With the recent increase in remote work and high-tech, it’s more important than ever to help protect your business against potential employee identity theft and fraud. Identity Verification from ShareAble for Hires compares your job applicant’s self-reported data to the TransUnion databases to verify if the data matches, or if you may need to do more investigation. Near-instant, ID reports are easy to read, ultra-affordable, and can help boost hiring confidence for small business owners.

Disclosure: This content, except as otherwise indicated or stated on this site, is the property of TransUnion Rental Screening Solutions, Inc. This content is for educational purposes and for convenience only. Trademarks used are the property of their respective owners, and no endorsement or affiliation is implied. The information presented in this content is “as is” without warranties of any kind, and specifically is not represented to be complete and does not constitute legal advice, and is subject to change without notice. You are encouraged to check these terms from time to time for changes, and by accessing this site you agree to these terms and all terms listed. Laws and regulations may vary by state and locality. Consult your own counsel if you have legal questions related to your rental property practices and processes.

Disclaimer: Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

You’ve found someone who looks like the perfect hire: They have a flawless cover letter, a killer resume, and nailed both their in-person and phone interview. So, what’s the problem Unfortunately, , this “perfect candidate” is using a fake identity to fill out employment paperwork.

Over the past few years, employment-related identity fraud has exploded alongside remote work. According to HR Executive, job scams––including fraudulent job applicants––grew by 250%, compared to the same period the previous year. Scams include stolen identities, fake names and credentials on resumes, and even fraudsters using AI to conduct deepfake video interviews.

In fact, even the FBI published a warning about the rise of deepfake fraud in remote hiring. Once the scammer is inside your business, they can steal trade secrets, sensitive client and employee information, financial data, intellectual property, and more––which can utterly destroy your small business.

While all-remote jobs in the technology and finance sectors are the most common targets, this––and simpler––types of fraud can hit any small business at any time. It can be especially damaging for small business owners who don’t have the resources to clean up the potential fallout. That’s why it’s essential to verify that your candidate is who they say they are before extending a job offer.

But, how can you, as an employer or hiring manager, combat the trend of identity theft? Verify your job applicant’s identity with online pre-employment screening from ShareAble for Hires®. This crucial step in the hiring process can help mitigate the risk of identity theft and may increase your chances of making a great hire from the start.

This article explains what you need to know to help protect your business from potential scammers, including:

- What is the Purpose of an Employee Identity Verification Check

- Online Identity Verification for Employment Screening

- How to Read an Identity Report

- What Happens If Your Job Candidate Fails Identity Verification

- How much does it cost to run an identity verification check

- Get Identity Verification with ShareAble for Hires

What is the Purpose of an Employee Identity Verification Check

Due to the abundance of websites that sell fake identities, identity theft has become a significant problem in the United States. According to the U.S. Bureau of Justice Statistics, 9% of all American adults were victims of identity theft in a single year (2021), which accounted for $16.4 billion in losses.

Beyond individuals, identity fraud can also impact your small business. If a job applicant supplies false information, then you’ll be making a hiring decision based on lies and potentially nefarious purposes.

How Identity Verification Helps Small Business Owners

Identity verification for employment through ShareAble for Hires helps small business owners determine whether additional verification steps are needed to bring someone onboard. Knowing your applicant is exactly who they say they are could help you prevent things like:

- Social security fraud

- Data breaches

- Theft of cash and sensitive data

- Unauthorized access to intellectual property

- Remote work scams

How Identity Verification Helps Job Applicants

In addition to discovering potential applicant fraud, identity verification may also help uncover job candidates who have no knowledge that their identity has been pilfered.

