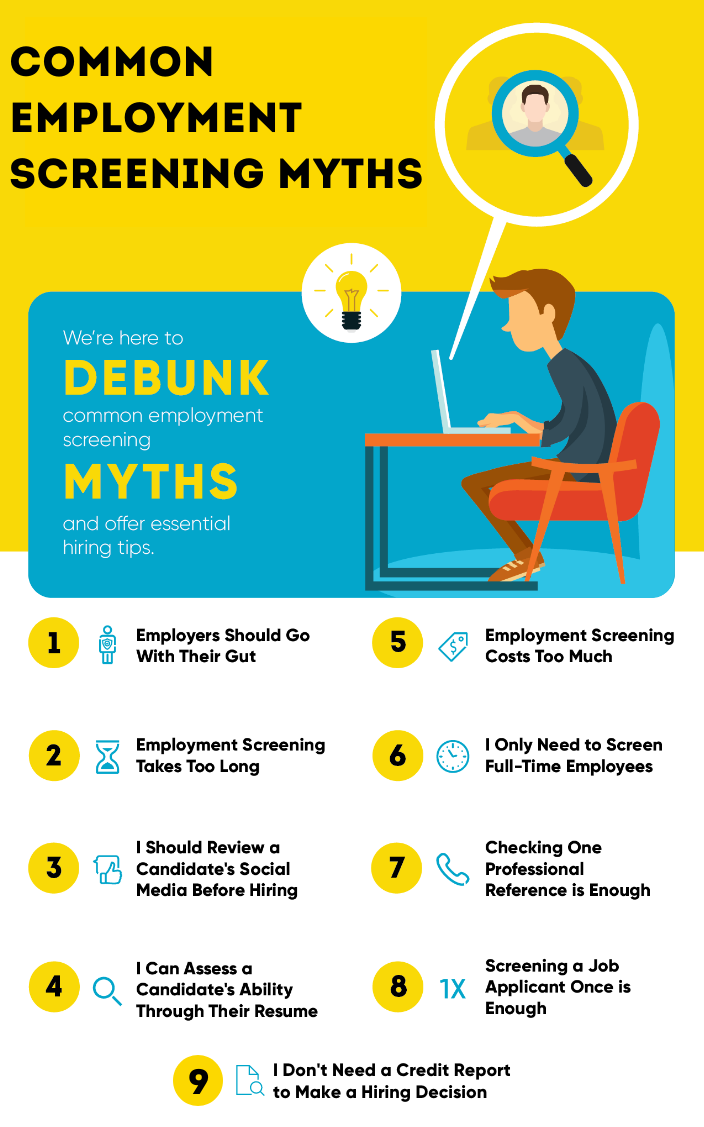

When running employee background checks, many small business owners can get caught up in common screening myths. These myths include: business owners only trusting their gut instinct, screening takes too long or is too expensive, only full-time employees need to have background checks, it’s wise or allowed to check a candidate’s social media pages, it’s ok to only check one reference or skip a credit check, and that a resume can tell you everything you need to know. Set the record straight with these tips from ShareAble for Hires.

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

Hiring for your small business can feel like an Olympic event. From resume fraud tofake references, you must constantly jump and dodge hurdle after hurdle—or else risk injury and harm.

Conducting thorough pre-employment screening with a service like ShareAble for Hires® should be as essential as wearing running shoes to a race instead of snow boots. Unfortunately, there are several employment screening myths that deter small business owners and hiring managers from properly vetting their job applicants.

This article debunks some of the common misconceptions around background checks when hiring, and provides tips for choosing winning candidates.

