How do I see the tradelines on my credit report?

Simply log in to your ShareAble for Hires dashboard, and then click into your screening request to view your credit report.

How to locate your tradelines

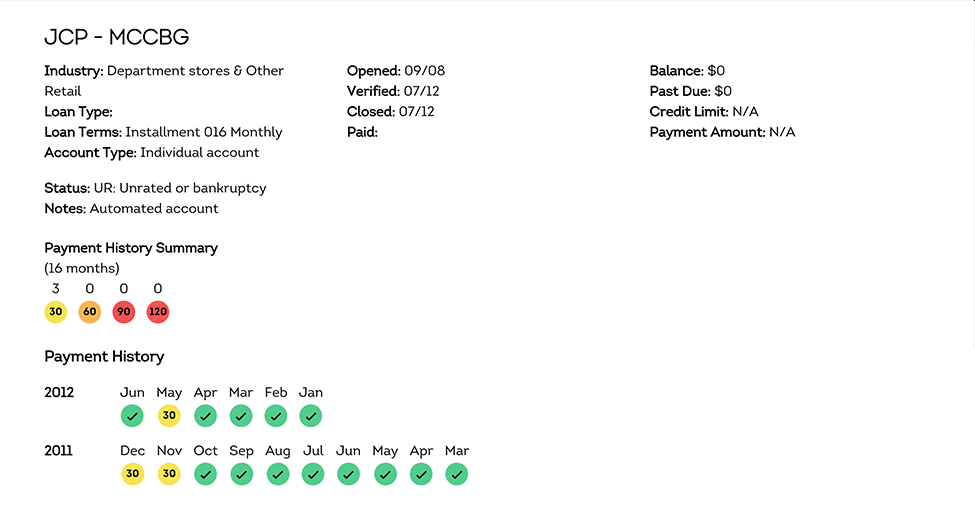

Your tradelines will appear under the Tradeline Summary, which provides a snapshot of active accounts, such as credit cards, auto loans or student loans.