Verifying a job applicant’s previous job history is essential to protect your business. Here’s how to inspect materials, ask pertinent verification questions during job interviews, run employment background checks and check applicant references for better hiring outcomes.

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

Success in business often requires focus on the future. However, when it comes to hiring new employees, it’s concentrating on the past that’s essential. Before bringing a stranger into your ranks, it’s crucial to confirm your great–looking candidate can withstand the test of time. If not, you could watch your business crumble into dust.

According to SHRM, not checking an applicant’s job history is one of the biggest mistakes you can make while running a company. Whenever you hire someone, you’re essentially giving an unknown person some control over your livelihood. Without verifying their past job record, you risk leaving your business open to ruin through costly mistakes, lawsuits, and potentially even nefarious fraudsters.

You don’t have a time machine to watch your candidate at work in previous jobs, but there are still several powerful tools at your disposal. Adding employment verification throughout your application process, checking references, and running a thorough employee background check through a reputable service like ShareAble for Hires can help protect your bottom line.

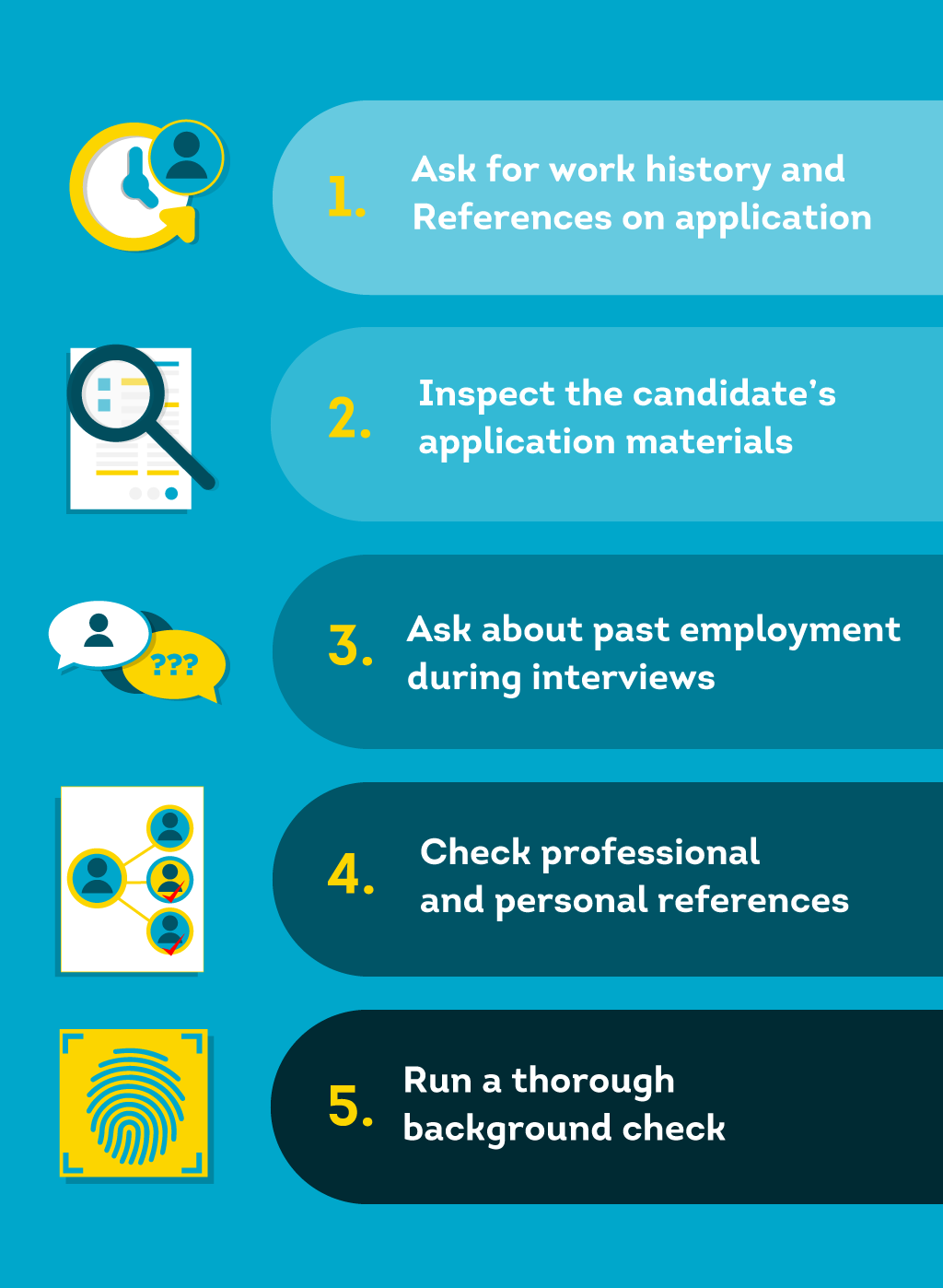

The article below outlines these five recommended steps for verifying a candidate’s glittering work history is really as golden as it appears on paper:

The first step to verifying a job candidate’s professional past is to request it on the job application itself. If you’re using a paper application that candidates complete by hand, make sure there’s a section requesting work history details. If you’re using an online application form, have a place for jobseekers to upload a resume or fill in relevant information.

