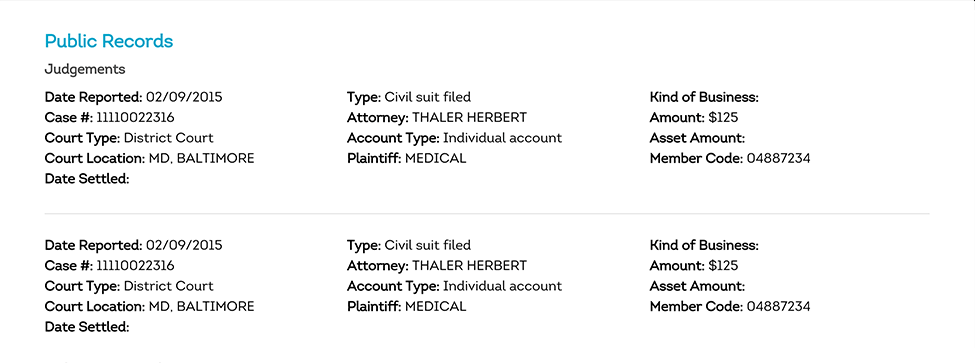

Summary Of Collections

This section indicates when an account becomes significantly overdue and is another key aspect when learning how to read a credit report. This section includes accounts a creditor has sold to a professional collections agency. The collections section reports on unsecured debt, including credit cards and other kinds of personal loans. Collection information is retained on an applicant’s credit report for seven years from the first delinquency date.

Collection information that you’ll be able to review includes:

- Name of collection agency

- Account type

- MOP (Manner of Payment) code and status

- Debt collector status of collection

- Original creditor

Also included in this section is the original balance of collection and current amount in dollars owed as of the date verified.

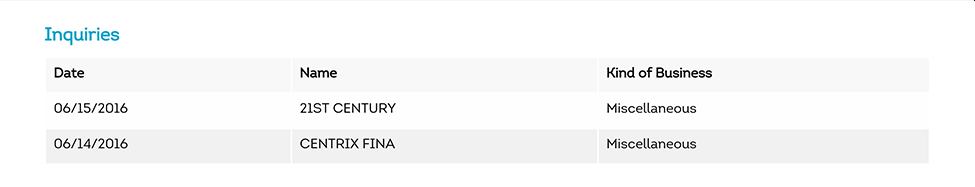

Inquiries

This section displays which companies have viewed the consumer’s credit file during the last one to three years, depending on the reason of the inquiry and geographical location of the applicant. It also shows the date when inquiries occurred. This helps you get a sense of the applicant’s credit activity and inquiries. The sample credit report above shows six hard inquiries that occurred over 10–11 months. In general terms, consumers who accumulate a large number of inquiries over a short period of time could present an elevated level of risk. They’re potentially getting access to additional lines of credit and possibly overextending their financial limits.

Of note: This summary is comprised of “hard inquiries” which involves a potential lender reviewing your credit profile to determine if they’ll extend credit to a consumer. Examples of hard inquiries are when a consumer applies for a credit card, auto loan or mortgage. For most credit scoring models, hard inquiries will sometimes result in a decrease in a consumer’s credit score. In contrast, “soft inquiries” are a more routine check that can be done without the consumer’s permission. This kind of inquiry results when a consumer accesses their own credit report or when a company with whom a consumer already does business checks his or her credit to make sure the consumer is still creditworthy.

Pre-employment inquiries, including those conducted through ShareAble for Hires, result in a “soft inquiry” on the consumer’s file. Therefore, the applicant doesn’t have to worry about any potential adverse impact to their credit score when completing pre-employment screening.

Conclusion

There are many aspects to consider when learning how to read a credit report. As a small business owner/operator, you could be the person reading a credit report and appraising the attractiveness of an applicant’s history and qualifications. So it’s important to be able to accurately interpret and understand the report information in order to know what’s acceptable for your company’s needs.