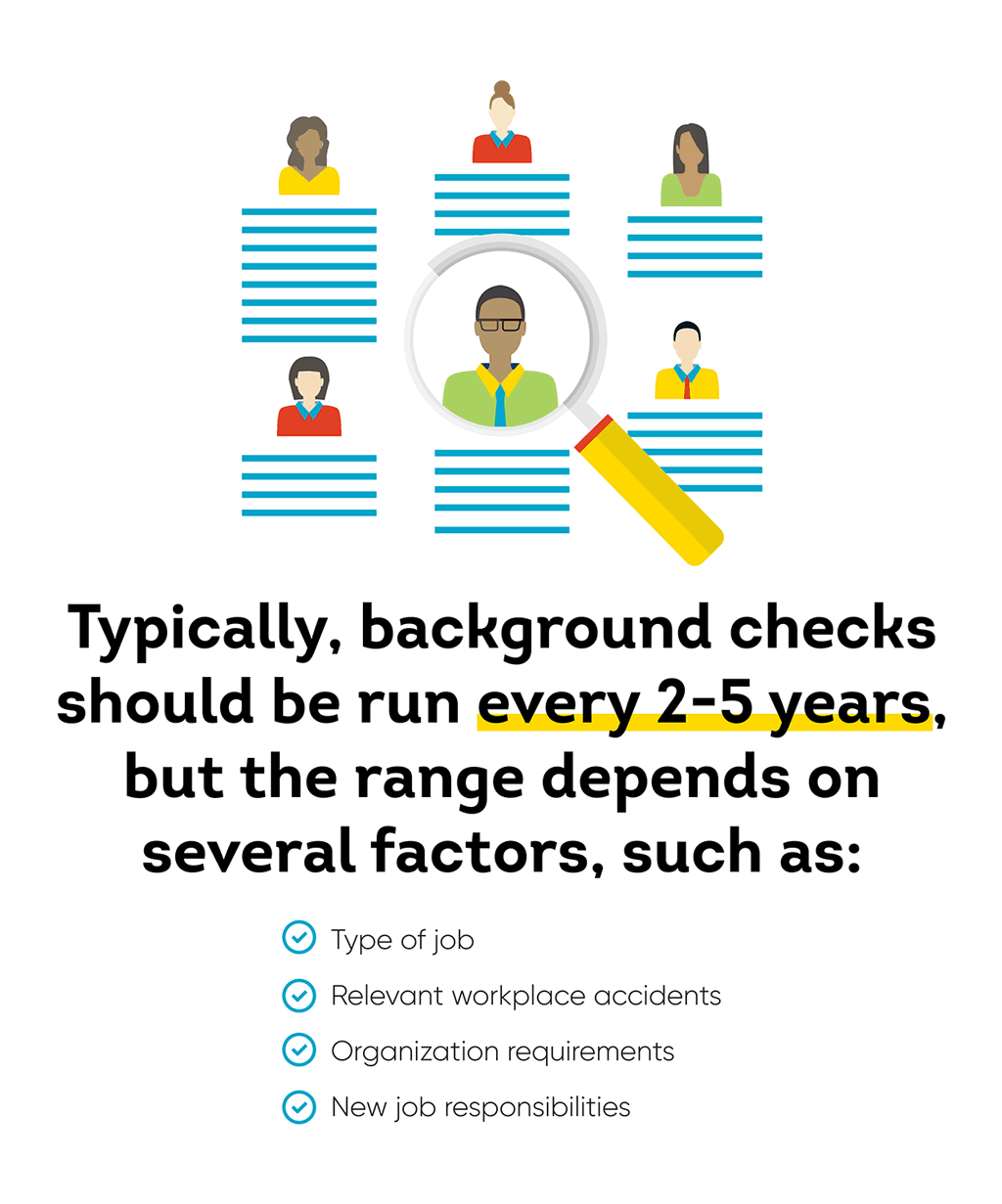

Running a background check is one of the best ways to hire trustworthy employees that protect your business. When should you consider re-screening your current employees While standard practice is every 2-5 years, the frequency of background checks depends on several factors, such as the type of job or company changes. Learn more about how long background checks last and how often you should re-screen employees here.