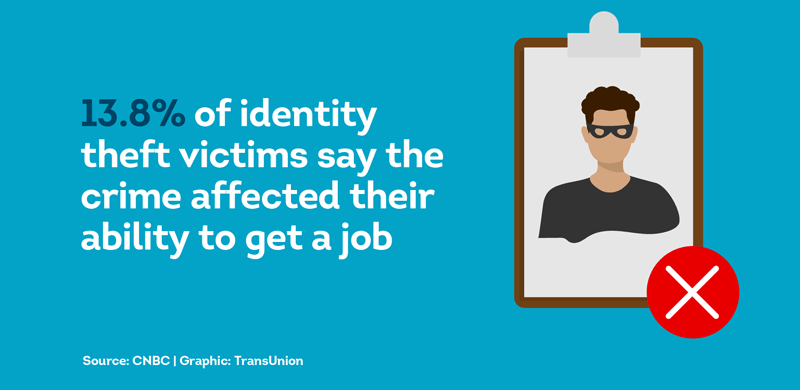

According to a story from CNBC, 13.8% of identity theft victims reported that their ability to get a job had been affected or that they had been unable to find a job as a result of identity fraud, and 8.5% had lost a job opportunity because of it.

This type of identity theft can be challenging to spot quickly, as it typically doesn’t immediately impact the victim’s finances.

It’s clear that identity verification plays an important part in the pre-employment screening process, and can help you make a more confident hiring decision.

Pro Tip: Adding pre-employment screening, including identity verification, is one way to beef up your recruitment efforts. Learn more ways to improve your recruiting process to attract better employees.

Online Identity Verification for Employment Screening

How does identity verification work?

Sadly, you can’t always take job candidates at their word. Identity Verification uses advanced record-matching logic to help confirm the personal data your job applicant provided is who they say they are.

In minutes, you’ll discover if your candidate’s supplied information throws up any red flags, like fraud or deceased person alerts. This can help indicate if your job applicant is a victim of fraud––or maybe even a scammer themselves..

Pro Tip: Identity verification helps you feel more confident before you hire. However, once an employee starts , there are additional identity and employment authorization verifications to complete, . Learn more about your I-9 responsibilities and how to verify past employment history.

How to Read an Identity Report

To ensure you’re making a good hiring decision, it’s important to understand how to read an identity report.

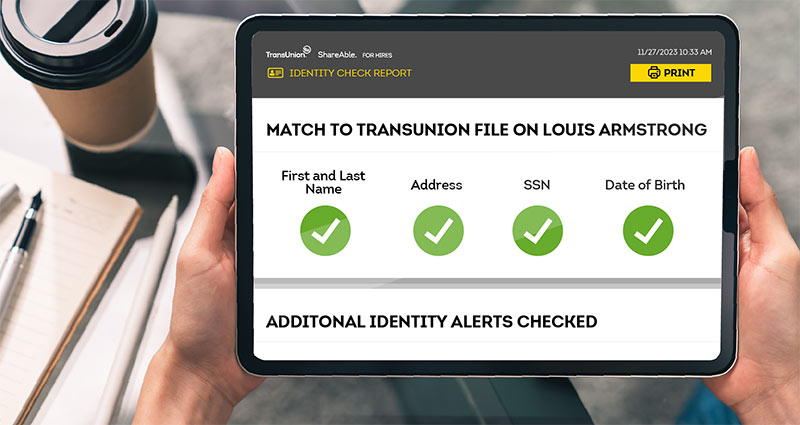

An identity report is broken up into two main sections:

1. Personal Data

How it Works

When doing a background check, applicants supply their personal information, such as first and last name, current address, SSN and date of birth. The sophisticated matching system compares their data to several key databases to help ensure the self-reported information is accurate.

What You See

Green check marks indicate that there’s a data match––great! However, if any of the checks comes back not-matching, then additional proof of identity may be necessary.