Employment Screening Myths

- I Always Trust My Gut and That’s Good Enough

- Employment Screening Takes Too Long

- I Should Review a Candidate’s Social Media Before Hiring

- I Can Assess a Candidate’s Ability Through Their Resume

- Employment Screening Costs Too Much

- I Only Need to Screen Full-Time Employees

- Checking One Professional Reference is Sufficient

- Screening a Job Applicant Once is Enough

- I Don’t Need a Credit Report to Make a Confident Hiring Decision

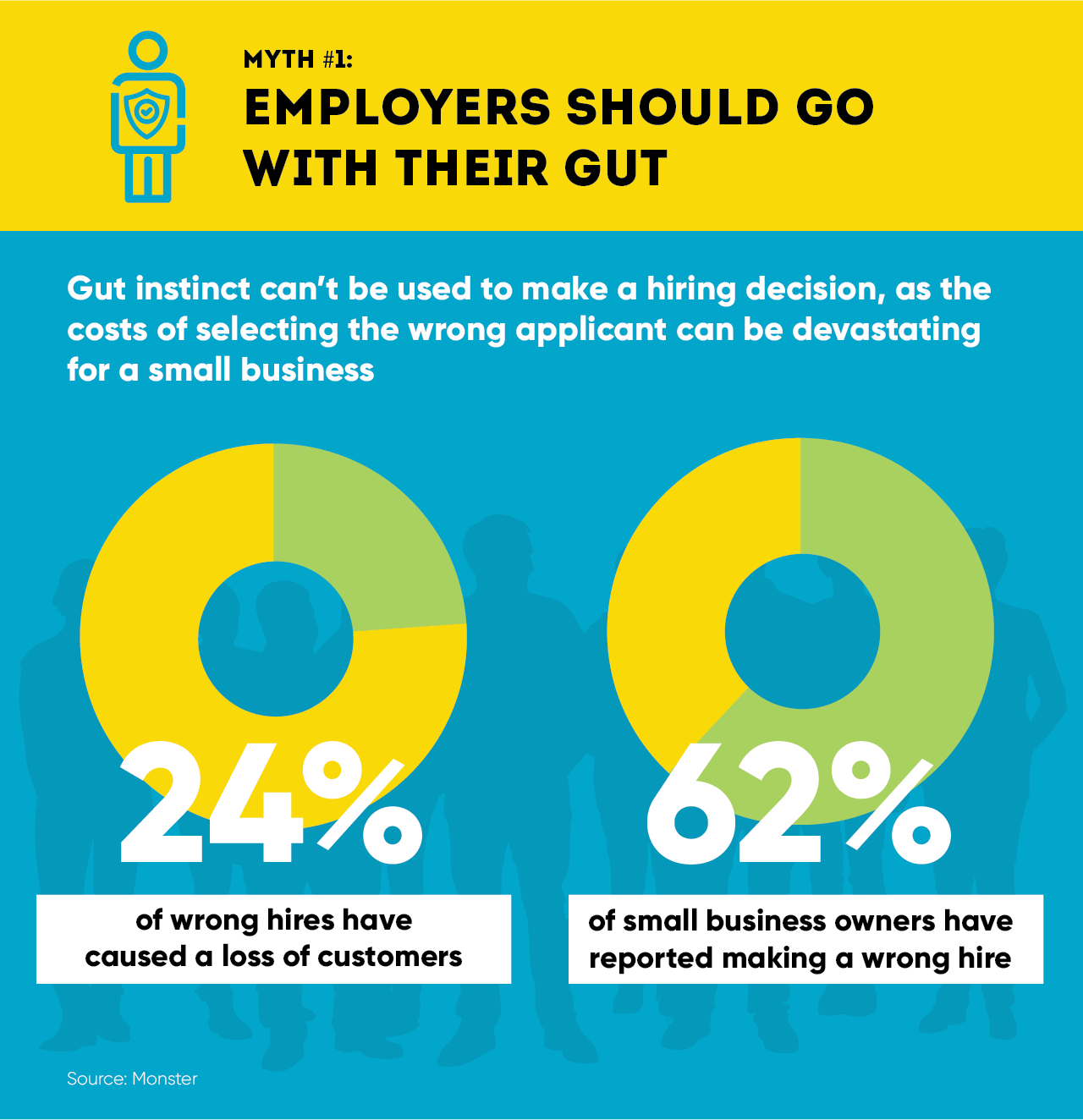

Myth #1: I Always Trust My Gut and That’s Good Enough

Your job applicant knocked their interview out of the park. You have a strong feeling they’re the right fit for your organization, and you want to extend an offer immediately.

However, gut instinct alone shouldn’t be used to make a hiring decision. The risk is just too high. According to the Society of Human Resources Management (SHRM), the majority of hiring professionals choose who to hire within the first five minutes of an interview. However, basing your decision on first impressions can lead to biased hiring processes, and result in selecting the wrong candidate.

According to job site Monster, more than 62% of small business owners have made a wrong hire, and the effects of a poor hiring decision can be long-standing. Monster also found that nearly 1 in 4 bad hiring decisions resulted in losing customers. This massive hit is on top of the thousands of dollars it costs to replace the wrong employee.

Reality: You should absolutely screen candidates thoroughly before bringing on a new hire—even if your gut instinct says they’re a sure bet. Comb through every candidate with a streamlined hiring process. Comprehensive background checks are the key to finding high-quality employees and providing peace of mind for employers and hiring managers.