Work history details to request on application:

- Company names

- Employment dates

- Locations

- Positions held/job titles

- Main responsibilities

How Far Back Should You Go?

It can be difficult to know how far back to request an applicant’s career details. There’s no standard length of time, but some career coaches and job sites advise applicants to include at least 10 years of employment history on a resume.

In addition to asking for work history, set the expectation for professional references early. Include a section in your application that states finalists will be asked to provide a set of references who can speak to their work ethic and professionalism. Some candidates will even include this information directly on the application form, which makes review even easier.

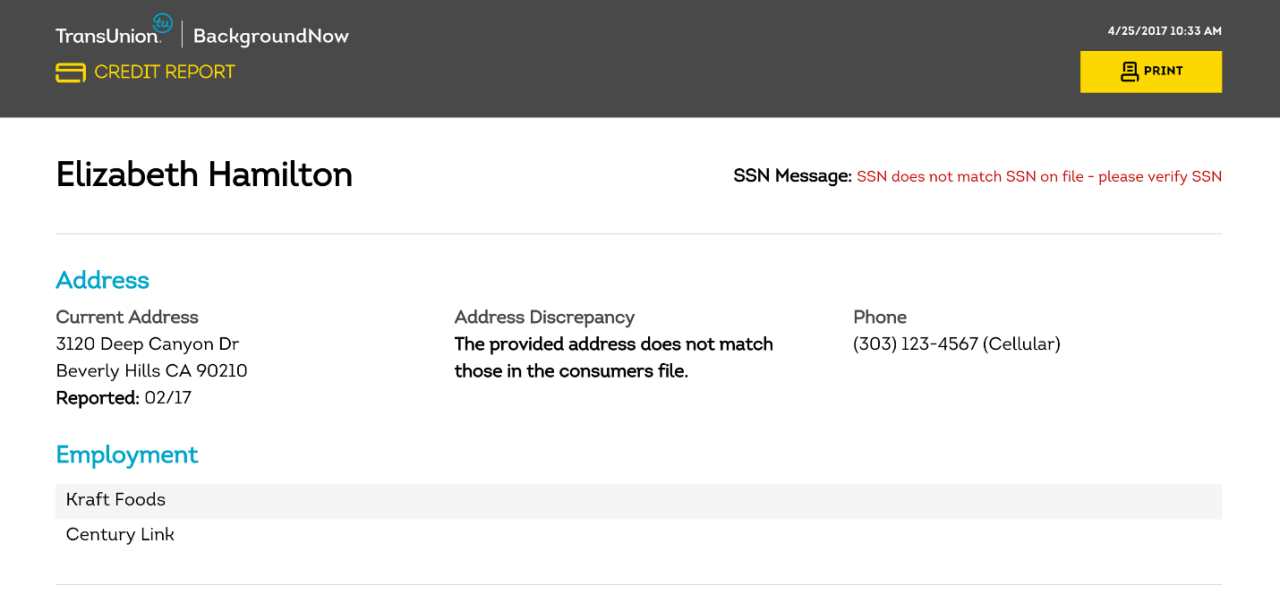

Pro Tip: Ordering an applicant’s credit report can help you to verify previous employment, as well. Determine at a glance whether the applicant’s information (name, current address, phone number) match up. Additionally, you could receive information about their recent work history and check if it matches what they put on the job application.

2. Inspect the Candidate's Application Materials

It’s not uncommon for some job applicants to misrepresent themselves on resumes. Some scammers even go so far as to create fake websites or businesses to trick potential employers. As you narrow down the hiring pool, it’s time to zero-in on the applicant’s resume and experience.

How to Spot Potential Fraud on Application Materials

- Look at the resume, cover letter, and other documents. Verify that the applicant's work history makes sense. Look for common red flags, including spelling errors.

- Research unfamiliar companies. Look up listed businesses online. Verify the official name matches what’s on the resume, the location is where the applicant says, and there are similar positions to the one included on their resume.

- Check for consistent, long-term employment: Does the candidate have a history of frequent short-term job hopping or solid employment? Do they seem to keep jobs only for a few months before moving on? If so, is that expected for your field? Keep an eye out for inconsistencies that might raise questions.

If you do uncover application falsehoods, you’ll have to decide what to do or if you’re still interested in the candidate. Trust is paramount when it comes to small businesses. In fact, according to CareerBuilder, 51% of hiring managers said they would automatically disqualify a candidate if they discovered a lie on their resume.

A Note About Employment Gaps

Periods of unemployment alone are not always cause for raised eyebrows. There are several valid reasons why someone might take months–or even years–off from work.

A larger concern might be frequent, unexpected interruptions or a pattern of only staying in long-term positions for a very short time. If you’re interested in a candidate with spotty history, ask them about the gap–and why they left their previous positions–during an initial interview.

3. Ask About Past Employement During Interviews

Once you’ve confirmed the information on a resume, your responsibility to verify a promising candidate’s past isn’t quite over. Whether by phone or in-person, interviews are a great place to learn more about an employee’s career so far.

