Employee credit checks can help you identify financial red flags that can harm your business. First, you must make sure you’re legally allowed to run a credit check for your open position. Then, you need to find a reputable credit service and get consent from your applicant. Then, it’s essential to know what to look for on a credit report and what to do if you decide not to hire someone. Throughout the process, you must be careful to adhere to all FCRA and other consumer data laws to help avoid legal trouble.

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

If you leave an office candy dish out for visitors, it’s not a big deal if an employee occasionally helps themselves. However, what if that candy dish was a bank deposit bag full of the day’s cash? Or a whole pile of valuable customer data?

According to Forbes, up to 30% of small businesses fail due to employee fraud, like theft or embezzlement. Common schemes involve tampering with payroll checks, billing schemes, and false expense reports. The same article claims 75% of employees have stolen from their employers at least once––whether that’s a few paperclips or a half the pension fund could mean the difference between maintaining or closing your small business.

It’s easier for large corporations to absorb the aftermath of employee misconduct. Many even have internal audits and checks to help detect theft. However, small companies typically have slighter margins, tighter budgets, and fewer oversights in place. Independent businesses are especially prone to employee abuse––and extra vulnerable to the devastating fallout.

Before you hire anyone into your livelihood, it’s imperative to understand everything you can about a potential employee’s past, and that absolutely includes their history with money.

Employee credit checks are often used while hiring new staff members or promoting current employees. They help you get a better understanding of someone’s financial track record. These staff credit checks are an integral part of any responsible pre-employment screening process that you might conduct through a well-known service like ShareAble for Hires®.

This article covers the basics of employee credit checks and provides step-by-step tips for getting employee credit reports when hiring or promoting, including:

- What is a Credit Check?

- Why Credit Checks Are Important for Hiring and Promoting

- When You Should Conduct Credit Checks for Employees

- How to Conduct a Credit Check on a Job Applicant

- Post-Decision Requirements

- Make Better Hiring Decisions with Job Applicant Credit Checks Through ShareAble for Hires

What is a Credit Check?

Before heading into the instructions on how to conduct an employee credit check, it’s helpful to first understand what a “credit check” really means. A “credit check” is a consumer report that details an individual’s financial and borrowing history. The report may include a consumer’s:

- Number of open and closed lines of credit

- Names of credit providers

- Information on loans and lenders

- Credit limits

- Payment history

- Debts and defaults

Credit checks are often used in financial situations, such as applying for house or car loans. Additionally, they may be used for things like judging credit-worthiness in a rental or leasing situation and to check someone’s financial history in a hiring process.

However, while credit reports are extremely useful, they are not freely available to anyone at any time. The information on a credit report is federally-protected by the Fair Credit Reporting Act.

These laws restrict who can request someone’s credit report, when they can obtain it, how they can use the information, and what to do with the report when you’re done. It’s important to always use an FCRA-compliant service like ShareAble for Hires whenever you get a credit check for a job applicant or employee.

How Employment Credit Checks Impact Applicant Credit Scores

Sometimes, requesting a credit report results in a “hard hit” on someone’s credit. These hard hits can negatively impact credit history and even lower credit score. However, you can check someone’s credit without damaging their score.

Using services like ShareAble for Hires result in a “soft hit” on a job applicant’s credit. Here, the job applicant consents to the report ahead of time. Because they give permission for the report, the resulting “soft hit” has no impact on the job applicant’s credit score or record.

PRO TIP: All ShareAble for Hires reports are FCRA-compliant, so you don’t need to stress about following the laws or unintentionally lowering your job applicant’s credit score.

Why Credit Checks Are Important for Hiring and Promoting

There are dozens of reasons why employers check credit. These reports help you judge if someone would be a good fit at your organization. Here’s what you can learn about potential employees through credit reports:

Is your job applicant responsible? Discovering how someone handles money is one way to find out. For example, if your applicant repeatedly skips their car payment, will they just as easily skip their work deadlines and obligations? If they can’t manage their own finances, then it could be an indicator that they can’t manage money for your business

Is your job applicant a potential risk? A disordered financial history and overwhelming personal debts could become a liability for people who manage finances or sensitive data. After all, desperate people often make foolish, short-sighted decisions. If you’re not careful with who you hire, your company could be the one that pays the price.

How much can you trust your job applicant? Knowing how someone managed financial responsibilities in the past can inform your hiring decision. Do they always pay their debts on time and in full? Do they meet their obligations? A credit check can help reveal the applicant’s real-world financial behaviors and choices. This could mean a more confident hiring decision for you.

