Hiring great employees can feel like running through a minefield. It’s stressful and difficult. Unknown surprises and hidden regulations lurk under every potential step. Then, when you finally find an excellent candidate, there’s a final, giant hurdle: understanding and complying with all employee background check laws.

Most small business owners already know that thoroughly vetting candidates is essential for hiring trustworthy and reliable employees. However, not everyone understands how federal and state laws dictate what data employers can gather about applicants and how that information can be used in the hiring process.

The consequences of violating FCRA, EEOC, or other hiring regulations—even accidentally—can be devastating to small business owners and could even lead to bankruptcy. To help avoid volatile legal pitfalls, it’s essential to choose a reputable, fully-compliant background screening service like ShareAble for Hires.

The guide below covers how to adhere to pre-employment background screening, including relevant laws, how to properly dispose of employee data, and how to run compliant checks.

Don’t get caught in legal tripwires during your next hiring process. Here’s what to know about background checks as an employer:

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

What Employers Need to Know About Background Checks

You have the perfect candidate for your open position and it’s time for a diligent criminal background check. After all, you don’t want to hand the keys to your livelihood to just anyone. Before you type their name into a search engine to see what comes up, there are several critically important considerations to keep in mind.

Whether attempting employment screening on your own or through a service, it’s essential to confirm you aren’t violating your potential employee’s rights. Performing criminal, credit, identification verification, or other pre-employment checks reveals private details about job applicants. Some of this personal data is protected by federal and state laws. This means there are very strict circumstances under which you can access and act on a job applicant’s personal information.

Key regulations from the Equal Employment Opportunity Commission, Federal Trade Commission, and individual U.S. states govern when employers can conduct a background check, what actions you can take based on the results, and what to do with the information you discover.

These rules help prevent hiring discrimination, which means violations result in potentially crippling penalties. To help avoid destructive legal trouble, the following sections outline what to know about background checks for each regulatory body.

