No one wants to get lost in paperwork, but keeping proper employee records is an essential responsibility of any company—especially small businesses. Failing to keep these employee records can result in hefty lawsuits. Following this quick guide—and screening applicants through ShareAble—could help smooth your hiring, onboarding and HR process.

Table of Contents:

Introduction

Keeping up with employee paperwork can sometimes feel like an impending avalanche. The looming tower of paper grows taller with each new hire and workplace incident. One wrong step or loud noise might bring the whole thing crashing down.

No one wants to get lost in a file pile but keeping proper employee records is an essential responsibility of any company—no matter the size. Documenting hiring paperwork, background check results, relevant medical and accommodation information, and other staff files is not only a good way to stay organized, but is often required to comply with federal and local laws.

Failure to keep sufficient records about your employees can result in hefty lawsuits, which can swallow your precious time and bank account. For example, when you run a preemployment screening or credit check, federal laws require that you keep the results for at least one year.

Using a reputable, online background check provider like ShareAble for Hires lets you conveniently keep background check results organized and accessible only to those who need to see them.

No matter your collection method, it’s essential to know how to maintain, secure, and dispose of the three types of employee files. Without this information, you risk leaving your business vulnerable to the fierce chill of legal trouble.

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

When hiring staff at your company, there three main file types you’re responsible for keeping for every employee:

All businesses have this documentation requirement, no matter their size or number of employees. Each of these file types has its own purpose and contains specific types of documents. Additionally, each file type has its own regulations about where they can be stored and how long they must be kept.

As you hire new staff members, it’s your responsibility to understand and comply with all laws regarding the sensitive information contained in their employee files. To help prevent a chaotic mess of paper, it’s wise to set up a detailed document retention plan.

Have a system for storing, securing, and disposing of employee files that is aligned with all federal and local laws. Good bookkeeping is not only good for organization but can also help protect you from legal trouble if lawsuits arise.

1: Personnel Files

Personnel files are documents having to do with an employee’s application, hiring process, job performance, and ongoing professional relationship with your company.

Some examples of personnel file documents include:

- Resume and application materials

- Background check reports

- Reference check results

- Performance reviews

- Official job offer and promotion letters

- Improvement plans or disciplinary action

- Termination or end of employment documentation

It’s crucial to keep personnel files so that you have ongoing documentation of an employee’s work history with you. A strong, proven record of success can be used for promotions and other rewards.

Although terminating someone is rarely on a small business owner’s bucket list, sometimes it’s necessary to protect your business or other employees. If a staff member is struggling, keeping records about improvement plans or expectations can help document the process. If you eventually need to fire someone, having detailed files could help prevent unfavorable lawsuits.

Who should have access? Access to personnel files should be limited. Only an employee’s direct supervisor, Human Resources, and upper management should be able to access an employee’s personnel file.

Where and how should I keep these files? In general, personnel files are kept by the Human Resources representative or department. Access should be secured, meaning they could be kept in a locked file cabinet or through password protected electronic means.

2: Payroll Files

When it comes to money, keeping careful records is always a great idea. At your company, employee payroll files contain anything having to do with compensation or other monetary benefits.

Examples of documents contained in a payroll file include:

- I-9, W-4, and other tax documents

- Salary and benefit information

- Records of payments and tax withholding

- Timecard or timesheet records

Keeping detailed payroll files lets you have a complete financial picture of the employee at your company. You’ll need this information for filing your own company taxes or when you’re setting up next year’s budget. Additionally, maintaining these records can help clear up any compensation or time–related disputes that might arise.

Who should have access? Payroll records can contain private and sensitive information. In general, it’s best not to have this information publicly available for all employees. These files should only be accessible by people who are responsible for the financial portion of your business, including Human Resources and Accounting.

Where and how should I keep these files? Payroll files should be secured in a location that’s not accessible to all employees. For paper documents, this could mean a lockable drawer. However, now that many payroll solutions are available online, there could be instances where this information is kept securely on a local computer or in the cloud.

3: Medical Files

Perhaps the most sensitive of all employee files, medical records should be treated with extra special care. In accordance with HIPPA regulations, an individual’s medical information cannot be shared with anyone (including employers) without explicit permission from the patient.

However, there are instances where employers have a right to request certain medical documentation from employees when it involves employee health benefits, work attendance or performance.

Examples of documents in an employee’s medical file might include:

- Health benefit and insurance information

- Doctor’s notes

- FMLA or medical leave details.

