Expanding your business typically means taking on a new roster of employees, but the hiring process can be rife with challenges. While hiring new team members always carries some form of risk, the wrong hire can be particularly devastating for a small business.

The process often brings up questions, including:

- Can the candidate work well with the rest of the team?

- What if he doesn’t put forth the effort and diligence the job requires?

- Will she leave for a new position after just a month or two?

Small business owners can be challenged to make the right choice. Interviewing and onboarding a new employee can be time-consuming and money-intensive. Following hiring best practices can help you reduce the odds of making the wrong hire, and increase the likelihood to get the right person placed in your company’s open position.

Here are six tips you can use to help reduce risk when hiring a new employee for your small business.

1. Define the Role in Detail

Attracting the right person to your company’s open position means understanding what the role requires, inside and out. Sit down with your current team and write out the duties of the position and the skills needed to accomplish them. You might also consider prior employment and education requirements to further narrow the pool of candidates.

Small businesses thrive on tightknit culture, and it’s important to find a potential hire that’s a good fit, both for the role and as a part of the company team environment. In your listing, describe the work environment your new hire can expect. Sharing details about the way your small business operates (and excels) will help both parties determine if a job candidate is the right fit.

2. Take Advantage of Referrals

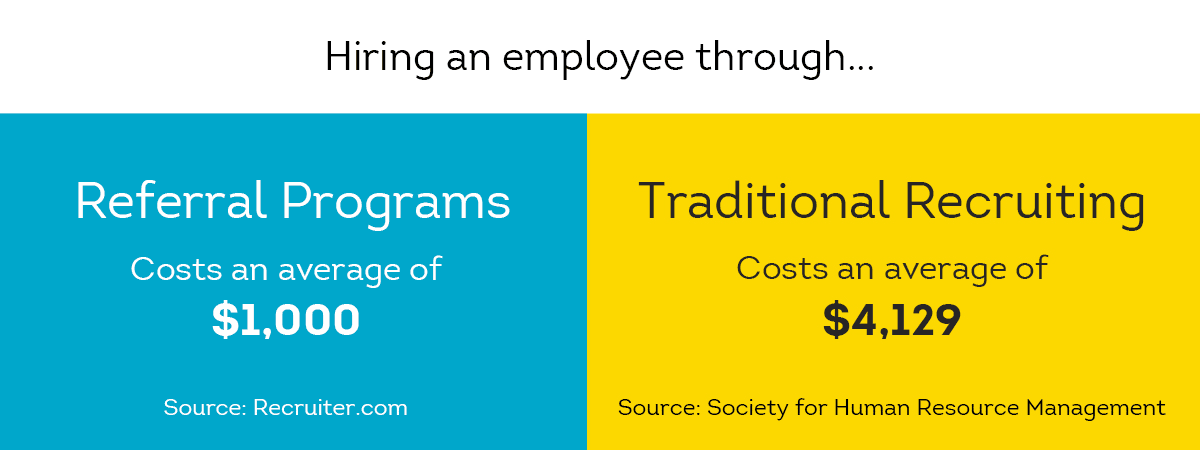

Referrals are one of the best ways to source talent you can trust. If you’d like to increase the amount of referrals you receive, consider an employee referral program. This type of program can save time and money; you’ll no longer spend hours wading through resumes or waste money on job postings that don’t seem to pull in the right candidates.

Your current team knows what it takes to be successful, and they can be a fantastic asset when it comes to finding new talent. Individuals that already work for your business will typically refer people with similar work ethic; if you already employee a high-caliber team, you’ll likely get referrals of the same caliber.

Hiring based on referrals tends to lead to a faster process, and is often cheaper. According to the Society for Human Resource Management, traditional recruiting processes cost an average of $4,129; in contrast, a referral program may cost you about $1,000 per hire— and most of this expense is typically compensation given to employees who refer a stellar candidate, so this may vary based on your organization’s needs and abilities.

3. Create a Rigorous Interview Process

The interview is an integral portion of your hiring process, so make sure it’s done well. Develop a list of phone interview questions to screen a candidate before bringing them in to meet the team. While this may take an extra 10 minutes out of your day, it will prevent wasting an hour of other team members’ time.

If the phone screening goes well and you decide to bring an applicant in for an in-house interview, have multiple employees take part in the interview process. It might be easier and quicker for you to handle the interview yourself, but facilitating a panel interview with employees from different areas of the business can help you make a well-rounded decision.

Panel interviews provide numerous benefits. As each interviewer takes turns to ask questions individually, the remaining panel members have time to listen to what the candidate is saying and observe their body language. Dividing the responsibilities gives both strong and weak interviewers the chance to ask questions; this increases the likelihood that all appropriate questions will be asked.