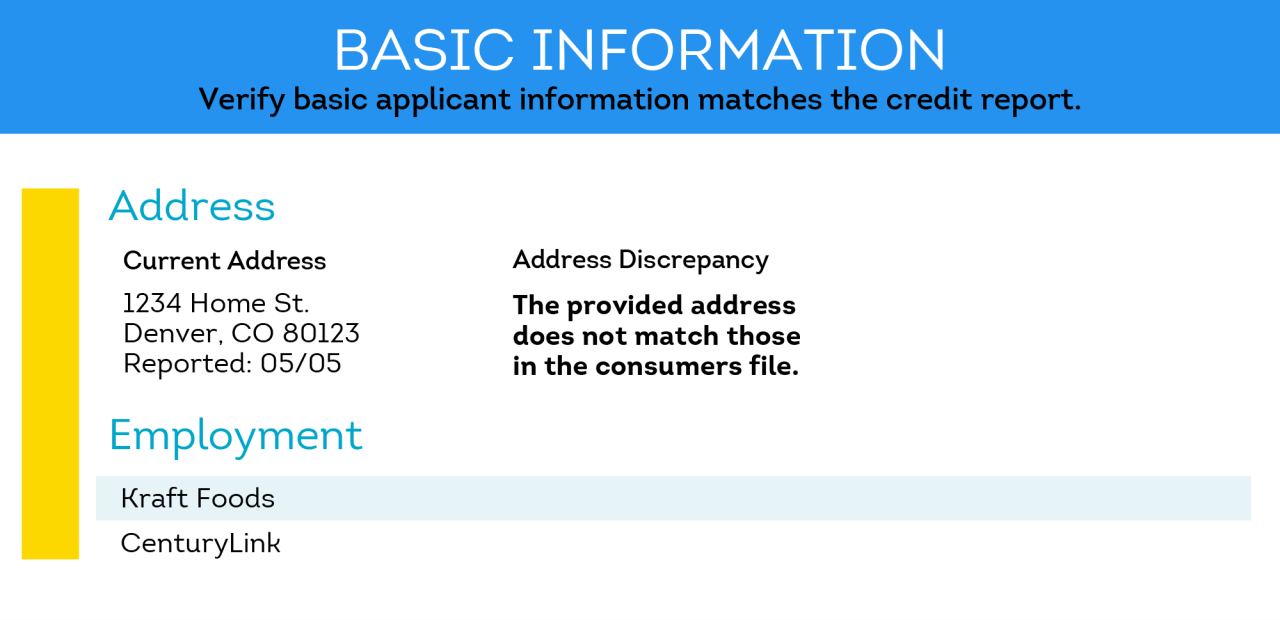

Is your candidate telling the truth?In addition to financial information, credit reports often contain biographical information that can be extremely helpful when making hiring decisions.

The top of a credit report includes an applicant’s name, current, address, and, in some cases, employment history. You can see right away if the personal and employment information matches what they put on your application form. This check helps confirm that your applicant is really who they say they are.

Pro Tip: Identity fraud is more common than you might think. Learn about the importance of identity verification and help prevent fraud with identity checks.

When You Should Conduct Credit Checks for Employees

Conducting pre-employment screening is a crucial step in protecting your business. Quality reports, like credit checks and criminal background checks, can also help reduce your chance of getting slapped with a negligent hiring lawsuit. However, while credit checks can be illuminating, you might not be able to run this report on every potential employee in every position.

It’s most critical to run credit checks for employees that will:

- Handle cash

- Oversee organizational finances

- Access sensitive data (like customer financial or personal data)

Knowing how they handle themselves financially could be helpful when making your hiring decision. For example: you’d want to know if they have any personal liabilities, such as large amounts of debt, that could be leveraged by outsiders who want to get their hands on your data.

However, be aware that some jurisdictions restrict if and when employers can use credit checks in the hiring process . According to The Balance Careers, some states only allow employee credit reports for positions that involve confidential information or financial transactions.

As always, contact your legal counsel if you have any questions.

How to Conduct a Credit Check on a Job Applicant

Here are the steps for running a credit check on potential employees at every stage of the process:

Preparing for Job Applicant Credit Checks:

As you prepare to check your job applicant’s credit, keep the following points in mind:

- Check your local laws and confer with legal counsel if needed. Remember, not every state and region permits credit checks in the hiring process in all cases. According to NOLO, at least ten U.S. states have laws that prohibit or restrict the use of credit reports in hiring decisions.

