Onboarding paperwork can be overwhelming for a small business and for the new employee joining the company. On a new hire’s first day of work, they’re bombarded with a towering stack of papers to fill out, many of which are legally mandated.

Although some paperwork might be specific to your company, there are a few forms that employers are legally required to maintain. One such document is Form I-9 for Employment Eligibility Verification. If you’ve wondering why you’re required to have one on file for each employee—this article can help.

Let’s explore what employment eligibility means and why it matters for your small business.

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

What is Form I-9 for Employment Eligibility Verification?

Form I-9 documents the verification of the eligibility of an individual to work in the United States. You can find the I-9 form for download on the U.S. Citizenship and Immigration Services (USCIS) website.

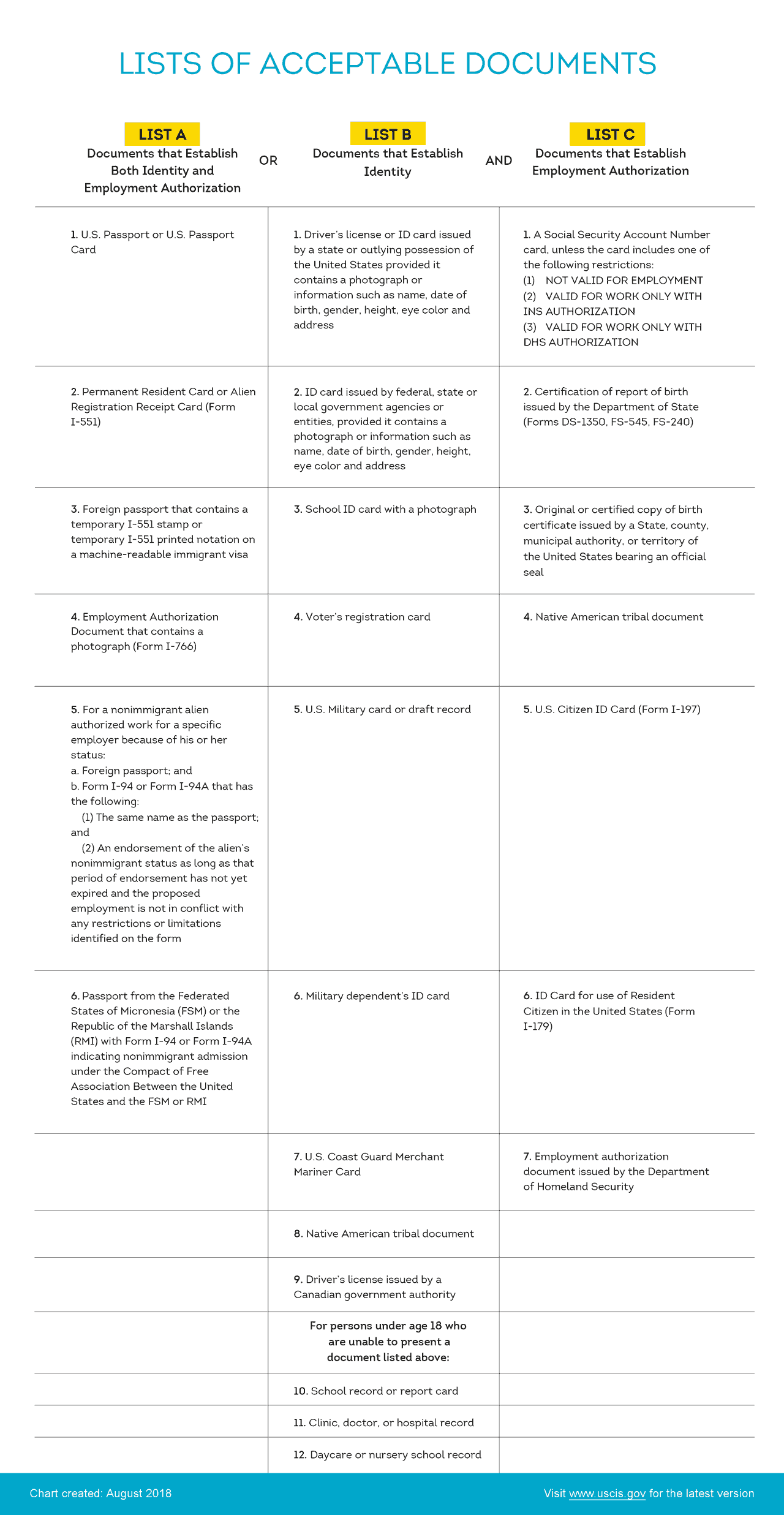

According to the USCIS, before any person can be employed in the U.S., he or she must attest to his or her employment authorization and provide the employer with acceptable documents evidencing identity and employment authorization. In order to do this, employees are required to submit documents alongside Form I-9 which show evidence of