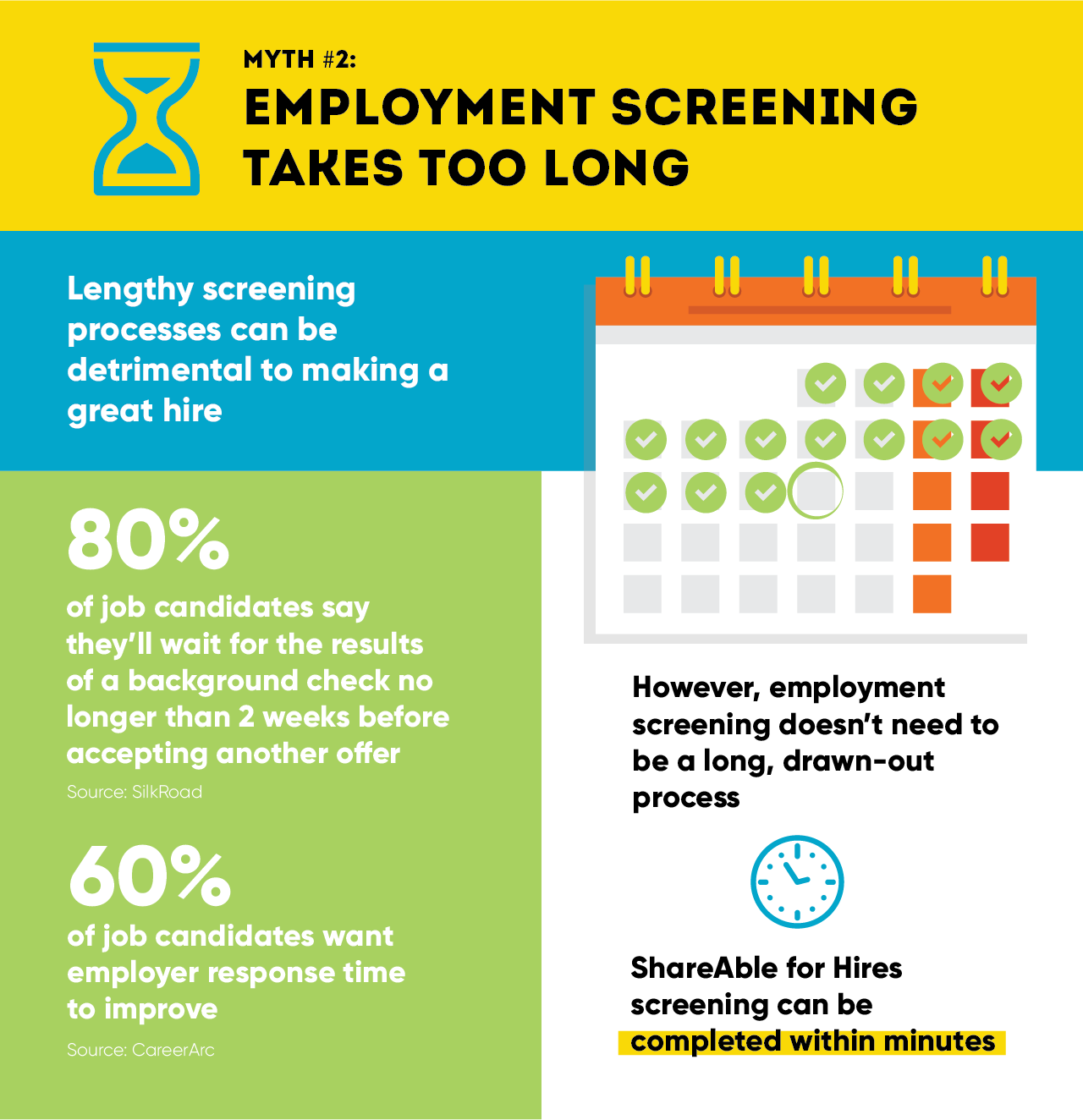

Myth #2: Employment Screening Takes Too Long

Some small business owners may think that it’s too hard or takes too long to screen a job candidate. Hiring managers may be used to traditional background check firms that take days, or even weeks, to get results. Of course, no one wants to lose out on top talent due to a slow, cumbersome hiring process. However, in-demand candidates may opt to take other opportunities rather than wait for a background check to clear.

A SilkRoad study found 80% of job candidates say they’ll wait for the results of a background check no longer than two weeks before accepting another offer. When polled, 69% of job candidates in a Career Arc survey said they wanted employer response time to improve during the hiring process.

Plus, when positions sit vacant, you and your employees may be saddled with more responsibility, affecting daily output and negatively impacting team morale. Because of these time-sensitive risks, some companies skip the background check process altogether.

Reality: Vetting a job applicant doesn’t need to be a long, drawn-out process. While traditional background checks may take weeks to complete, ShareAble for Hires delivers lightning-fast, on-demand credit, criminal and ID verification reports within minutes. You could interview, screen, get results, and hire on the same day.

Myth #3: I Should Review a Candidate’s Social Media Before Hiring

According to a CareerBuilder survey, up to 70% of employers say they use social media sites to research job applicants. This can be a big mistake that can land you in deep trouble. Here’s why:

- Your decision-making could be unconsciously biased by what you discover

- Screening via social media could open you up to allegations of discrimination

In certain states, employers are prohibited from accessing their employee’s social media accounts. Plus, the account you find may not even be associated with the correct person, especially if they have a common name. What you discover on social media could reveal protected information about an applicant or skew your perception. This could result in a biased hiring decision that doesn’t follow the regulations put forth by the Fair Credit Reporting Act.

Reality: Perusing candidate social media pages can drop you into legal hot water. It’s essential to follow all national and local hiring laws, including the FCRA and fair-hiring regulations that protect against discrimination. Screening job applicants via social media fails to follow these regulations and could leave you with expensive, destructive lawsuits. Instead, stay off social media and run FCRA-compliant background checks through a reputable service like ShareAble for Hires.

Pro Tip: Consult state and local regulations regarding social media screening in your area and talk with legal counsel to ensure your screening practices follow all applicable laws.