A cumulative hiring decision may also help reduce the risk of personal bias, and can better ensure the validity of the interview findings. As panel interviews tend to be a bit more intimidating for the applicant, this type of question-and-answer format may give you better insight into a candidate’s ability to perform under pressure.

A panel interview also benefits the candidate, providing them the opportunity to examine how potential future coworkers might interact. They may also glean a better understanding of the role as it’s seen through multiple team members’ eyes.

4. Check References

Even if you’ve found an applicant with an impeccable resume who nails the first interview, it’s crucial that you follow up with references. Checking a candidate’s references can:

- Confirm their education or certifications

- Confirm which title or position they held in a previous job

- Provide more information about the nature of their former duties

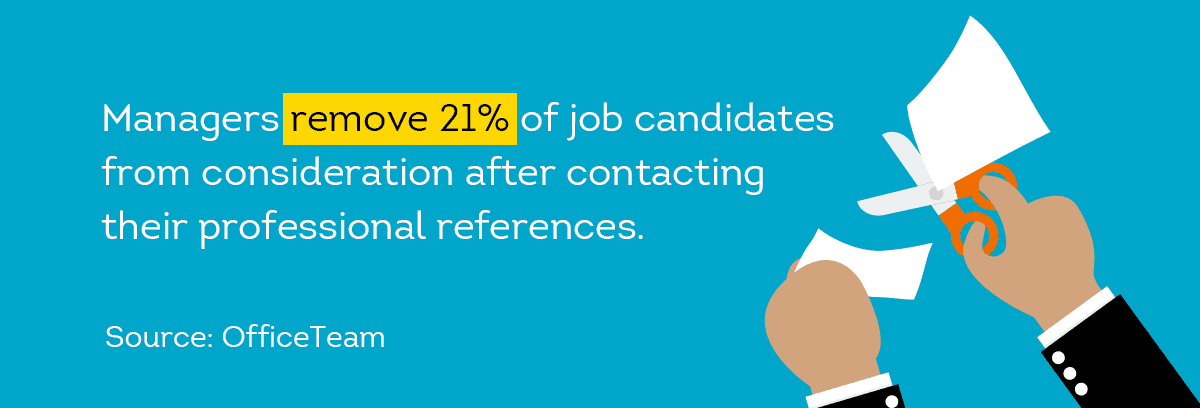

A reference check can help you narrow down your pool of candidates, especially if you’re torn between several applicants who all interviewed well. According to a survey completed by OfficeTeam, managers eliminate 21 percent of job applicants from consideration after checking in with their professional contacts. Learning about an applicant’s professional background from a direct source can be a great way to determine if they’re a good fit for your organization.

Cross-reference contact information through your own independent research; if they provide a contact number for their supervisor at a former place of employment, look up the organization on your own. Matching the number and name to the correct person can ensure you don’t fall victim to inaccurate information.

5. Consider a Trial Period of Employment

Some companies choose to engage in trial periods of employment. This trial basis can let you see how they perform, without making a commitment to permanent employment. Many employers like to see how new hires interact and fit in with the rest of the team. This is also a time to assess performance, discovering whether they’ll be a successful long-term fit or not.

A trial period of employment could help you save money and give you the time and proof needed to assess a candidate’s abilities—beyond what their resume indicates. Instead of offering in-house trial employment, some small business owners require a paid assignment completion; the candidate completes the assignment on their own time and sends in for review. They’re paid for their work as contractors, and you’re given deeper insight into their capabilities, making it beneficial for both parties.

6. Conduct a Background Check

Conducting an employment background check after making a contingent job offer can help you discover important details about your candidate. The right pre employment screening service can provide you with the must-know information needed to confirm your hiring decision.

A background check service like ShareAble for Hires gives you access to:

- Employment History: If the applicant has reported the name of their employer to lenders in the past, their employment history may be visible on the credit report.

- Criminal History: ShareAble for Hires crawls through 370+ million national and state criminal records, pulling information from numerous sources, including Most Wanted databases and the National Sex Offender Public Registry.

- Credit History: If the role involves the handling of sensitive financial information, you can conduct a credit check for employment access a job candidate’s financial history.

Assessing all available information about a job candidate is a crucial component of creating a solid team of employees. ShareAble for Hires provides small business owners with a job applicant’s financial history, criminal background, and employment record in just minutes.

All of the data you need to reduce risk with your new employee is presented in an easy-to-read format. This ensures you and your team can make quick, efficient hiring decisions that keep your business, employees, and customers safe. ShareAble for Hires offers you convenience by delivering fast results, peace of mind with high-quality reports that are compliant with the FCRA, and confidence in a trusted brand with over 40 years of experience as a reputable credit reporting agency to help ensure your next hiring decision is a good one.