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

Being a responsible business owner is like maintaining a house. Even if the foundation is strong, it’s still essential to check for signs of trouble regularly. Small cracks that escape your notice can easily transform into majorly destructive headaches and bring the whole building down. For any-sized company, this crucial upkeep includes frequent employee background checks of current staff members.

You may already know that ongoing employee screening through a reputable service like ShareAble for Hires® helps protect your business. However, many small business owners aren’t sure exactly how frequently background checks should be completed.

Although there’s no one-size-fits-all answer, the general consensus is: often!

The ideal frequency of background checks depends on several factors, including business size, the type of data or sensitive information handled, employee access to company cash, and more. If you’re considering regular criminal background checks for employees, it’s important to understand how to best protect your business—and learn what could happen if you don’t.

Read on for several vital considerations in determining the ideal frequency of current employee background checks, including.

Here’s what we'll cover:

- How Often Should I Run Background Checks on Employees

- Events than Should Trigger Follow-up Background Checks

- How Long Do Background Checks Take to Complete

- Common Reasons Background Checks Get Delayed

- How to Help Protect Your Business with Strategic Background Checks

Without ongoing, attentive care, even the best constructed house will crumble into ruin. Protect what you’ve worked hard to build with regular employee screening through ShareAble for Hires

How Often Should I Run Background Checks on My Employees

No two businesses are identical. So, the recommended frequency of current employee background checks also varies. One long-standard practice is to conduct additional background checks every 2 to -5 years.

For lower risk businesses, such a long gap between background checks might be perfectly acceptable. However, in some industries, including those working with vulnerable populations, personal data, and cash, infrequent checks could be a business liability.

Consider increasing the frequency of background checks if your staff includes:

- Childcare providers or other employees who work directly with underage individuals

- Workers who deal with large amounts of money directly, such as cashiers

- Cybersecurity professionals or anyone else with access to sensitive information, especially customer and client data

- Employees who operate under a non-disclosure agreement (NDA)

- Employees who handle health information for clients and customers

- Anyone who may have access to legally protected, compromising, or otherwise confidential information belonging to clients, other employees, or even your business

- Work in an industry or location with increased risk of fraud or scammers

No matter how often you screen current employees, it’s important to select a reputable provider.

Unfortunately, there are often major gaps in small business background checks. Working with cut-rate or free background check services or attempting to conduct a background check on your own can significantly increase the chance you’ll miss valuable information that could harm your company and reputation.

Running background checks often and with a respectable service like ShareAble for Hires is one of the best ways to help ensure a solid base on which to expand your business.

Events that Should Trigger Follow-Up Background Checks

In addition to screening at the regular time intervals mentioned above, you may also want to add follow-up employee screening before or after significant business events. A few important triggers for re-running background checks include:

- During company expansion: Growth is exciting. However, nothing will ruin the thrill like a nasty surprise that tanks your bottom line. Any time your company scales up, it’s wise to background check everyone—even your existing employees.

- After a fraud attempt: A successful fraud attempt can bankrupt you. Scammers cost companies billions of dollars each year If your business has been the recent victim of fraud, or even a fraud attempt, it’s time to rescreen your employees. Even if you’re positive your employees weren’t responsible, ensuring the security of your company is always a best practice.

- With enhanced or widened data collection: If your business starts collecting additional sensitive information from clients (like insurance details or even Social Security Numbers) it’s a good idea to institute company-wide background reviews—just to be on the safe side. Double-checking everyone involved can help decrease the likelihood of fraud and keep your clients feeling secure.

- When adding new, higher-value services or products: Boosting your company’s offerings and increasing high-value transactions is every business owner’s dream—until it becomes a nightmare. The more money moving through your business, the potential greater your risk of fraud. When you’re ready for next-level offerings, make sure you have next-level security by checking everyone’s criminal background again.