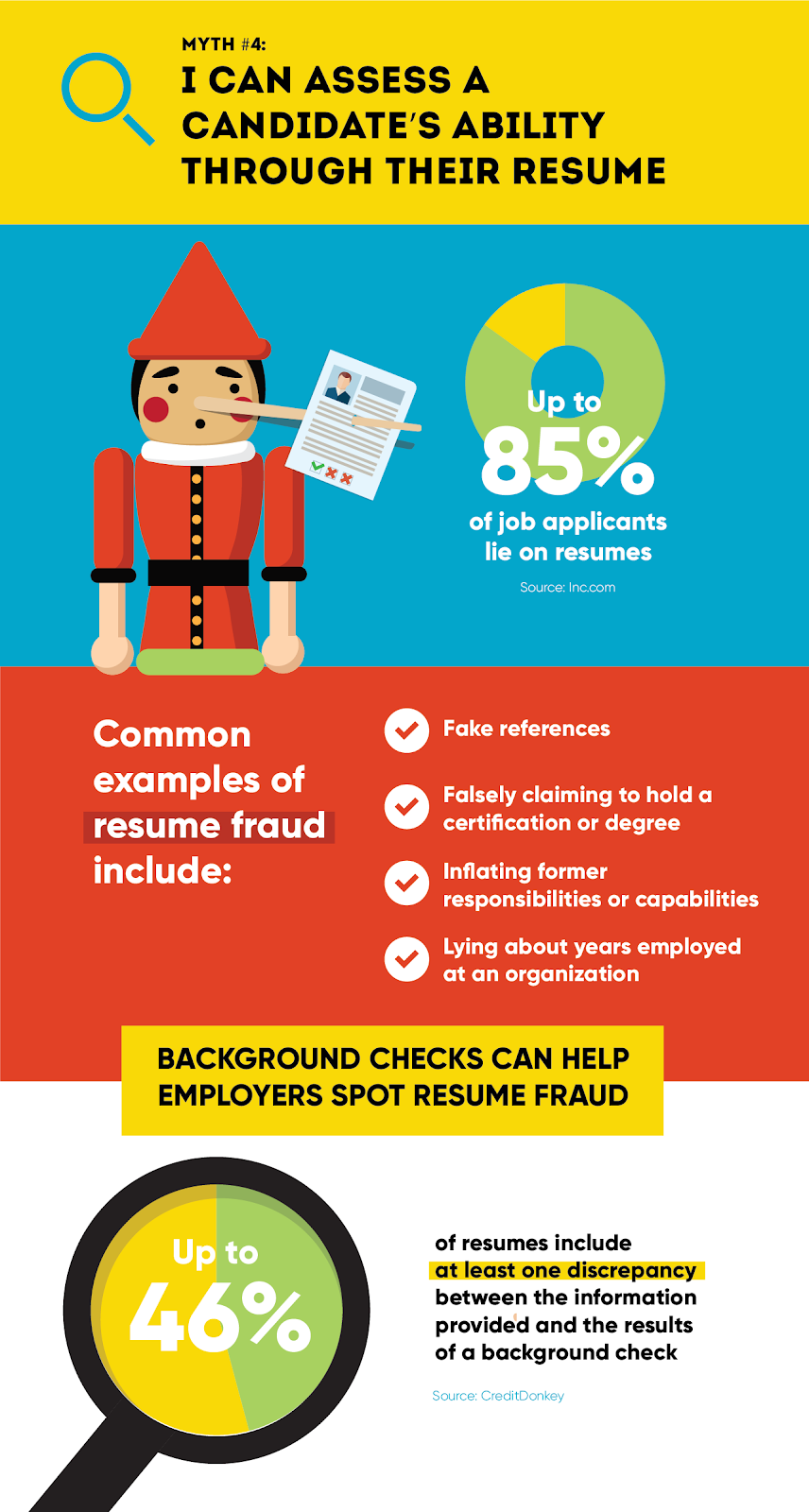

Myth #4: I Can Assess a Candidate’s Ability Through Their Resume

A resume is your first look at an applicant’s abilities, work history, and education. Proper resume review can help employers narrow down the pool of applicants to only those that are qualified—at least on paper.

Unfortunately, what you see on a resume can’t always be trusted at face value. Recent studies from Inc. show that up to 85% of resumes are intentionally inaccurate. These can range from small lies that inflate a candidate’s work history to all-out fabrications about degrees attained and positions held.

Common examples of resume fraud include:

- Fake references

- Falsely claiming to hold a certification or degree

- Inflating former responsibilities or capabilities

- Lying about years employed at an organization

Hiring based on an applicant’s resume alone can be a mistake, as you may fall victim to fraud and scammers. Plus, if someone’s willing to lie on their application, what might they do once let loose in your small business?

Reality: Resumes are an important part of the hiring process, but they never tell the whole story. It’s imperative to use background checks in conjunction with resume and other application material review. This helps ensure the reported information is accurate and that your candidate is really as qualified as they say.

Background checks can also help employers spot resume fraud. By comparing the results of a background check with the information reported on an applicant’s resume, you can verify key elements like employment history, criminal records, and more.

Myth #5: Employment Screening Costs Too Much

Why spend money on an employee screening if you’re already sure the applicant is a great fit? Because the cost of a background check is a small price to pay compared to the potential havoc and expensive destruction a bad hire brings.