- Worker’s Compensation files

- ADA accommodation notes

Who should have access? By law, access to employee data call records must be limited to only those who have a legitimate need to see them. This might include benefit providers, Human Resources and those responsible for creating accommodations

Where and how should these files be kept? Regulated by the ADA, employee medical documents must be kept separately from other employee documents. This might be in a separate file cabinet from Personnel and Payroll files, separate room, or password-protected file on a computer.

Keeping files straight can be a challenge for small business owners. To complicate matters, the length of time you need to keep each document within the files varies. In addition to some of the federal laws already mentioned, there could also be state and local-level regulations that dictate how long you must retain staff data.

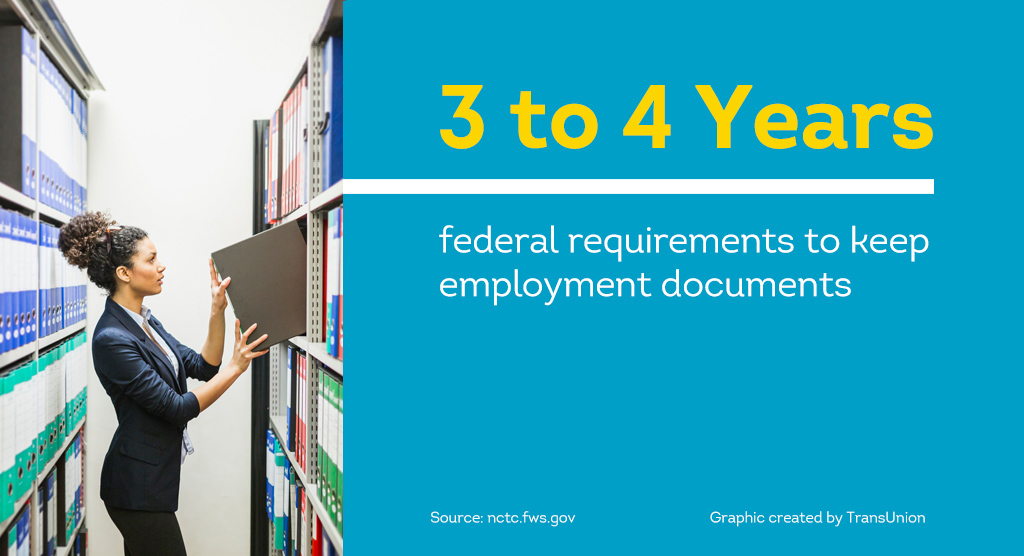

According to federal record retention guidelines, most types of employment documents have federal requirements to be kept up to 3 years, but individual states may have additional regulations that lengthen the required time.

For example, ADEA and FSLA require employers to keep payroll documents for at least three years. However, the state of Texas requires employers to keep some of these for four years.

As you create your document retention policy, make sure to research each type of document for your locale. It’s advisable to keep all documents for the longest-lasting statute.

When you’re no longer required to keep an employee’s documents, it’s time to dispose of them. Keeping documents for only as long as you need them is a good way to stay organized and may help prevent liabilities resulting from incomplete or outdated information.

Part of your responsibility as a small business owner is to ensure employee documents are disposed of responsibly. Ensure physical files are destroyed completely—by shredding, burning, or other means. Delete electronic files permanently in a way that cannot be restored.

Include a plan for tracking and disposing of employee files in your document retention strategy.

Help Yourself to Comply with Employee File Regulations with ShareAble for Hires

Keeping good employee files can sometimes feel like scaling Mount Everest. It’s a long, steep trudge that can be massively overwhelming. Given that the financial penalty for mishandling an employee’s private data can bankrupt a company, it’s enough to make a small business owner freeze up.

Help thaw some of the anxiety about document retention with employee screening through ShareAble for Hires. Created specifically for small businesses and backed by TransUnion—a major credit reporting agency—ShareAble for Hires delivers near-instant employee criminal background checks, credit reports and identity verification, which are stored securely online and available forever.

Feel more confident about accurate document retention with FCRA-compliant screening from ShareAble. Simply create a free account and send your job applicant a screening request through the site. When your employee agrees to the background check and successfully verifies their identity, you get results in a matter of minutes—and a high-quality report available online whenever you need it.

Say goodbye to losing documents in towering mountains of paper. Help reach peak employee file efficiency with ultra-convenient, online employee screening through ShareAble for Hires.