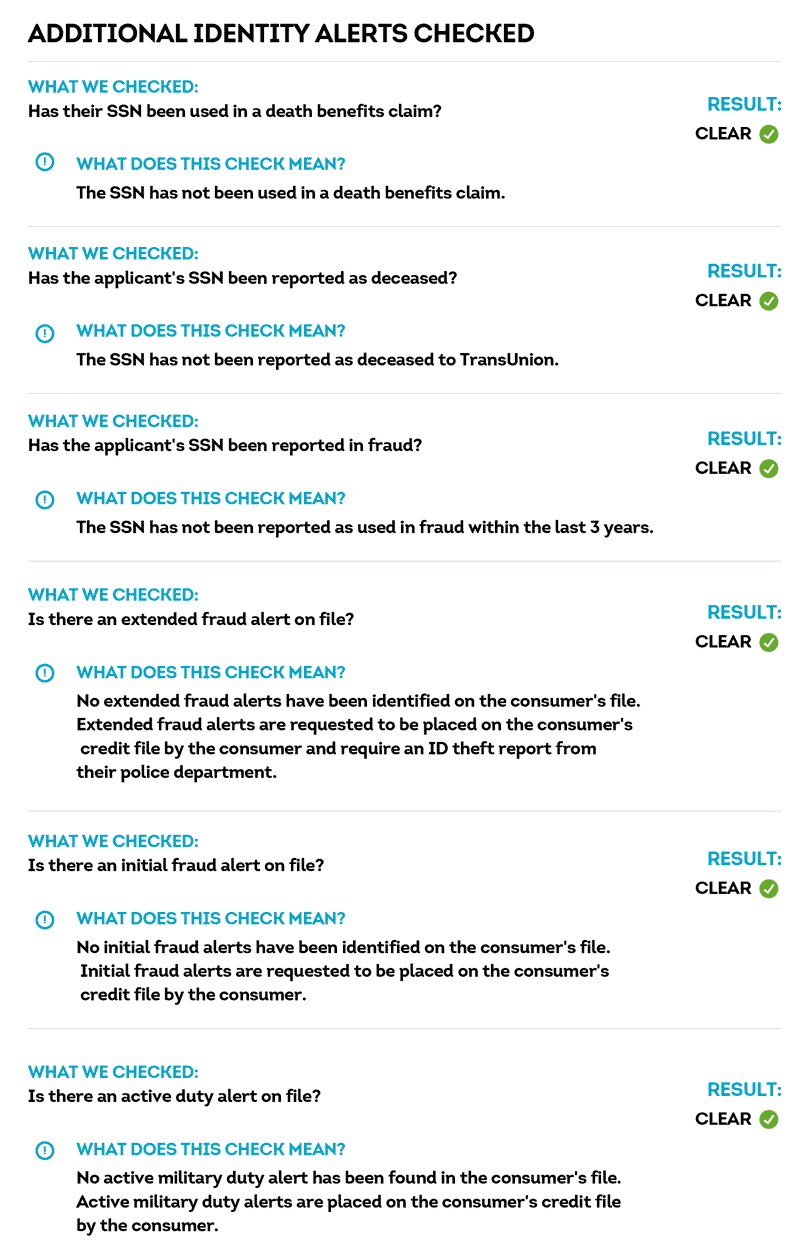

2. Fraud Alerts

How it Works

Next, the identity report scans fraud alerts on the hunt for any matches to your job applicant’s data. The report looks for things like:

- Is the SSN associated with a fraud case

- Does the SSN belong to a person listed as “deceased”

- Are there any fraud alerts on file

What You See

The report shows each check alert and its status. If there are any suspicious flags, you may consider requesting additional proof of identity.

What Happens If Your Job Candidate Fails Identity Verification?

If your job applicant fails the identity verification process, then it doesn’t necessarily mean they’re using a stolen identity. However, it does indicate that you may want to complete additional pre-employment screening to ensure your candidate is who they say they are.

Important Note: an ID report cannot be the basis for denying an applicant and is not adverse actionable. ShareAble for Hires ID reports can only be used to help you determine if additional proof of identity is necessary. It’s always encouraged to review the terms and conditions for ID reports and to speak with your legal counsel on these matters.

How much does it cost to run an identity verification check?

Identity checks cost much, much less than the potential financial fallout of employee theft, fraud cases, data breaches, and negligent hiring lawsuits you could face if you hire a scammer.

Considering even standard employee turnover can cost anywhere from 16% to 213% of that employee’s salary, you are wise to thoroughly vet every applicant before extending a job offer.

For as low as $40, you get identity verification, a criminal background check, and help increased confidence in your hiring decisions.

Check out all three flexible, flat-fee background check packages.