- It’s been a while. Do you know how long background checks last for things like credit and licenses Or how long criminal background checks stay valid Just a few years, it turns out. A lot can happen in just a few years. If it’s been a while, it may be time to rescreen your staff.

As a small business owner, a stable team is the cornerstone of success. The right people will help your business grow, while an ill-fitting hire can demolish your company and devastate future plans. Regular employee background checks can provide the security, assurance, and confidence you need to expand without compromising security.

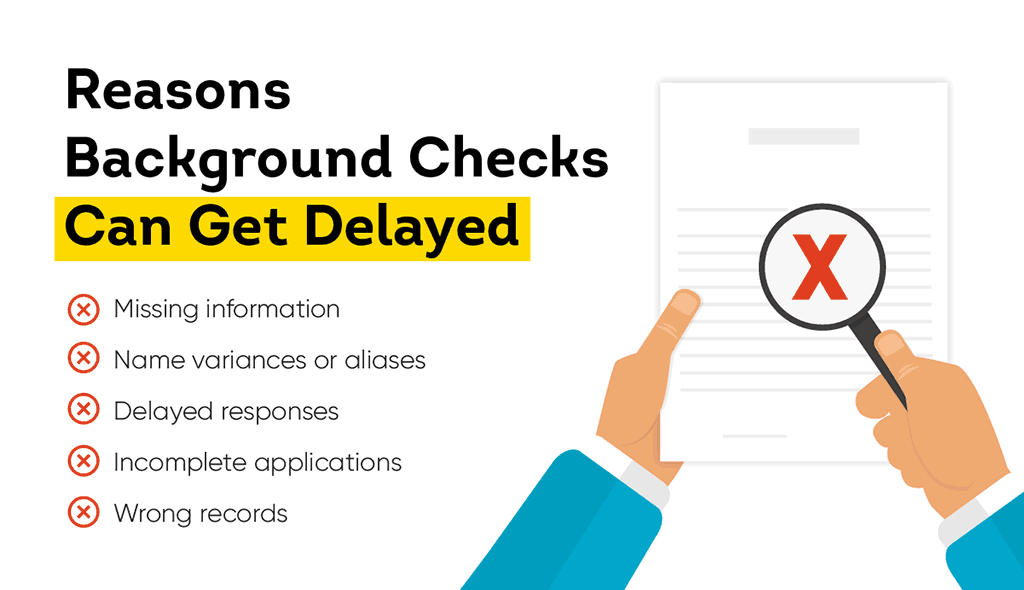

How Long Does a Background Check Take

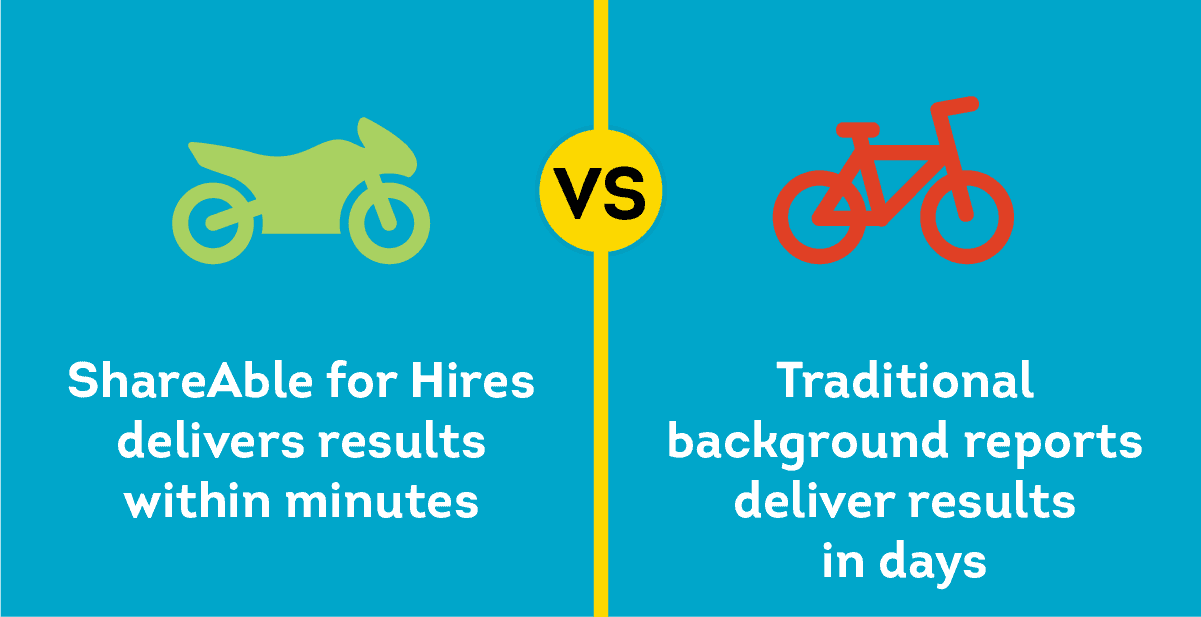

You’re busy—most business owners are. Among the thousand other things you need to manage, there’s hardly any time for new employee screening—let alone rescreening the employees that already work for you. That’s why screening services like ShareAble for Hires deliver comprehensive, lightning-fast results detailing crucial information about employees, including relevant convictions that could potentially jeopardize your business.

Traditional background check services can take several days—or even weeks—to provide reports. It takes time for some providers to track down paper records, sift through protected databases, or follow-up with previous employers.

Working with traditional background check providers, or, more extreme—trying to manage the process entirely on your own—can be a monumental hassle. When weighing employee background check costs, ultra-low (or even free) price tags might seem tempting, but few business owners have the time to assess all potential providers and wait for lengthy screening processes to complete. Additionally, violating federal compliance requirements—even unintentionally—could result in prolonged, resource-intensive legal proceedings.

Instead of trying to do it all yourself or scrambling to find where to get a background check for employment, considering getting the critical information you need to protect your business through a reputable, FCRA-compliant background check service like ShareAble for Hires.

How to Help Protect Your Business with ShareAble for Hires

There are legitimate reasons to re-screen your employees. Just like with a house, neglecting basic maintenance on your business can lead to complete destruction. Don’t let your hard work fall into disrepair because of unexpected surprises.