- Stay consistent. To help avoid discrimination lawsuits , job requirements and vetting should be the same for everyone. Everything from phone interview questions to background checks should stay consistent across candidates. Only running credit reports on some finalists but not others could be grounds for a discrimination lawsuit.

- Notify the applicant that a credit report is necessary and that you might use the report to make your hiring decision. Many employers build this notice into their existing paper or digital job application. Some employers prefer that employees initial the notice as an individual line item. Others list the notice alongside other required disclosures and require only one signature for everything.

- Choose a credit reporting agency or service. Always use a highly reputable credit reporting service that provides only FCRA-compliant reports, such as ShareAble for Hires. Here’s why:

- Trustworthy experience. ShareAble for Hires is backed by TransUnion, a “big three” credit agency with nearly four decades of credit experience. With proven data expertise, you can feel more confident the information you receive is accurate and complete.

- Built-in FCRA compliance. ShareAble for Hires manages all required communication, automatically sends notifications, and provides copies of all reports directly to your applicant, so you don’t need to worry about meeting the requirements on your own.

- Ultra-fast reports. Once your applicant consents, you get lightning-fast credit reports delivered in just minutes. There’s no need to wait around for long clearing processes or administrative chokeholds.

Running the Employee Credit Check

Once you’ve chosen your provider, it’s time to start the process. The first step is getting written consent from your job applicant.

Applicant consent not only results in a “soft” credit hit, but is also a requirement of FCRA. If you use ShareAble for Hires, the consent process is automatically built-in. You don’t have to take any additional steps to get permission and run a legal credit check.

If you do try to run your own credit check or go with a different provider, it’s extremely important to confirm they follow all laws to help you avoid serious legal trouble. After all, failing to follow FCRA requirements is one of the five major background check mistakes small businesses make.

Pro Tip: Make it easy for yourself. With ShareAble for Hires, all you need to start your credit check is your job applicant’s email address. The system handles the rest automatically.