Equal Employment Opportunity Commission (EEOC) Laws

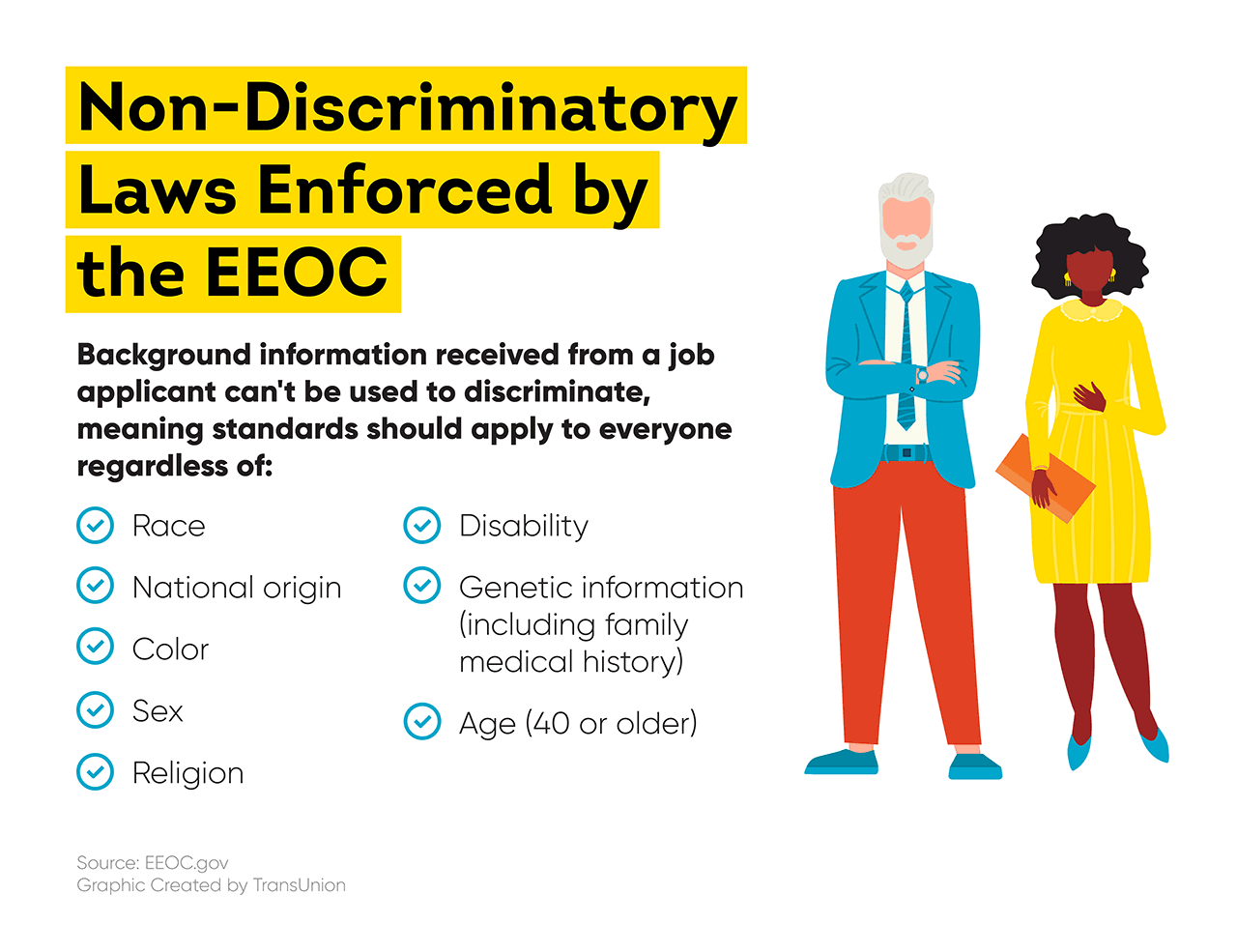

The Equal Employment Opportunity Commission (EEOC) is a federal agency that strives to ensure everyone has an equal opportunity to secure employment based solely on relevant skills and work experience. This means that small businesses need to treat all job applicants fairly. It is illegal to discriminate against an applicant based on their race, gender, religion, national origin or other protected identities.

In addition to preventing discrimination against members of the Protected Classes listed above, the EEOC also regulates how you can make hiring decisions based on a person’s criminal record.

As a business owner, it’s unlawful to not hire someone because of a conviction that’s unrelated to the job in question or irrelevant to your business. You also can’t use an arrest record alone to make hiring decisions.

If you pass someone over based on information revealed through a criminal background check, you must prove that your decision was directly related to the job or business. Additionally, when reviewing an applicant’s convictions, you must consider the nature of the crime and when that crime occurred.

For example, if you’re hiring for a job that requires significant driving and your applicant’s criminal history includes dozens of serious traffic offenses in the last year, then it may be relevant to include the applicant’s criminal activity in your decision. However, if those convictions occurred decades ago, perhaps they’re not so relevant to your company today.

In addition to considering context, you’re also required to inform candidates if your decision is based on their criminal record. You must give the excluded candidate a copy of the report, make them aware of their rights, and give them an opportunity to explain you why they shouldn’t be excluded.

Following these EEOC laws is a critical part of how to do a background check. The same rules apply whether you use an established traditional firm, a low-cost background check service, or try to do it yourself. Failure to comply with EEOC laws can cause severe legal repercussions.

Federal Trade Commission Laws

In addition to the EEOC, you must also consider Federal Trade Commission (FTC) laws when you’re running pre-employment screening. The FTC works to prevent fraud, unfair business practices, and deception. One of the laws enforced by the FTC is the Fair Credit Reporting Act (FCRA).

The Fair Credit Report Act (FCRA) small business owners, this means that you can’t run FCRA-protected background checks if the information you’re looking for isn’t relevant to your hiring decision. For example, if your new employee will be handling large amounts of cash, then a credit report is a wise choice. If they’ll be handling large amounts of cheese, a full credit history might not be as relevant.

Your Responsibilities Under the FCRA

Once you determine you have a “valid need” to run a credit report on a job applicant, you must make sure to do these three things:

- Inform your applicant that the information you receive could be used in your hiring decision. The notice must be in writing and in a stand-alone format (i.e. not tucked into other documentation).

- Receive explicit, written consent to conduct the background check from the job applicant.

- Notify the applicant if the report leads to adverse action being taken (i.e. if you don’t want to hire them based on the report findings).