How frequently you run background checks on your staff will depend on the type of data being processed, sensitive information handled, employee access to cash funds, and other factors.

Conduct regular, ongoing employee screening with ShareAble for Hires.

Backed by TransUnion, a major credit reporting agency, ShareAble for Hires delivers comprehensive, FCRA-compliant employment background checks in a matter of minutes.

ShareAble for Hires streamlined process gives you rapid access to tools and delivers critical applicant background information fast.

ShareAble is unique because it:

- Has no application process to determine eligibility

- Grants access to screening tools for every SMB

- Makes the tool available for immediate use, 24/7

- Has applicants enter in their information, not you

- Is wholly self-service, no need to call to start

- Delivers reports fast

With digital, consent-based screening, you can choose from ultra-fast, all-inclusive reports that confirm identity, scan for criminal history, check credit, and more.

Protect your business with critical information that’s verified against multiple sources, including:

- State and county records

- Federal Watch Lists

- National Sex Offender Registry

- National Most Wanted Lists

- Name and identity verification records

- Known fraud alerts

- Deceased persons SSN check

- Self-reported prior employment

- Current & previous addresses

- Detailed credit reports

The process is simple. Simply establish your account and send a background screening request to your employee through ShareAble for Hires system. ShareAble notifies the job applicant about the screening invitation. The employee consents to screening, enters their personal information into the system, TransUnion verifies their identity, and reports are delivered in minutes to both employer and applicant.

Affordable, flexible pricing means you pay only for the reports and information you need. There are no subscriptions, no minimum screening caps, and no commitments.

People, like buildings, can change over time—and not always for the better. These days, a single pre-employment screening isn’t always enough. Build a stronger, more confident future. Help maintain a trustworthy foundation with employee background screening through ShareAble for Hires.