their eligibility. The employer cannot require specific documents for this purpose. An employee can provide a document from List A or a combination of one selection from List B and one selection from List C.

All U.S. employers are required to properly complete a Form I-9 for each individual hired for employment in the United States. This includes both citizens and noncitizens. Under certain circumstances, a person who is not authorized for work can obtain a work authorization document prior to employment (EAD).

Why do employers need to verify employment with Form I-9?

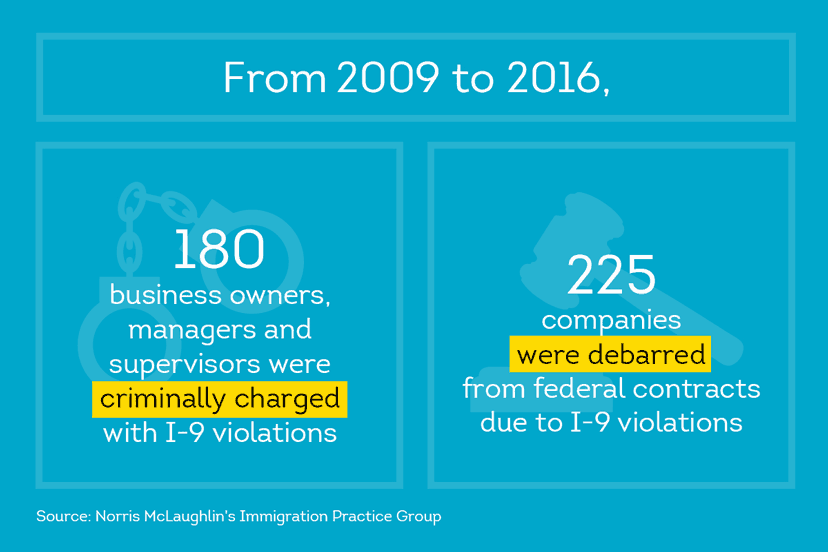

To comply with United States immigration law, employers must verify the identity and employment authorization of each employee they hire, and complete and retain a Form I-9. Employers who fail to obtain the appropriate documentation from new employees—whether intentionally or not— can be fined with penalties. Since January 2009, 180 business owners were charged with I-9 violations, 225 companies debarred from federal contracts.

The Immigration Reform and Control Act (IRCA) was passed and signed into law in 1986. The act created major changes to immigration laws. IRCA designates which workers are eligible for legal employment and instructed employers how to verify the identity and work authorization of their workers.