Sadly, you simply can’t take a job candidate at their word. Skipping background checks to save a buck often results in massive consequences, including productivity losses, customer service issues, and employee burnout, and turnover. According to hiring platform Breezy, the cost of a bad hire can reach up to 30% of that employee’s annual salary. That kinds of loss could sink a fledgling small business.

Reality: The minimal cost of an employment background check can help you avoid making a far-more-costly hiring mistake. ShareAble for Hires screening starts at $25. There are no hidden costs, fees, minimums, or subscriptions. Pay only for the reports you need and only when you need them.

Delve into your applicant’s criminal record, credit history, and identity to ensure you’re making a wise talent investment that will benefit your small business.

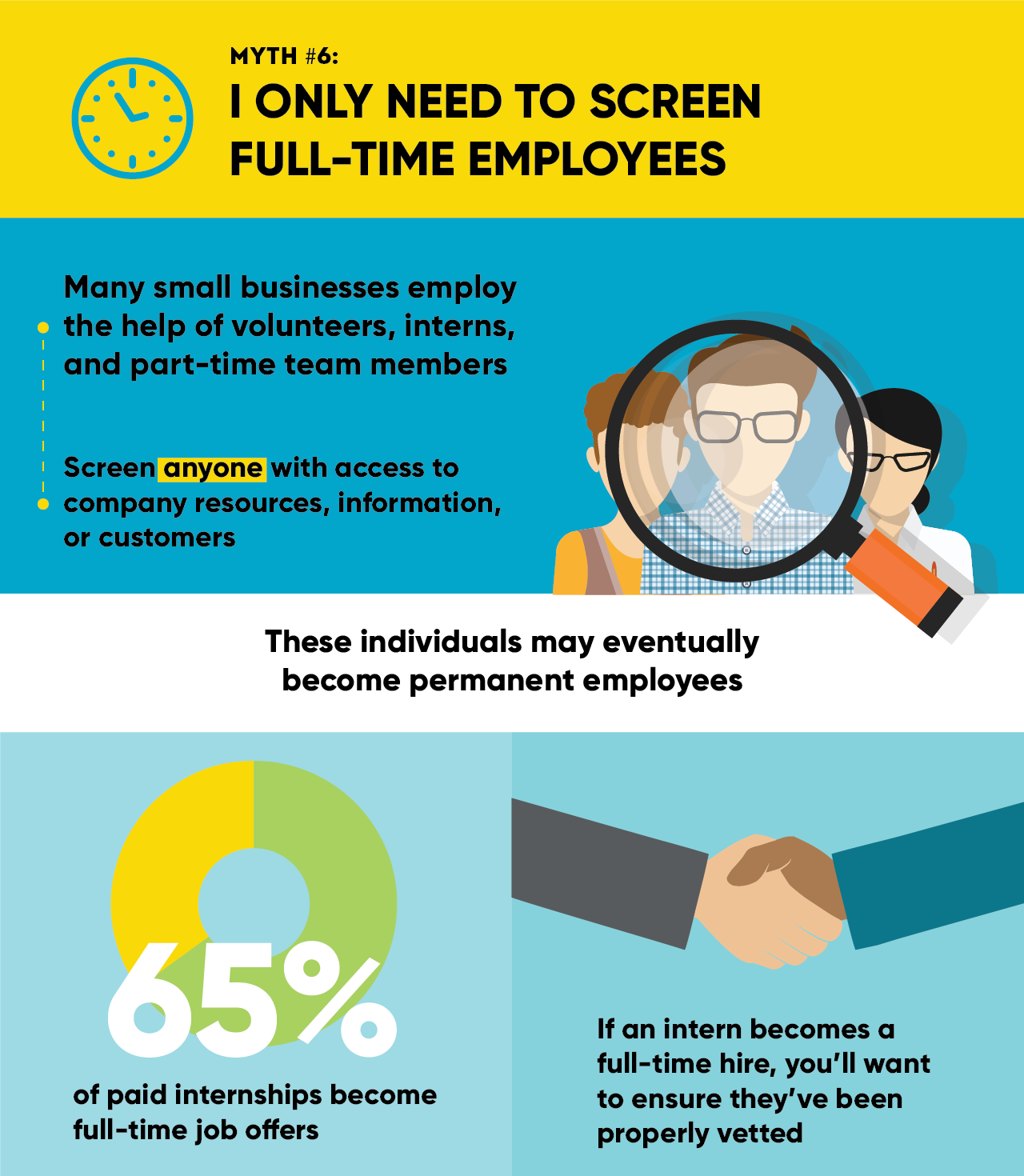

Myth #6: I Only Need to Screen Full-Time Employees

Many small businesses employ the help of volunteers, freelancers, interns, and seasonal team members, but not all business owners screen these part-time workers. They think that if someone isn’t an “official” full-time employee, screening isn’t necessary or worthwhile.

Reality: Any person with access to company resources, information, or customers should be thoroughly vetted with an online background check. Workers—no matter the duration of their tenure—can have a lasting impact on the success of your company. And if they interact with the public, they are serving as the face of your brand. Any mistakes made reflect the same as it would if committed by a permanent, full-time employee.