If you do find some potentially unsavory information on your applicant’s credit history, that may not be the end of the line. If you decide not to hire based on an employment credit check, the candidate has the right to dispute the findings. It’s the reporting agency’s responsibility to investigate the dispute and determine validity

Like with the EEOC, violating FCRA regulations can lead to severe penalties that can cripple your small business. If any individual feels you didn’t follow the letter of the law, they can contact the FTC to file a complaint.

Willful non-compliance is the worst way to violate the FCRA, but there can still be harsh consequences for businesses who break the law even on accident. Most of the time, negligent non-compliance comes with smaller penalties, but violation scan leave a dark stain on your company that lingers for years to come.

Along with reading and understanding the regulations, you can help prevent the likelihood of consumer reporting lawsuits by using a fully-FCRA compliant background check reports from ShareAble for Hires. As mentioned above, this article is intended to provide helpful information. You are encouraged to consult your legal counsel for assistance in understanding and maintaining your business compliance with laws and regulations.

State Background Check Laws

While your primary focus might be federal background check regulations, it’s essential to also review relevant laws at the state-level. Many U.S. states have passed their own screening policies to encourage equal opportunities and prevent hiring discrimination.

For example, in California Fair Chance Act the works to remove hiring barriers for people with a criminal history. This law is typically referred to as a ban-the-box law . Under the Fair Chance Act, employers with at least five employees aren’t allowed to ask job candidates about prior criminal convictions before making an offer. This helps prevent discrimination against individuals with a criminal history, who, historically, have a tough time finding jobs.

While the Fair Chance Act is specific to California, several states have similar ban-the-box laws. Before you run any criminal background check, make sure you answer two important questions:

- What are the specific background check laws in my state, if any

- What can I do with the information discovered in a background check in my state

Depending on where you live, there may be several additional legal layers for hiring or there could be very few. A great place to start searching for relevant laws is the Labor Office for your specific state. Most labor websites have FAQs and other online information detailing state-wide hiring laws.

How to Dispose of Background Checks

You’ve run your background check for employment and made your informed decision. You may not need the physical report anymore, but you can’t just throw in the trash. Like other employee and company records, consumer reports like credit and background checks contain sensitive information that must be handled according to federal employee record-keeping laws.

Typically, you’re required to retain background checks and other hiring records for one year after you pulled the report or took action based on the information in the report (whichever comes later). In some cases, such as with educational institutions and federal employees, you may be required to keep records for even longer. If an applicant files a discrimination suit, it’s your responsibility to produce these records and maintain them until the case is closed.

Even when you’re allowed to get rid of consumer reports, it’s important to dispose of them properly. It’s not only a legal requirement, but it also helps protect both you and the applicant from things like identity theft.

Burn, shred, or pulverize paper documents, so that the information can’t be read. If you’re dealing with electronic records, completely delete them so they can’t be recovered or reconstructed down the road.

Run Compliant Background Checks with ShareAble for Hires

With the perilous obstacles, pitfalls, and buried details riddling the legalities of employee background checks, it can be difficult for employers to make it to the other side of the hiring process unscathed. Without intricate, detailed knowledge of EEOC, FCRA, and state-level screening laws, an unsuspecting business owner could find themselves pinned down in serious legal trouble.

Reduce the uncertainty from background check compliance with comprehensive employee screening through ShareAble for Hires. Designed specifically for small business owners with only occasional background check needs, ShareAble for Hires provides thorough, fully FCRA-compliant employee screening reports with lightning-fast results and friendly pricing.

Backed by TransUnion, a trusted credit reporting agency, every step of the process adheres to all federal consumer reporting guidelines outlined in the article above. Simply sign-up for an account and enter your employee’s email address. Once your candidate provides their consent and personal information, the background check starts immediately.

Ultra-fast results are sent to both you and applicant for total transparency, while the service provides all legally required notices and communication automatically.

In addition to full federal compliance, ShareAble for Hires removes stress from pre-employment screening by helping to ensure great candidates don’t get poached before you can hire them. Traditional background checks sometimes take a surprisingly long time to process. These screening delays can cause you to lose competitive candidates. ShareAble for Hires delivers reliable results in a matter of minutes, meaning you can hire the best candidates without delay.

Navigating the complex world of employee background check laws doesn’t have to be perilous. Sail through the legal minefield of employee screening more confidently with ShareAble for Hires.