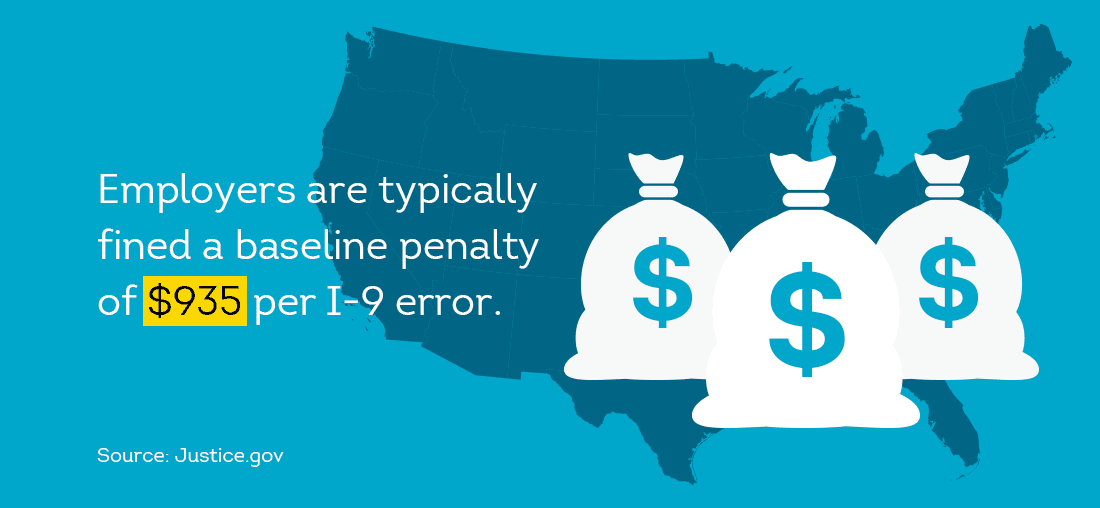

In 2016, The Department of Homeland Security doubled the fines for Form I-9 penalties, which now range from $216 to $2,156 per violation—that means a separate charge for each I-9 employment verification form violation.

Within three days of hire, every new employee must show their employer documentation that establishes both their identity and their authorization to work in the United States. Under the IRCA, if an employer fails to verify the identity and employment authorization of a new employee and maintain a Form I-9, they can face a host of civil and even criminal penalties.

Which documents can an employee provide to verify employment authorization and identity?

Employees can demonstrate their identity and employment authorization by using a variety of documents. The list of Acceptable Documents must be made available to the employee, and the categories for documentation are broken down into 3 categories:

- List A: Establishes both identity and employment authorization, such as U.S. passport or permanent resident card among other options.

- List B: Documents that establish identity (such as driver’s licenses, school/military ID cards, etc.) but must be presented in conjunction with authorization from List C.

- List C: Establishes employment authorization (including Social Security cards, birth certificates, or other documents that authorize legal employment) but must be presented in conjunction with document from List B.

In short, anything from List A can be presented as standalone identity and employment authorization, but List B and C requires the presentation of one document from each list.

Your Responsibility as an Employer

Both employees and employers are obligated to fill out certain portions on each individual I-9. Employers must be sure to fulfill all relevant responsibilities, including:

- Requiring all new employees to complete Section 1 of Form I-9 on their first day of work, and ensure all fields are complete. Employees can have help completing Section 1, including a translator, to fill out their personal information such as:

- Full legal name

- Other names, if applicable

- Current address

- Date of birth

- Check box indicating citizenship or corresponding option

- Signature and date

- Physically examining the identity and work authorization documents presented by the employee to determine they reasonably appear to be genuine and to relate to the employee presenting it.

- Completing Section 2 of the Form I-9 within three business days of the new hire’s employment and after determining the reasonable genuineness of the supporting documents. Section 2 information includes:

- The employee’s legal name found from Section 1

- The provided document(s’) title, issuing authority, and expiration date if applicable

- The employment start date

- The legal name, signature, and title of the employer completing Section 2, as well as the employer’s business address

Common Mistakes Employers Make with Form I-9 – And How to Avoid Them

Employers must be diligent to avoid errors regarding Form I-9 organization and documentation. It is important to fill out the I-9 form correctly, as violations add up. In court cases, ICE has used a baseline penalty of $935 per I-9 error.

Common mistakes include:

- Failing to complete all necessary information. Read through all boxes on Section 1 and 2 and double-check their completion.

- Failing to have employee fill out Section 1. If you forget Section 1 and only verify the documents in Section 2, the form will be incomplete.

- Failing to conduct an internal I-9 audit. Sometimes in massive hiring sweeps, it can be easy to miss paperwork for one individual. Conduct regular internal audits to ensure you have an I-9 on record for each employee and for the correct amount of time.

You are legally required to verify employment authorization, and these requirements are enforced by the USCIS.