In addition, part-time workers may eventually become permanent employees. According to RiseSmart.com, 65% of paid internships become full-time job offers. If your intern, volunteer, or seasonal employee becomes a full-time hire, you’ll want to ensure they’ve been properly vetted before extending that full-time job offer.

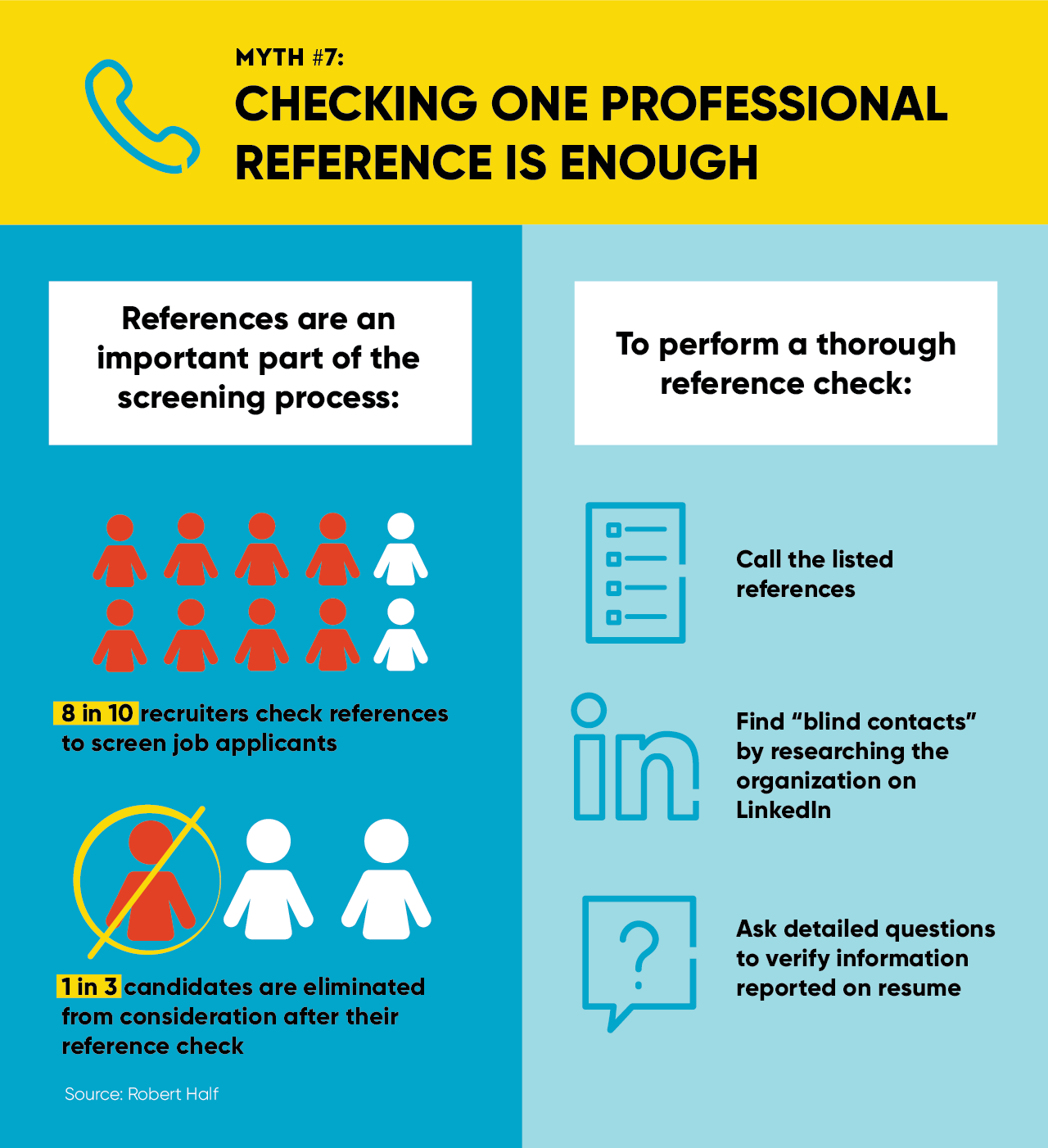

Myth #7: Checking One Professional Reference is Enough

Employee reference checks play an important role in the screening process. Detailed reference checks can help employers verify that the information reported on an applicant’s resume is accurate and narrow down the pool of applicants. The majority of hiring professionals utilize this pre-hire step to find the right candidates. According to a study by Robert Half, 8 in 10 recruiters check references. Some hiring managers and employers believe that receiving one glowing reference is sufficient. However, the situation is much different.

Reality: To perform a thorough reference check, you should check with multiple contacts—sometimes even those not listed on the job candidate’s application. Ask candidates to provide two to three references, then follow up with all of them.

Know that the listed references may not provide a complete picture of your applicant. You may also consider finding blind contacts by researching the listed place of employment on LinkedIn. By cold-calling individuals that work at the same organization, you can ensure the listed references weren’t false contacts, and verify that the job candidate’s resume information checks out.