Provide all interviewers with a copy of the candidate’s application. Ask about previous jobs, employment dates, duties, or any other questions related to work. Go for high-quality, open-ended questions, such as:

- “What was your proudest accomplishment when working with X company?”

- “How have your previous jobs prepared you for the duties of this position?”

- “Tell me about a time you disagreed with a supervisor’s decision at X company. What happened and how was the situation resolved?”

Asking pointed questions about previous jobs can help reveal irregularities. It’s usually easy for employees with real experience to talk about past employment.

Interview tip: To keep questions consistent between candidates and standardize evaluation criteria, use an interview scorecard or similar system. Scorecards help improve focus in interviews, add objectivity, make it easier to share thoughts on applicants, and keep important hiring criteria at the forefront.

4. Check Professional References

As a candidate advances closer to getting an offer from your company, it’s time for more caution—not less. During the final hiring round, ask your applicant for a set of professional references who can talk about their past job performance and personality at work.

A good standard is to request 3 to 5 references, including previous direct supervisors. It’s helpful to have the following information for each:

- Reference name and job title

- Relationship to candidate

- How long they’ve known the candidate

- Email address

- Phone number

Once you have the list, don’t just take it at face value. According to SHRM, the practice of using fake references is on the rise. Some people list friends, relatives, significant others, or even fake reference-providing companies on their application.

Before contacting anyone, do some research. Does the reference have a personal or professional email address? Are they listed on the company’s website? Does the phone number provided match the place they claim to work for?

Inconsistencies on references don’t automatically mean fraud. People frequently change jobs or might prefer using their personal contact information for nonbusiness communication. Even so, it’s still wise to check for obvious discrepancies.

Tips to Conduct an Employee Reference Check

- Call them. If possible, check references by phone instead of email. It can be harder for fakes to fabricate answers on the spot than it is for them to write a recommendation.

- Ask quality questions. Dive into the relationship to the candidate directly and follow up with specific questions only a colleague could answer.

- Discuss challenges. In addition to successes and positive qualities, ask the reference about a candidate’s areas of growth. Most managers should be able to talk about challenges as well as achievements.

5. Run a Thorough Background Check

At this final job stage, you’ve done all you can do to verify your candidate’s work history is legitimate. Now it’s time to leave it to the pros to conduct an in-depth background check. When it comes to revealing the nitty gritty of an applicant’s criminal past, credit history, or identity, you have many options.

Traditional Way

Traditional background checks can take days or weeks for results. Some options can be unaffordable for small business, especially if they make you pay to signup, require memberships, or impose screening volume requirements.

All of this slows down your hiring process—that is if you can even get started. Traditional background check providers are typically geared towards large companies and often include lengthy, complex sign-up procedures. They might require you to call to establish an account, reject your application to use their service, impose prerequisites, or make you wait weeks for screening approval.

DIY at the Courthouse

Trying to do it yourself by going to the courthouse could work, but it can take a huge chunk out of your day. Additionally, you may not find out anything if they’ve committed offenses in another state.

Go on Social Media

You could snoop on social media like 70% of hiring managers do according to Career Builder. Though it might seem like a good idea, it isn’t an approved way to screen. Violating federal and local consumer data laws—even accidentally—can obliterate your small business with lawyer fees and lawsuits.

ShareAble Way

ShareAble for Hires, a TransUnion product, puts small businesses on the fast-track to screen on-demand and make informed, hassle-free hiring decisions.

ShareAble for Hires is the only service on the market that can:

- Offer pre-employment credit reports without traditional credentialing

- Provide immediate access to start screening

- Deliver critical reports in minutes

Online, self-service and always-available, ShareAble can be used from your phone, computer, or tablet. It delivers reliable and easy-to-perform employment background checks that include credit history, national criminal information and identity verification reports.

With ShareAble, you get quick, reliable information to help make important hires faster and with more confidence. With less effort required to screen applicants, your time is free to spend on more important tasks—like running your business.

Verify an Applicant’s History and Screen with ShareAble for Hires

The digital age brings plenty of opportunities for entrepreneurs. However, advanced technology also creates openings for scammers and fraudsters to infiltrate your life’s work. Fake company websites, nonexistent references, misleading resumes–it’s all out there, just waiting for unsuspecting small business owners.

It’s more important than ever to verify your applicant’s history and be diligent. There are several actions you can take to help make the best possible hiring decision. Whenever you have a serious job candidate, be sure to:

- Get work history information

- Inspect candidate materials

- Ask about prior job performance at interviews

- Check work references

- Run thorough background checks

With a reputable service like ShareAble for Hires, you can get a fuller picture of your candidate’s past with high-quality background checks designed specifically for small business needs. There are no subscriptions, no monthly minimums or hidden fees, and no lengthy application or approval process.

Don’t make someone else’s rocky past your future problem. Feel more confident about your hiring decisions with critical information identity, credit and background information delivered to your fingertips in minutes from ShareAble for Hires.

Simply sign up for a free account and start screening immediately.