Reviewing Credit Report Results

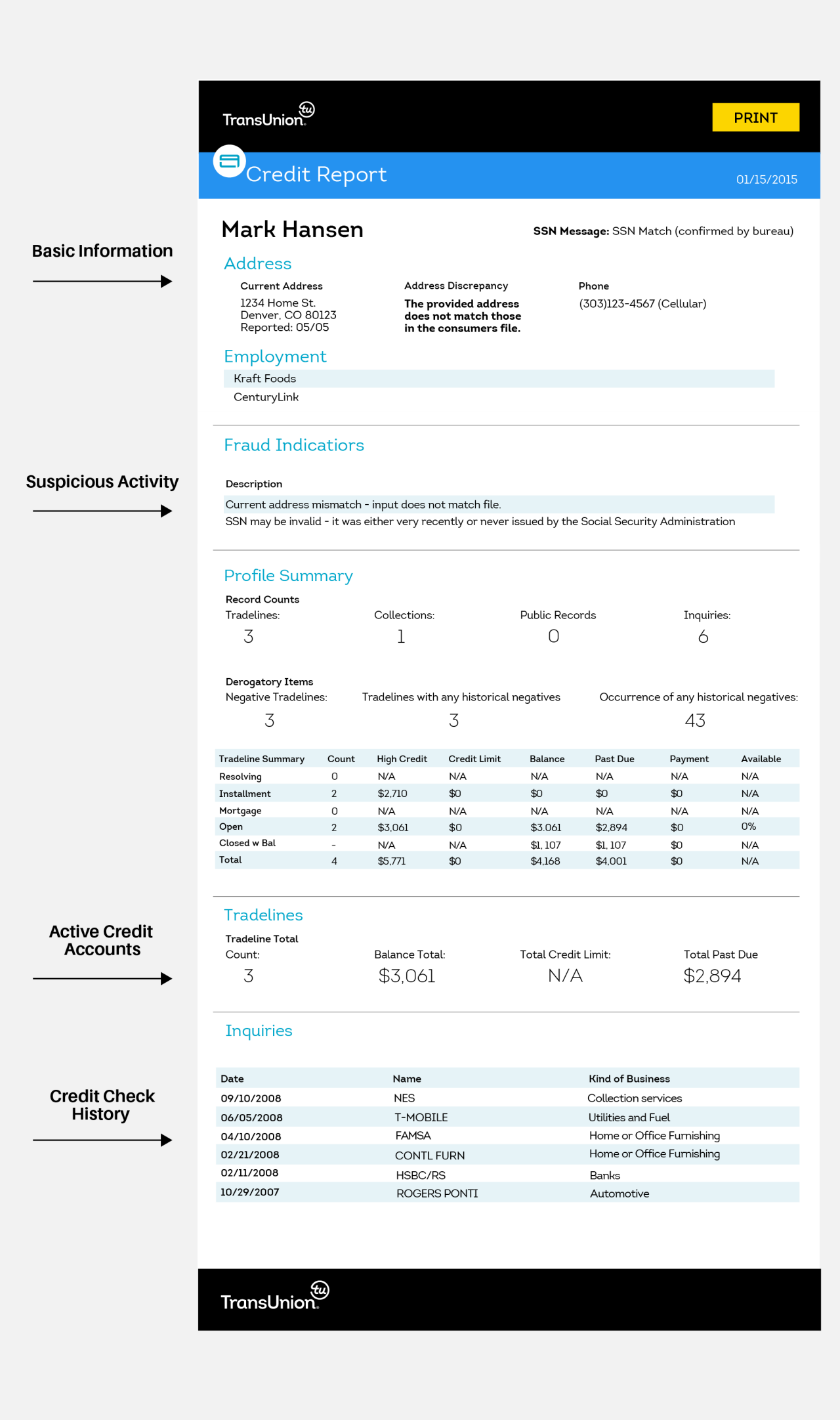

The next step is reviewing the actual credit report. Before you begin, it’s helpful to know how long background checks take, so you can know when to expect resutls. With ShareAble for Hires, you’ll get an easy-to-ready report almost immediately after your candidate consents to the check.

While reports may vary with the service you use, the end result should look something like the following example from ShareAble for Hires.

Check out how to read an employee credit report and know what watch out for. Some red flags include:

- Excessive collections

- Delinquent accounts

- Very large sums of money owed

There may be perfectly acceptable and legitimate reasons for people to have less than stellar hits on a credit report. However, these red flags might also point to a worrying history with money that could harm your small business

Either way, it’s helpful to consider this detailed financial history when making hiring and promotion decisions.

Post-Decision Requirements

If the report looks good and you decide to hire or promote the person––great! You can move on to providing an offer and setting up effective onboarding.

However, the report might also spark worry or doubts. You may decide it’s a liability to hire the applicant based on their credit report. If you go ahead with this “adverse action,” know that you still have some obligations and requirements to meet.

Adverse Action Requirements

If you take adverse action (such as not hiring someone) based on the contents of a credit report, there are a few things you must do to comply with FCRA laws, including:

- Notify the job applicant that you’re taking adverse action and include the following with the notice:

- A copy of the credit report. If you use ShareAble for Hires, a copy of the report is sent to the applicant automatically

- A copy of the FTC’s A Summary of Your Rights Under the Fair Credit Reporting Act document

- Information about the reporting agency, including contact information

- After providing these documents, you must give your applicant a reasonable amount of time to review and fix any inaccurate information and appeal your decision.

Proper Disposal of Consumer Reports

No matter the result of your report, keep copies of all relevant hiring documents for the required length of time. This could be from 1 to 3, or even more years, depending on the policies of your state, region, or even company.

Once you can get rid of the documents, make sure to dispose of them properly. The FTC states that burning, shredding, or pulverizing paper documents and deleting all trace of digital data are among the acceptable ways to dispose of consumer reports.

Make Better Hiring Decisions with Job Applicant Credit Checks Through ShareAble for Hires

A new employee should be the cherry on top of your hard-work Sundae––not a destructive wrecking ball that demolishes everything you’ve built. Help discover if your job applicant is as sweet and innocent as they claim with ultra-fast online employee credit checks through ShareAble for Hires.

Employee theft, fraud, and embezzlement is shockingly common––and leaves more than a bitter taste in your mouth. With built-in FCRA compliance, automatic notifications, and ultra-fast, all-digital reporting, you can focus on the quality of your applicants instead of confusing FCRA requirements.

Quickly search for red flags with complete, easy-to-read reports delivered just moments after your employee consents to the check––a “soft hit” check that won’t impact their credit history. Backed by four decades of TransUnion data expertise, ShareAble for Hires delivers easy, affordable employee credit reports you can trust.

Some people can’t resist the sweet allure of crime. Help prevent bad actors from getting a taste of your livelihood with data-backed employee credit checks through ShareAble for Hires.

ShareAble for Hires

Sign-up Now. Reports Now. Hire Now.