Be sure to ask detailed reference check questions to verify the information your applicant has reported on their resume.

These questions might include:

- How long have you known the candidate and what’s your relationship?

- Can you confirm the candidate’s employment, job title, and responsibilities?

- Would you describe the candidate as reliable and dependable?

- Were there any issues that you’re aware of that negatively affected their job performance?

- What would you say are the candidate’s greatest strengths and weaknesses?

- Did the candidate conduct themselves in a professional manner?

- How did they get along with others in the workplace?

- How would you describe the candidate’s work ethic?

- Would you recommend this candidate for the position?

- Is there anything I haven’t asked that you think I should know about the candidate?

As you talk with your job candidate’s references, Robert Half recommends watching out for the following red flags:

- Inconsistencies with information that your applicant reported either during their interview or within their resume may indicate that your job candidate has been less than truthful about their experience or abilities.

- Overly positive reviews may indicate you’re speaking to the wrong reference. If the contact can't offer a single weakness or opportunity for the candidate, they may not be providing an honest review.

- Receiving negative feedback about your candidates seems like a no-brainer, but it needs to be said. If your employee references paint someone in a negative light, you may want to consider looking elsewhere.

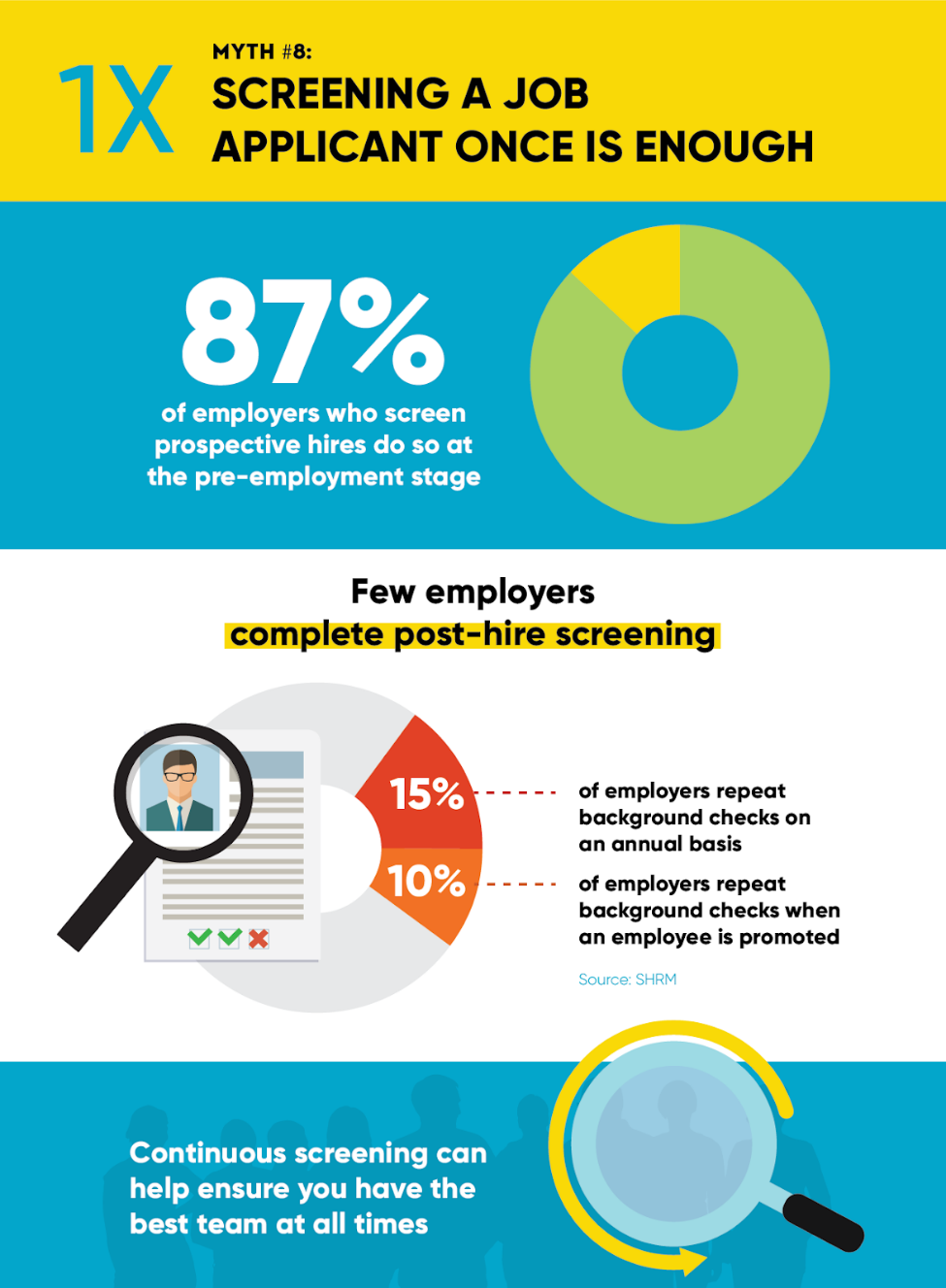

Myth #8: Screening a Job Applicant Once is Enough

Screening your employees is an integral part of the hiring process. According to SHRM, 87% of employers who screen do so at the pre-employment stage. However, few employers complete post-hire screening. SHRM reports:

- Only 15% of employers repeat background checks on an annual basis

- Only 10% of employers repeat background checks when an employee is promoted

Once you’ve checked that your job candidate has no relevant criminal records, has a good financial history, and you’ve verified their previous employment, there’s no need to check again, right? Well, not necessarily. If your new hire commits a crime or in some way becomes ineligible to complete their job duties after being hired, you need a way to know about it.

Reality: By incorporating periodic background checks into your employment policy, you can make sure your current team is suited for their roles and mitigate the risk of costly legal action. Depending on your industry, your organization may be legally required to perform post-hire screenings on a regular basis. For example, medical and transportation industries must conduct annual background checks.

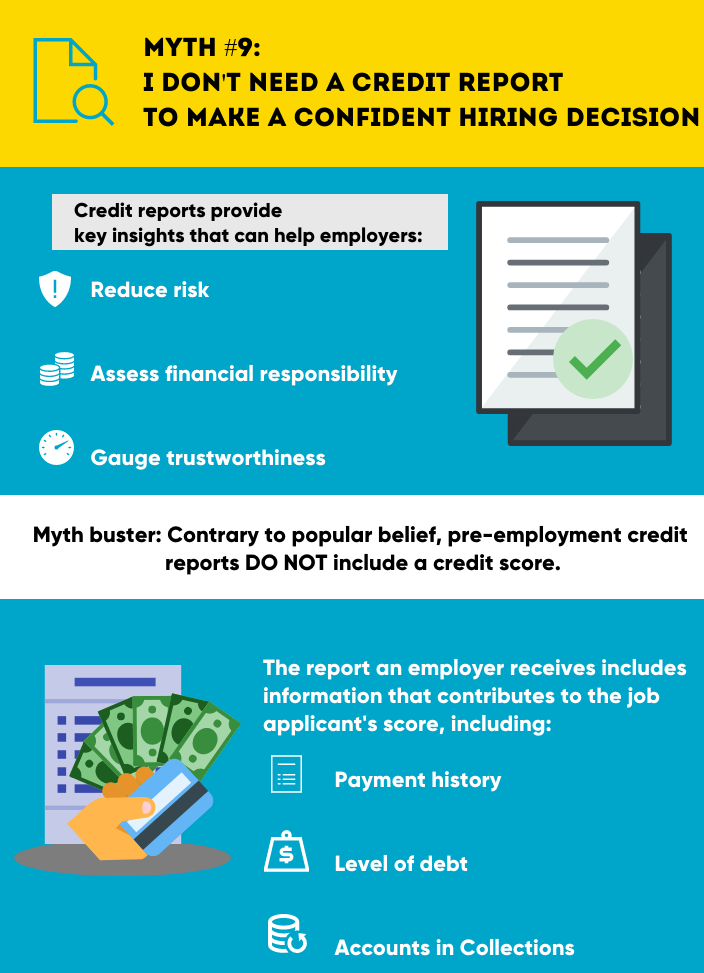

Myth #9: I Don’t Need a Credit Report to Making a Confident Hiring Decision

Credit reports provide key insights that can help employers reduce hiring risk by helping assess a job applicant’s financial responsibility and trustworthiness. The information contained within a credit check can help assist hiring managers looking to fill open roles that handle sensitive company information or finances.

While many believe that pre-employment credit reports contain a credit score, this is a myth. The report an employer receives includes information that contributes to a job applicant’s overall credit score, including:

- Payment history

- Level of debt

- Accounts in Collections

…along with other key indicators of fiscal responsibility.

Reality: Running credit checks on prospective hires can help you assess risk and make more confident decisions. With a detailed credit report, employers can better protect their organization and find the best hires for open roles.

Help Bust Myths with ShareAble for Hires

In the frenzy of hiring new staff, one screening misstep could lead to the downfall of your small business. Don’t fall victim to employee background check myths. Help reach the finish line with ultra-fast, reputable online screening through ShareAble for Hires.

Employee background checks don’t have to be slow or expensive. Flexible, online screening packages mean you pay for exactly what you want and only when you want it. There are no subscriptions, minimums, or hidden fees.

Quickly and easily learn about your job candidate’s:

- Credit history: Comprehensive reports can show previous employment, and indicate financial literacy—particularly important for positions that handle money.

- Criminal record: Protect your clients, customers, and other employees by searching nearly 400 million state and federal criminal records for your applicant.

- ID Verification: Help confirm your applicant’s name, address, social security number, date of birth, and get notified of certain fraud alerts.

Going the DIY route or scouring a candidate’s social media page can lead to making less than informed hiring decisions and possibly even major legal problems. With reports sent to you from TransUnion—a major credit agency—you get trustworthy reports that are more reliable than just trusting your gut and fully comply with FCRA.

Believing employee screening myths can lead your small business on a race to the bottom. Forget the tall tales. Help come out on top with ShareAble for Hires.